Daily Comment (January 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

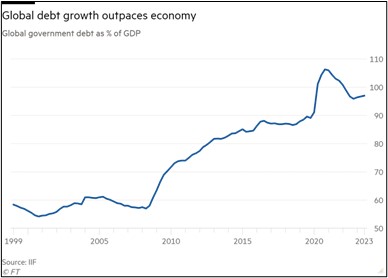

Our Comment today opens with a warning about high government debt levels from the Institute of International Finance. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a dramatic example of violence in Ecuador and the latest on fiscal policy negotiations in the U.S.

Global Government Debt: The Institute of International Finance has issued a report warning that the “unmoored” level of public debt around the world is raising the risk of a bond-market backlash. The report indicates that government debt isn’t just a problem in the U.S., the U.K., and other developed countries, but is also a problem in many emerging markets.

- Our analysis suggests much of the problem in the U.S. can be traced to the lingering effects of the COVID-19 pandemic, which pushed legions of baby boomers into retirement (replacing Social Security contributions with Social Security withdrawals), boosted price inflation, and prompted generous new entitlement benefits.

- In theory, policymakers could attack some of those issues, say by bringing down inflation and curtailing benefits. On the other hand, other issues will generate continued spending pressures, such as further population aging and new geopolitical tensions that will require higher defense budgets.

Eurozone: Luis de Guindos, vice president of the European Central Bank, warned in a speech today that even though the eurozone economy is likely to enter another downturn this year, persistent inflation pressures could keep the monetary policymakers from cutting interest rates as aggressively as market participants expect. The statement illustrates how bond investors in Europe are probably too optimistic about near-term interest rate cuts, just as they are in the U.S.

United Kingdom: Former defense officials have gone public with complaints that the Ministry of Defense is trying to cover up data showing a serious shortfall in skilled personnel for the armed forces. The lack of skilled sailors has reportedly prompted the early retirement of at least two navy vessels. Meanwhile, The Telegraph reports that total U.K. armed forces personnel has fallen to 184,865, the lowest number since the end of the Napoleonic Wars in 1815.

Ecuador: Armed gang members yesterday staged attacks across the country, including breaking into a public television station and temporarily interrupting a live show while they brandished guns and grenades. The gang violence appeared to be a warning against President Noboa’s plan to crack down on the gangs and bring them under control. The violence highlights the growing power and violence of drug cartels, which threatens to destabilize governments, imped investment, and drive more migrants to the U.S.

United States-China: As more evidence that the U.S. military is preparing for a potential future conflict with China, an important Air Force intelligence unit is reportedly urging its Arabic- and Pashto-speaking cryptologic linguists to learn Mandarin. The move by the 70th Intelligence, Surveillance, and Reconnaissance Wing comes as the U.S. Marine Corp is completely restructuring to fight a war in the Indo-Pacific region, while the U.S. Army has reinstituted jungle warfare training, and the U.S. Navy is broadening its submarine efforts with Australia.

U.S. Fiscal Policy: Even though lawmakers have reached an agreement on the top-line budget parameters for the current fiscal year, Senate Minority Leader Mitchell yesterday advised that there won’t be enough time to pass all the specific appropriations bills needed to finance the government when the current stopgap funding law expires beginning in about two weeks. In other words, Congress may have to pass yet another stopgap to avoid a partial government shutdown until the appropriations bills are finished. Stay tuned for more budget chaos.

- Separately, lawmakers who are working on separate tax legislation are reportedly considering curbing the controversial pandemic-era Employee Retention Credit (ERC). That law, passed in 2020, gives employers a lucrative tax break for retaining employees during the pandemic shutdowns, but it has been wracked by fraud and an overly long availability until 2025.

- Curbing the eligibility for that credit or cracking down on spurious claims could help generate funds for other priorities the lawmakers are discussing, such as reversing the requirement in the Trump tax package of 2017 that corporate research deductions be spread out over five years instead of being expensed immediately.

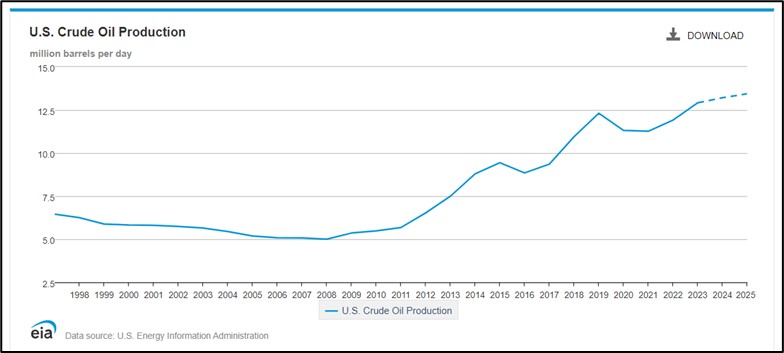

U.S. Energy Market: A new outlook from the Energy Information Administration forecasts that U.S. oil production will rise further from the record high of 12.9 million barrels per day in 2023 to further new record highs of 13.2 million bpd in 2024 and 13.4 million bpd in 2025. The agency also projects that U.S. output of natural gas will also rise to new records this year and next year. The figures underscore how the U.S. has become an energy powerhouse since the arrival of new technologies such as hydraulic fracturing and horizontal drilling.

- While “green” policies and investor demands for capital discipline did discourage new exploration and development for much of the last decade, drillers more recently have boosted output.

- Along with weakening demand growth in China and other markets, the surge in U.S. energy output has helped push down prices in recent months, helping bring down the overall rate of consumer price inflation.

- If the U.S. economy slows too much and slips into recession, the further loss of demand would likely weigh even more heavily on global oil and gas prices.

- Nevertheless, we think the hesitant drilling in recent years and increased geopolitical tension will buoy oil and gas prices again over the longer term.

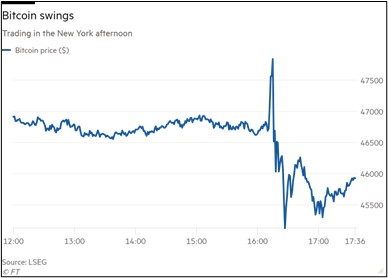

U.S. Cryptocurrency Market: Bitcoin (BTC, $45,108.20) and other cryptocurrencies swung wildly in price yesterday after a hacker took control of the Securities and Exchange Commission’s social media account and falsely announced that the agency had approved the U.S.’s first-ever cryptocurrency ETFs. Crypto prices surged, only to fall sharply within minutes when the SEC disclaimed the report. Nevertheless, the SEC is widely expected to announce its official decision on crypto ETFs either today or tomorrow.