Daily Comment (January 4, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Global markets hum with cautious optimism as investors dissect the latest FOMC minutes, while the European football world holds its breath for Kylian Mbappé’s blockbuster transfer decision. In today’s Comment, we delve into the Fed’s policy signals, why Europe’s central bank deserves a closer look, and the escalating tensions in the Red Sea. As always, our comprehensive report equips you with the latest domestic and international data releases.

Pivot or Not? While some investors anticipate swift rate cuts, FOMC minutes suggest a more gradual and data-dependent approach, prompting concerns about unrealistic expectations in the market.

- Wednesday’s minutes revealed that policymakers acknowledged potential 2024 rate cuts while stressing ongoing restrictive policy for now. Inflation progress toward the 2% target was noted, but officials demanded further proof of easing pressures before declaring victory. However, optimism was tempered by concerns from others within the committee. They flagged potential risks to inflation from global energy/food prices, geopolitical developments, a potential rebound in core goods, and effects of nearshoring. While some saw the labor market’s cooling, which was further buttressed by the JOLTS report’s low job vacancy figures, as evidence for dovishness, others remained cautious, emphasizing the need for comprehensive data before changing course.

- Beyond conventional economic gauges, Fed officials highlighted a potentially disruptive factor influencing their policy decisions — the looming commercial real estate debt wall. Over $117 billion of office building loans in the U.S. face maturity in 2024, according to the Mortgage Bankers Association. Issued during an era of low rates, these loans now burden properties whose value has fallen, raising concerns about potential losses and limited lender capacity for extensions. The ongoing crisis in CRE markets adds a layer of complexity to the Fed’s decision-making process, as they must weigh not just inflation and employment risks but also financial stability concerns.

- The 2019 mid-cycle adjustment by the Federal Reserve serves as a reminder that an outright recession isn’t always necessary for them to cut rates. Following a series of hikes to normalize monetary policy during that period, Fed Chair Jerome Powell explained the policy shift as a tactical move to mitigate the dampening effects of international developments on U.S. growth, manage downside risks to the economy, and support a symmetrical return to the Fed’s 2% inflation target. However, complications within the repo market emerged as a key driving force behind the decision. With inflation exceeding its target, the central bank is likely to prioritize price stability over short-term growth concerns, potentially leading to less aggressive rate cuts than the market anticipates.

ECB Bluffing? After pulling back on bets for U.S. rate cuts, investors should consider revising their expectations for the European Central Bank as well.

- Growth expectations have taken center stage in shaping rate expectations for the European Central Bank (ECB). After a promising first half of 2023, the eurozone economy stumbled in the third quarter, with GDP contracting at an annualized rate of 0.1%. This slowdown was further underscored by the recent Purchasing Manager’s Index (PMI) reading of 47.6, dipping below the 50 threshold that indicates a contraction in private sector activity. These indicators have significantly increased the possibility of the eurozone slipping into a technical recession, defined as two consecutive quarters of negative GDP growth. As a result, bets for rate hikes have faded, and speculation about potential easing measures is rising.

