Daily Comment (December 19, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Note to readers: the Daily Comment will go on holiday after December 20, 2023, and will return on January 2, 2024. From all of us at Confluence Investment Management, have a Merry Christmas and a Happy New Year!

Our Comment today opens with a discussion of the potential fallout if the U.S. and its European allies stop providing military aid to Ukraine. While some observers say there would be no impact, a new study argues that it would lead to much higher costs later on. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including a decision by the Bank of Japan to hold its monetary policy unchanged and a call by one Federal Reserve policymaker for multiple U.S. interest-rate cuts in 2024.

Russia-Ukraine-United States: A new report by the Institute for the Study of War warns that if the U.S. and its European allies end their military aid to Ukraine, the country would be at risk of being overrun and conquered by Russian forces. In such an event, the Kremlin’s battered but triumphant army would stand on NATO’s borders from the Black Sea to the Arctic Ocean, posing a major conventional military threat to NATO for the first time since the 1990s.

- The study finds that Russia’s current wartime defense industry expansion and large pool of potential military recruits would allow it to recover quickly from its steep equipment and troop losses in the Ukraine invasion to date. At the conclusion of fighting, the Russian army would also have a wealth of experienced officers and troops, effective tactics honed on the modern battlefield, and innovative new weapons.

- The study argues that the second-worst scenario would be to freeze the conflict with Russia holding the 20% of so of Ukrainian territory it currently controls in the country’s east and south. President Putin would almost certainly use such a freeze to rebuild his forces and prep them for a new invasion in the future, but at least his forces would remain far from NATO’s southern frontier.

- The best scenario for the U.S. and NATO would be to help Ukraine drive the Russians completely out of their territory. Putin would still likely respond by rebuilding his forces for a new future invasion, but those forces would then have to transverse all the territory of a potentially rebuilt Ukraine.

- If President Putin could deploy his rejuvenated army to positions along NATO’s entire eastern frontier, perhaps with Chinese approval and/or prodding, the study finds that the U.S. and its allies would need to invest enormous sums to rebuild the military strength needed to deter them, even as the allies are forced into an expensive defense buildup against China in the Indo-Pacific region. The study argues that the cost of this European defense buildup would far exceed the current cost of military aid to Kyiv.

- Such a scenario would force the U.S. to make painful trade-offs between deploying deterrence forces to Europe or to Asia.

- In other words, allowing Russia to win in Ukraine (either in full or in part) wouldn’t allow a full focus on Asia. Russia’s appetite for aggression would only increase, forcing the U.S. and its allies into an expensive two-front military buildup in both Europe and Asia.

- The ISW study is therefore consistent with our thesis that rising frictions between the U.S. geopolitical bloc and the China/Russia bloc will continue to fracture international relations, creating risks for investors but also creating opportunities in sectors such as broad industrials, defense companies, defense-focused technology firms, and mining and energy firms.

United States-NATO: Speaking of NATO, one little-noticed provision of the National Defense Authorization Act passed by Congress last week prohibits any future U.S. president from pulling the country out of NATO without a two-thirds vote of approval in the Senate or separate legislation from Congress.

Israel-Hamas Conflict: As Iran-backed Houthi rebels in Yemen continue to launch retaliatory missile and drone strikes on ships in the Red Sea, the U.S. and six of its allies yesterday agreed on an expanded naval task force to protect shipping in the region. The task force will include ships from the U.S., the U.K., France, Bahrain, and several other countries to protect commercial ships and oil tankers in the region.

- Some 9 million barrels of crude oil are shipped through the Red Sea each day, representing almost one-tenth of global demand. After oil giant BP (BP, $35.12) said on Monday that it would pause its shipments through the Red Sea on security concerns, investors spooked by the prospect of supply disruptions bid up Brent oil to $77.95 per barrel, up 1.8% for the day.

- So far this morning, oil prices have given up a portion of yesterday’s gain, possibly reflecting satisfaction with the expanded naval task force.

