Daily Comment (January 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Risk assets are off to a rough start as CPI failed to reinforce rate cut expectations. On the bright side, Real Madrid secured a nail-biting win over their city rivals Atlético Madrid in extra time, keeping their Supercopa dreams alive. Today’s Comment starts with our thoughts on the resurgence of demand for fixed-income securities. We then discuss the SEC’s approval of a bitcoin ETF and provide an update on the conflict in the Red Sea. As always, our report also includes an overview of the latest domestic and international data releases.

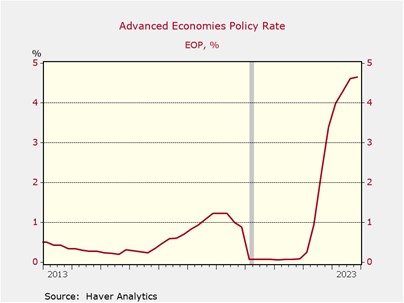

Bond Rush! Anticipation of central bank rate cuts has led investors to flock to fixed-income securities; however, policymakers continue to play their cards close to their chest.

- G-7 central bankers are hinting at the end of rate hikes, but they’re staying mum on potential cuts. While New York Fed President John Williams believes current rates can tame inflation, he emphasizes the need for continued evidence of a sustained cooldown before considering any easing. The European Central Bank’s Isabel Schnabel and Bank of England Governor Andrew Bailey both echoed this cautious stance by warning against premature speculation due to persistently high inflation exceeding their 2% target. Although inflation has eased notably over the past year, growing concerns from economists and analysts suggest that inflation may struggle to reach the 2% target within the year due to geopolitical and supply chain risks.

- Ignoring central bank warnings of steady rates, investors drove European bond sales to a record high of 118 billion EUR ($108 billion) this week. Supranational organizations and sovereign governments fueled the surge, seeking to lock in lower rates and fund annual expenditures. This borrowing spree wasn’t limited to Europe. Emerging market governments and corporations also jumped in, raising $50 billion in the first half of January to capitalize on the temporary dip in rates. This global borrowing spree reflects investor optimism in the wake of easing rate pressures, signaling potential financial relief across markets after a period of hawkish policy.

- While falling rate expectations eased borrowing costs and boosted liquidity, a long lasting ease in financial conditions will likely require actual policy changes from central banks. Despite isolated suggestions like Fed Governor Waller’s hint at a March cut, no clear evidence points to an imminent pivot. Thus, the risk remains real, similar to 2023, that the current bond rally may fizzle out before it gains firm footing, revealing more risk in long-duration bonds than current pricing suggests. We recommend that investors cautiously approach the prospect of rate cuts as a deceleration in inflationary pressure may prompt policymakers to maintain current rates beyond market expectations.

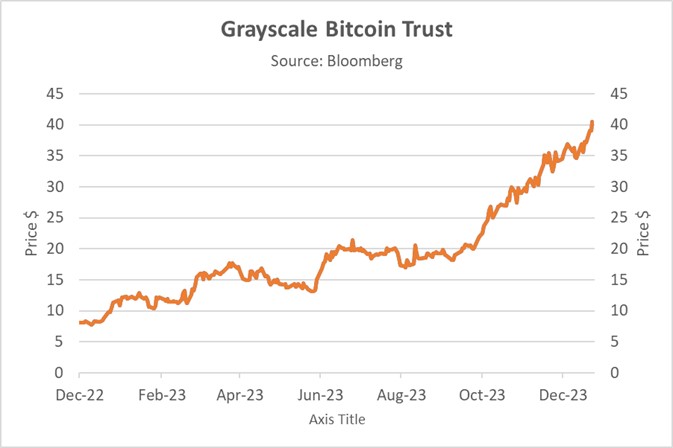

SEC Approves: Crypto traders achieved a crucial victory as the Security and Exchange Commission approved the first spot Bitcoin ETFs.

- After years of regulatory limbo, 10 crypto ETFs secured approval, marking a significant step forward for the industry. This green light follows a decade-long legal battle that culminated in the federal courts forcing the SEC to review Grayscale’s Bitcoin ETF application. Despite the SEC’s concerns about potential manipulation and fraud in digital assets, this decision clears the way for the first crypto ETFs to begin trading as soon as this morning. This opens the door for both retail and institutional investors to gain regulated exposure to digital assets for the first time, a move that could significantly boost adoption and legitimize the crypto market.

- Following the announcement, Bitcoin, the most widely traded currency, rose as high as 2% on the day and volume jumped to a 10-month high. This surge reflects investor excitement over the potential domino effect, paving the way for broader adoption of other digital assets. While crypto’s mainstream appeal remains debatable, its dedicated fanbase is undeniable. A recent Crypto Council for Innovation survey revealed that a whopping 83% of holders favor clear regulatory guidelines from the next president, hoping they will nurture the industry’s growth. Crypto may not swing elections, but its rising influence is becoming clearer.

