Daily Comment (December 18, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with several items related to the U.S.-China geopolitical rivalry and what it means for investors. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including more bad economic data out of Europe, a growing risk that Japan’s prime minister may be forced to resign, and new warnings from Federal Reserve officials that U.S. investors are being too optimistic about early cuts in interest rates.

U.S.-China Technology Flows: A new report from the Chinese Academy of Sciences warns that China is at risk of falling into a “middle technology trap” because of the recent U.S.-led curbs on sending advanced technologies with potential military applications to the country. The report defines such a trap as a situation where a developing country partially industrializes via technology importation, imitation, absorption, and tracking, but fails to join the top tier of rich, advanced countries because it can’t produce its own innovative technologies.

- The report confirms that one of the major challenges for the Chinese economy these days is the U.S. geopolitical bloc’s clampdown on trade, investment, technology, and even human capital and tourism flows with China, as countries in the bloc belatedly work to reduce their vulnerability to China’s military and economic power.

- In 2024, we believe China will continue to face economic headwinds from what we call the “Five Ds”: weak consumer demand, high corporate and local government debt, poor demographics, economic disincentives from the Communist Party’s increasing intrusion into the economy, and decoupling by foreign countries.

- These challenges have prompted General Secretary Xi to seek an easing of tensions with the West, and we think he’ll remain focused on détente in 2024, at least in diplomatic and economic relations. That could spark a temporary rebound in Chinese asset prices, but we think the Five Ds will still limit the returns available in China in the near term.

U.S.-China-Mexico Trade Relations: To get around the broader U.S. tariffs and other trade barriers against Chinese imports, the Financial Times says at least three of China’s electric vehicle makers and one of its EV battery producers are looking to set up factories in Mexico. Because of the U.S.-Mexico-Canada trade agreement, producing in Mexico would potentially give the companies tariff-free access to the U.S. market, while also spurring new investment and economic growth in Mexico.

U.S.-China Military Relations: While we write a lot on the growing U.S.-China geopolitical rivalry and what it will mean for investors, sometimes it’s the small operational changes in the military that best illustrate the situation. On that score, the New York Times on Friday had an article on how the U.S. Army is again ramping up its jungle training school in Hawaii. After two decades focused on fighting in dry, desert locations like Iraq and Afghanistan, the Army is trying to prepare its troops for a potential war with China in the jungles of the Indo-Pacific region.

- The effort to re-introduce U.S. troops to jungle warfare comes as the U.S. Marine Corps has embarked on a controversial re-design that will transform its Pacific expeditionary forces into light, highly mobile ship killers who, in time of conflict, could deploy to islands throughout the region with powerful anti-ship missiles to wreak havoc on the Chinese navy.

- For those of us who travel often and see lots of soldiers in desert camouflage in the airport terminals, the shift in geopolitical tensions toward the Indo-Pacific and Europe may really hit home when we notice more and more of those soldiers in dark-green jungle or woodland camouflage.

- On the Chinese side, provincial civilian officials have begun appearing at public events in military uniforms, in an effort to show their support for the military and military-civilian coordination.

Israel-Hamas Conflict: As Israeli troops continue their attacks on Hamas fighters in Gaza, Iran-backed Houthi rebels in Yemen continue to launch retaliatory missile and drone strikes on ships in the Red Sea. In response, oil giant BP (BP, $34.81) said today that it is temporarily pausing all its tanker transits through the area. Shipping majors A.P. Moller-Maersk (AMKBY, $8.58) and Hapag-Lloyd (HPGLY, $68.88) on Friday also curbed operations in the Red Sea after attacks on their vessels. The moves reflect the conflict’s risk to world oil supplies and commerce.

- Separately, the Israel Defense Force admitted over the weekend that its soldiers mistakenly shot and killed three Israeli hostages during a chaotic combat operation, even though the hostages were waving a white flag and shouting in Hebrew.

- True to character, Prime Minister Netanyahu was slow to acknowledge the mistake or take responsibility for it, drawing further anger from Israelis who see him as having allowed the Hamas attacks on Israel on October 7 and then risking the hostages and Israel’s reputation with the IDF’s attack on Gaza.

Japan: After the ruling Liberal Democratic Party’s spiraling illegal fundraising scandal forced Prime Minister Kishida to sack four of his ministers last week, government and party officials are now openly discussing the possibility that Kishida may soon be forced to resign as party chief. Since elections aren’t required until 2025, another LDP official would likely take Kishida’s place as prime minister. The risk for investors is that increased political chaos could undermine confidence and short-circuit the Japanese stock market’s recent strong run.

Germany: The IFO Institute’s December business climate index fell to a seasonally adjusted 86.4, well short of expectations that it would rise slightly from the November reading of 87.2. Along with a decline in the December purchasing managers’ indexes published last week, the findings suggest the German economy is limping to the end of the year with declining activity. Because of the German economy’s large size, its weakness is likely to weigh on other European economies and asset prices.