Germany-Norway: In a deal signed today, Norwegian energy giant Equinor (EQNR, $31.71) agreed to supply 129 billion cubic meters of natural gas to German state energy firm SEFE through 2039. Worth about 50 billion EUR ($54.8 billion) at today’s prices, the long-term pipeline supply deal would reportedly be enough to cover one-third of Germany’s industrial gas demand over the period, helping replace the cheap Russian gas shut off after the Kremlin’s invasion of Ukraine.

- The deal will therefore be important in ensuring energy security for Germany, and for Europe in general, in the coming years.

- The deal is also an example of how global geopolitical fracturing will sometimes merely shift trade patterns, rather than end cross-border shipments.

United Kingdom: Bank of England Deputy Governor Ben Broadbent yesterday warned that volatile, inconsistent data on wage growth will keep the central bank from making an early judgment on whether inflation pressures are easing, which in turn will discourage it from early interest-rate cuts. The statement adds to the pushback from major central banks against investors betting on rate cuts in the near term.

- Responding to the risk that BOE policymakers could keep interest rates too high and prompt a big slowdown in the British economy next year, the chief investment officer of bond giant PIMCO said he is keeping his exposure to U.K. government bonds higher than he usually does.

- Other investors have apparently also been buying British bonds aggressively, pushing the yield on 10-year Gilts to about 3.673% recently, down approximately 100 basis points since late October.

Japan: Dashing some investors’ hopes for policy normalization, the Bank of Japan today held its benchmark short-term interest rate at -0.1% and made no change to its “soft” ceiling on 10-year Japanese government bond yields. In addition, BOJ chief Ueda said in his post-decision press conference that the policymakers want to see more evidence of sustained wage and price rises before ending their negative interest rates and yield curve control policies. Without even a hint of monetary normalization, the yen (JPY) today has weakened by 1.1% to 144.34 per dollar ($0.0069).

U.S. Monetary Policy: In contrast with the recent pushback against rate-cutting talk from other Fed policymakers, San Francisco FRB President Daly told the Wall Street Journal yesterday that cooling U.S. inflation in 2023 should prompt the policymakers to consider cutting interest rates several times in 2024. As inflation cools, Daly said it makes sense for the Fed to make sure its high interest rates don’t disrupt the U.S. labor market. The statement could potentially give a further boost to risk assets in trading today.

U.S. Air Travel Industry: A recent report from the Federal Aviation Administration said the agency is struggling to find enough fully certified air-traffic controllers. With nearly all FAA facilities facing controller shortfalls, the crisis is raising concerns that the agency might have to slow flight operations around the country. Besides affecting airlines and air shippers, such a slowdown in air travel could disrupt supply chains, boost price pressures, and weigh on overall economic growth.

- The shortage of air-traffic controllers can be ascribed in part to mass retirements in recent years. At the same time, the tight labor market has made it harder to attract applicants.

- On a related note, the National Defense Authorization Act passed by Congress last week calls for U.S. active-duty military personnel to fall to 1.285 million by the end of fiscal 2024, down almost 64,000 from three years ago. As with the air-traffic controllers, the smaller target mostly reflects the difficulty of recruiting in a tight labor market, rather than a decline in the mission or responsibilities.

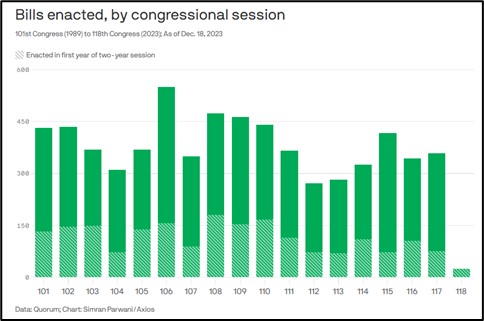

U.S. Political Dysfunction: In yet another sign of how political tensions and disdain for compromise are affecting U.S. policymaking, new analysis shows that just 20 bills have passed both chambers of Congress and been signed into law this year, with another four awaiting President Biden’s signature. Most of the bills that have become laws were uncontroversial measures like naming Veterans Affairs clinics.