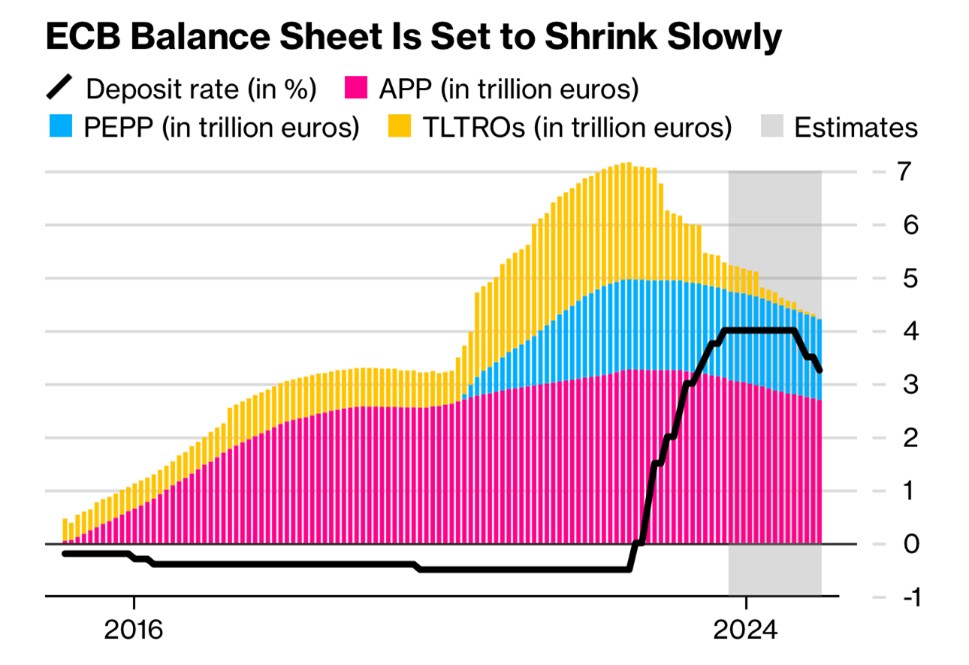

- Investors dismissing the ECB’s commitment to a tight policy may be overlooking a hidden weapon — the lingering Pandemic Emergency Purchase Programme (PEPP). While the bank has hiked rates to record highs and started shrinking its balance sheet, PEPP’s ongoing reinvestments of maturing securities suggest it hasn’t fully embraced monetary tightening. Even though net purchases ceased in 2022, PEPP has continued to reinvest maturing securities. Despite its initial aim of preventing fragmentation, PEPP’s ongoing presence has inadvertently provided the eurozone with a buffer against the potential negative impacts of tighter policy on its financial system.

(Source: Bloomberg)

(Source: Bloomberg)

- While the eurozone’s financial system is better equipped to handle rising rates compared to the U.S., a looming debt maturity wall in their junk bond market could still force cuts. The share of lower-rated firms facing debt repayments within the next three years has risen to its highest level since 2015, particularly in high-yield debt for telecom, consumer staples, and real estate. This significant vulnerability could lead policymakers to rethink monetary policy stance. As a result, we maintain that aggressive rate cuts as soon as the market expects are unlikely in the near term. However, we acknowledge that conditions may change in the future.

Middle East Uncertainty: Houthi rebel attacks on commercial vessels in the Red Sea have spooked markets, raising fears of a wider Middle Eastern conflict.

- The U.S. and its allies have threatened military action against the Houthi rebels if the group continues its attack on vessels traveling through the Red Sea. The warning comes after the Yemen-based military group carried out at least 23 attacks since the fighting broke out between Israel and Hamas. In addition to warning the rebels, the U.S. also aimed criticism toward Iran, viewed as the Houthis’ primary financial backer, by warning of repercussions if Iran continues to support these attacks. Prior to the warning, the U.S. Navy was forced to use self-defense against rebel boats, killing 10 Houthis in the process.

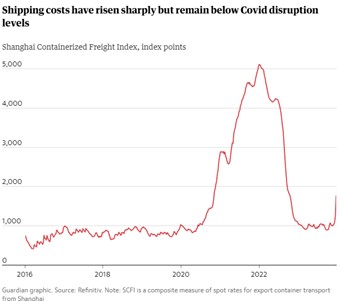

- Simmering tensions in the Red Sea threaten a vital global trade route, raising concerns about supply disruptions and potential inflationary pressures. The vital Bab el-Mandeb Strait, nestled between the Arabian Peninsula and Africa, funnels 12% of global trade, including containerized goods and oil, towards the crucial Suez Canal. Recent attacks on shipping have forced rerouting, causing over $1 million in extra fuel costs, rising insurance premiums, and delaying deliveries. While below the chaos of the pandemic, these disruptions are no less worrying. Increased shipping costs and delays ripple through supply chains, potentially translating into higher consumer prices.

- While current oil prices and consumer spending trends haven’t fueled a major inflation hike due to the conflict in the Red Sea, escalating tensions could quickly disrupt supply chains or amplify energy market volatility, triggering a more pronounced surge in price pressures. Although crude oil has seen a 6% increase recently, it remains below $80 a barrel, and slowing global demand, evident in the economic slowdown in Europe and China, could provide some downward pressure on global prices. However, the conflict’s unpredictable nature keeps the inflation threat on the table, requiring close monitoring of its potential economic fallout.

Other news: Former President Donald Trump faces a crucial legal hurdle as he pushes the Supreme Court to decide if Colorado can remove his name from its presidential ballot. The dispute reinforces our view that the outcome of this year’s presidential election will be less predictable than previous contests. Meanwhile, economic cracks widen in China as the world’s second-largest economy grapples with a property market slump and declining exports. Chinese provinces have been forced to pump billions into their fragile banking system, raising concerns about a prolonged slowdown and its global ripple effects.