Serbia: In parliamentary elections yesterday, right-wing populist President Aleksandar Vučić’s ruling Serbian Progressive Party won 47% of the vote, which will allow it to govern without relying on any coalition partners. Vučić had already been accused of building an authoritarian state modelled largely on Viktor Orbán’s Hungary, and opposition leaders immediately complained that his win yesterday reflected electoral fraud.

Chile: In a ballot yesterday, Chileans voted 56% to 44% against a new constitution that would have shifted policy decidedly to the right. The rejection came about a year after voters strongly rejected a radical leftist constitution and four years after the widespread rioting and protests that kicked off the effort. For now, the result will leave in place the pro-business constitution passed under the Pinochet dictatorship in 1980.

U.S. Monetary Policy: In a speech today, Cleveland FRB President Mester warned that investors have gotten ahead of themselves by pushing up asset prices in anticipation of early interest-rate cuts by the central bank. Her comments align with similar warnings on Friday from New York FRB President Williams and Atlanta FRB President Bostic. They also align with our view that Fed policymakers are so intent on rebuilding their reputation as inflation fighters that investors should take them at their word when they say rates will stay “higher for longer.”

- In her comments, Mester said, “The next phase is not when to reduce rates, even though that’s where the markets are at. It’s about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2%.”

- More to the point, she also added that, “The markets are a little bit ahead. They jumped to the end part, which is ‘We’re going to normalize quickly,’ and I don’t see that.”

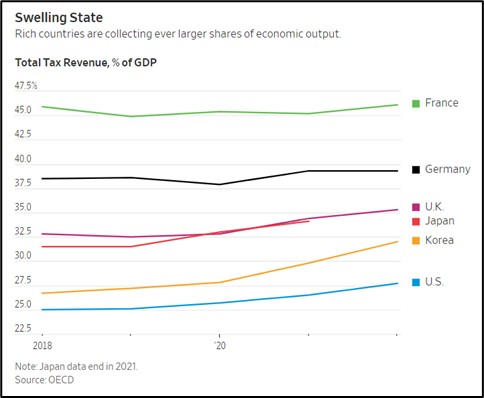

U.S. Fiscal Policy: Data from the Organization for Economic Cooperation and Development shows government revenue as a share of gross domestic product has risen noticeably in the U.S. and other major developed countries in recent years. According to the analysis, the rise generally hasn’t come from newly legislated tax hikes. Rather, the increase has come from price and wage inflation, which can push taxpayers into higher tax brackets.

- In the U.S., tax receipts at all levels of government rose to almost 28% of GDP last year, up from 25% in 2019 and one of the highest levels in decades.

- While the higher tax take can impede consumer spending and entrepreneurship, the new resources will also be available to help fund new initiatives, such as infrastructure rebuilding and increased defense spending.

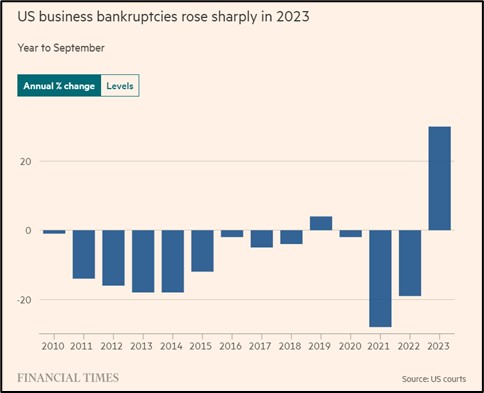

U.S. Corporate Finances: An updated review of bankruptcy filings shows business failures in the U.S. in the year ended in September were up 30% from the previous year. The data shows that bankruptcies in several other key countries have also climbed by a similar amount. The research suggests that the rise in bankruptcies can be attributed to higher costs, rising interest rates, and the continued withdrawal of pandemic relief funds by governments.

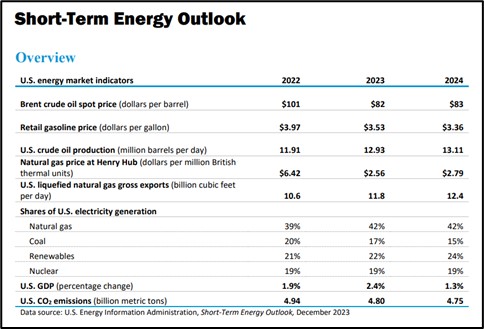

U.S. Energy Industry: New forecasts from the Energy Information Agency project that solar and wind-generated electricity will surpass coal-generated electricity in the U.S. energy mix for the first time in 2024. The report shows natural gas will remain the top source of electricity, accounting for 42% of the nation’s total, while all renewables will account for 24% and nuclear will stand at 19%. Coal is projected to provide only 15% of U.S. electricity in the coming year.