- Although the ruling improves crypto’s attractiveness, the market remains rife with regulatory uncertainty and elevated volatility. Bitcoin’s $47,000 price tag faces a bumpy road ahead, with analysts predicting declines towards $28,000 by year-end, countered by some optimistic forecasts eyeing a climb above $100,000. This stark contrast underscores the inherent volatility of the asset. As a result, unless a divine power comes down to meet us at Mt. Sinai to tell us otherwise, we will remain steadfast in our belief that crypto is not a safe choice for risk-averse investors.

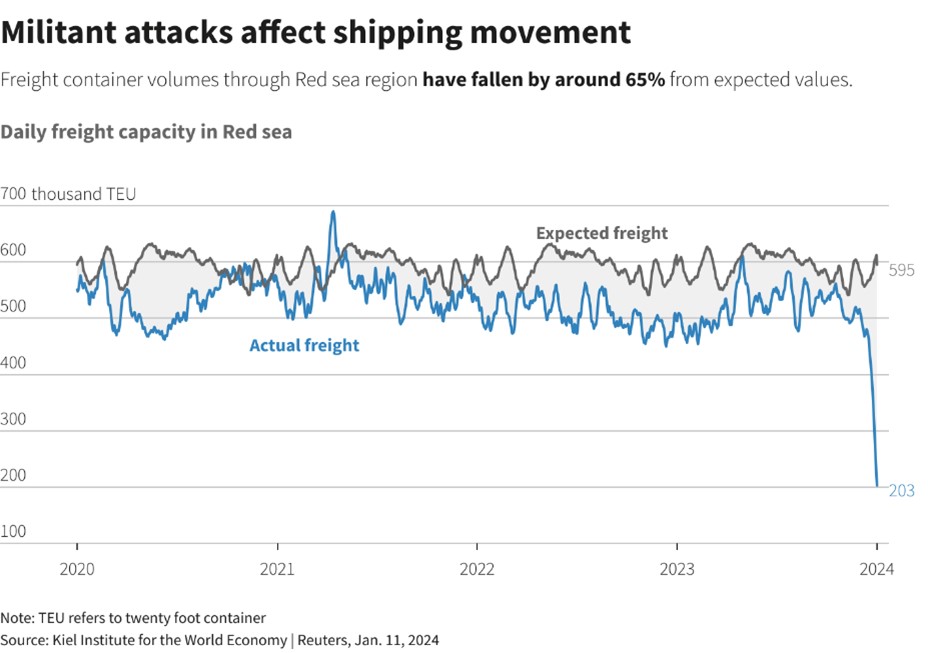

Conflict in the Red Sea: The Iranian-backed Houthis have continued to escalate tensions with the West by launching attacks on commercial ships entering the Red Sea.

- Frustration mounts as leaders from the United States and its allies issue stern warnings of military action in response to ongoing Houthi rebel attacks on shipping vessels in the Red Sea. This escalation comes after a recent barrage of attacks by the Houthis, which involved 18 drones, two anti-ship cruise missiles, and one anti-ship missile aimed at commercial ships traversing the crucial global trade route. The Houthis have linked their actions to the ongoing conflict between Israel and Hamas by vowing to continue their attacks until Israeli forces withdraw from Gaza. This raises concerns of a wider regional conflict.

- Houthi attacks on Red Sea shipping are worrying, but their inflationary impact remains elusive. Violence in the Red Sea has spiked freight costs, as shippers are forced to pay higher shipping costs through insurance and take longer shipping routes to transport their goods. That said, freight costs remain well below pandemic levels. Meanwhile, overall global trade dipped 1.3% in December suggesting that countries are still being impacted. The European Union, specifically, saw a sharp drop in trade with imports falling by 3% and exports declining by 2%. However, there are still no signs that the shipping problem will impact inflation.

- Weak confidence and elevated rates, which dampen demand, largely shield consumers from the conflict’s immediate sting. This trend is likely to hold in the next three to six months assuming that the conflict in the Middle East remains relatively contained. We foresee a broader conflict significantly impacting European inflation, more so than the U.S., while proving bullish for commodities like oil and metals. However, Western intervention remains a major headwind for financial markets as it could lead to a renewed war effort, but this remains a low probability.

Other News: With Chris Christie suspending his presidential bid, Donald Trump is now closer to facing a one-on-one fight for the Republican nomination. While he still appears to be the frontrunner, we can’t rule out an upset. China has gestured toward more cooperative U.S. ties days before Taiwan’s elections, potentially reducing the risk of miscalculation regarding an island takeover if its preferred candidate loses. Alphabet Inc.’s Google (GOOG, $143,80) plans to lay off hundreds, in a sign that tech may be trying to meet earnings expectations through a smaller workforce.