Daily Comment (January 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! December jobs bury the bull market’s hopes, while Crosby and Bedard steal the NHL All-Star spotlight. In today’s Comment, we dive deep into the mysteries of the January Barometer, explore why the Magnificent Seven’s reign may be nearing its end, and analyze how Ukraine war fatigue might pave the way for de-escalation in Europe. As always, our comprehensive report encompasses the latest domestic and international data releases.

January Gloom: Equity prices are on track to finish the week down in a bad omen for financial markets.

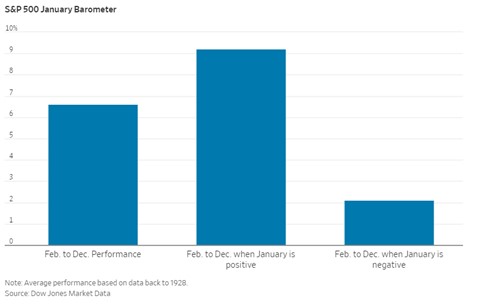

- The weak start to January raises concerns about the rest of the year. Data from 1954 to 2023 reveals an unsettling pattern — in 11 out of the last 17 occurrences when January saw declines in both the first week and month as a whole, the S&P 500 finished the year lower. Rising interest rate concerns, fueled by mixed economic data, are driving this bearish sentiment. While the latest JOLTS report signaled that firms are slowing their hiring, both initial claims and ADP’s private payroll data suggest workers are having no trouble finding new work. Fueling anxieties further are the ongoing conflicts in the Middle East that threaten to disrupt energy supplies and exacerbate pre-existing inflationary pressures.

- This early-year phenomenon likely reflects investors’ tendencies to anchor expectations to limited data, seeking early signs for dominant themes. While the S&P 500 started 2023 with a decline in its first week, Microsoft’s (MSFT, $367.94) extended partnership with OpenAI, a leading artificial intelligence (AI) company, buoyed the index to a 6.3% gain by month’s end. Hopes for monetary easing have gripped investors since the last Fed meeting in December, where officials hinted at potential rate cuts in 2024, but these hopes have faced a sharp reality check. Investor expectations of a March rate reduction have drastically contracted, with the CME FedWatch Tool probability plummeting from 73.4% a week ago to 60.9% today.

- Just like in the lead-up to the climax of the classic romantic comedy When Harry Met Sally, investors will spend 2024 analyzing every move of the FOMC, trying to decipher the next step in their rate-cut tango. Will it be a graceful glide to lower rates or a clumsy stumble into recession? Prepare for a comedy full of “mumbling with great incoherence,” with investors caught between hope and frustration as the Fed navigates the economic tightrope. But remember, while monetary policy takes center stage, don’t forget the political circus happening backstage. Half of the world will be voting, and these elections could redraw the global economic map, which is also likely to have a major impact on financial markets.

Tech Rally Over? Lower rates threaten the Magnificent Seven’s market dominance. Prepare for a changing of the guard.

- In an environment of high-interest rates and cautious investor sentiment, firms with significant growth potential and limited downside risk became particularly attractive investment targets. Large companies with exposure to AI technology, a field perceived to hold immense future potential, were among the most sought-after. Investors were drawn to these companies because the firms have the ability to grab market share in an industry that is expected to play a significant role in reshaping the economy. Consequently, the excitement over AI has led investors to neglect other sectors offering opportunities.

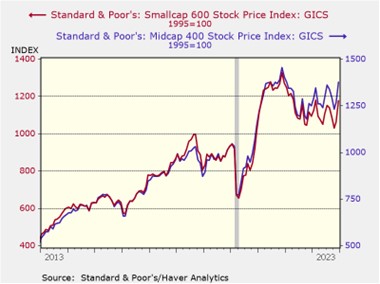

- The prospect of lower rates has helped shift investor attention toward stocks with a better value proposition. With a hefty P/E above 20, the S&P 500 looms large over its smaller rivals. Mid-cap companies, long overshadowed by big-name hype, finally saw their alluring P/E ratios attract renewed investor attention. Though initially buffeted by a 6.5% headwind in the first 10 months of 2023, the S&P 400 Mid Cap Index roared back with a vengeance, finishing the year an impressive 11.5% higher. At the same time, small-cap companies have had a similar performance, rising 13.9% to the end of the year.

- Market fundamentals favor a potential shift from large caps to smaller peers, but unforeseen headwinds like recession or rising rates could slam the brakes on the trend, dampening risk appetite and prompting caution. So far, all signs suggest that the Fed will be able to navigate a soft landing. The Atlanta GDPNow forecasts continued economic resilience with the economy expected to expand at a 2.5% annual rate in the fourth quarter. At the same time, Cleveland Fed data suggests the year-over-year change in core PCE inflation could dip below 3% this month, offering a glimmer of hope for risk-averse investors and potentially accelerating the shift towards smaller companies.

Fresh Ukraine Worries: The growing difficulty in supplying Ukraine with military equipment has fueled anxieties among Eastern European nations bordering Russia, who fear it could leave them more vulnerable to Russian aggression.

- Amidst the ongoing war in Ukraine, Latvian Foreign Minister Krišjānis Kariņš sounded the alarm, warning that Russia’s ambitions likely extend beyond Ukrainian borders and could pose a broader threat to Eastern European nations. He is pushing for the West to develop a longer-term strategy that will contain the ostracized country. His concerns come on the same day that the Pentagon stated that it had no funds left to replace weapons sent to Ukraine. Although there was $4.2 billion left for aid, it warned that the lack of additional funding may force the U.S. to pause its support

- With brutal new bombardments engulfing Ukrainian cities and Ukrainian counteroffensives pushing outwards, the need for further aid hangs precariously in the balance, shrouded in the uncertainty of allied agreement on a new spending package. The ongoing Congressional debate in the U.S., balancing domestic security concerns with foreign commitments, further clouds the picture. Meanwhile, Europe gropes anxiously for alternative solutions that don’t hinge on Hungarian approval, adding another layer of complexity to the already precarious situation. Ukraine’s stark assertion that no plan B exists beyond securing Western funding underscores the gravity of the situation and amplifies the pressure on allies to reach a decision.

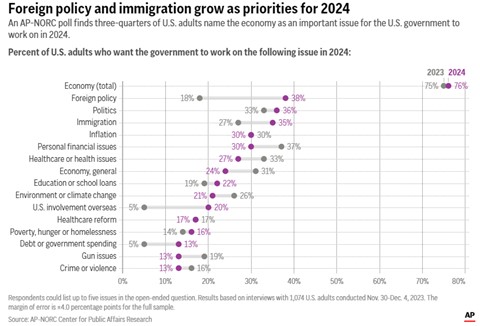

- Though further Western aid for Ukraine does seem likely, its long-term sustainability remains on shaky ground, influenced by rising American anxieties about both securing their own borders and the escalating tensions in the Middle East. While America’s foreign policy focus is sharply rising, with four in 10 now saying it should be a top government priority — double the sentiment from a year ago — this change in attitude doesn’t translate directly to unwavering support for Ukraine. In fact, America’s focus on the war has dipped slightly from 6% to 5%. This shift in priorities could potentially make the West more receptive to a quicker peace deal.