Daily Comment (January 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with some notes on the important voting in Iowa and Taiwan over the last few days. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including further Houthi attacks on commercial ships in the Red Sea and a Federal Reserve policymaker’s warning against cutting interest rates too soon.

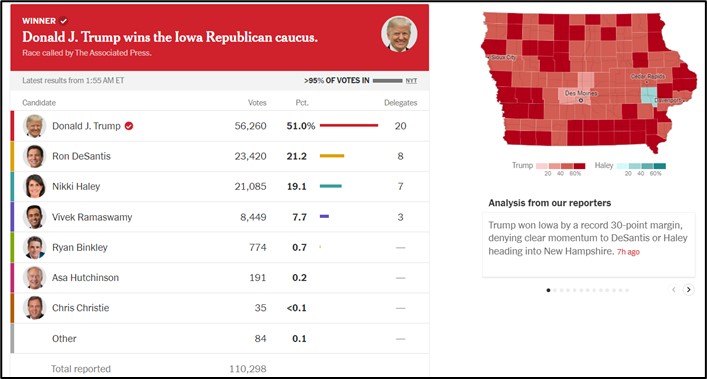

U.S. Elections: In the Republican Party’s Iowa caucuses yesterday, former President Trump overwhelmingly won, as expected, with about 51% of the vote. Florida Governor Ron DeSantis came in second with 21%. Former South Carolina Governor Nicki Haley only came in third with 19%, despite her recent surge in polling support. Entrepreneur Vivek Ramaswamy came in fourth with less than 8% and announced that he will end his long-shot bid for the nomination. Next stop for the remaining candidates is the New Hampshire primary next Tuesday.

- Although Trump’s margin of victory was a record for Iowa, it’s important to keep in mind that the state has had a poor record of choosing the ultimate Republican candidate in recent election cycles. Trump still looks like the likely candidate for the Republicans, but his position at the top of the ticket isn’t yet assured.

- Another thing to keep in mind is that it’s still unclear whether Trump’s candidacy should be treated as that of an incumbent or as an upstart. Over history, the political and financial market dynamics around an election have differed depending on the status of the ultimate winner. For example, if Trump were considered an incumbent, he would have been expected to take nearly all the vote in last night’s balloting.

- In any case, we’ll continue monitoring the election campaigns, with a key focus on the implications for issues such as:

- U.S. foreign policy, especially the U.S.’s tense relationship with China, the strength of its alliances, and approach to international trade, investment, and migration;

- Monetary policy, especially the independence of the Fed and likely nominations for key officials;

- Fiscal policy, including the fate of the Trump tax cuts due to expire in 2025, the outlook for the federal deficit and debt, and spending priorities in the budget; and

- Regulatory policy, including antitrust policies and the regulation of the energy industry and financial services.

(Source: Wall Street Journal)

(Source: Wall Street Journal)

Taiwan Elections: In Saturday’s election, independence-leaning Vice President Lai Ching-te of the ruling Democratic Progressive Party won the presidency with 40% of the vote. Lai’s win will anger Chinese leaders, as it means Taiwan’s government will continue to resist near-term reunification with the mainland. Still, Beijing may be partly appeased that the DPP lost control of the legislature to the China-friendly Kuomintang. Thus, the results may be the best possible outcome for peace in the Indo-Pacific and the security of Taiwan’s world-leading semiconductor industry, which produces 90% of the world’s most advanced computer and cellphone chips.

- Separately, the tiny Pacific Island nation of Nauru (pop. 11,000) yesterday recognized the People’s Republic of China, dumping its diplomatic recognition of Taiwan. In response, the Taiwanese foreign ministry accused Nauru of trying to extort large sums of money from Taipei to maintain its recognition of Taiwan.

- As a result, just 12 countries around the world now recognize Taiwan as the official representative of the Chinese nation.

South Korea: Although Taiwan’s election outcome probably boosts the near-term security of its chip industry, governments around the world still worry that the U.S.-China rivalry could threaten future semiconductor supplies. Reflecting that concern, the South Korean government yesterday announced a plan to develop the world’s largest semiconductor manufacturing hub by channeling $471 billion of private investment into the project over the next 25 years.

- Much of the investment will come from the country’s premier electronics firms, including Samsung (005930.KS, KRW, 73,900) and SK Hynix (000660.KS, KRW, 134,100).

- As with similar chipmaking plans in the U.S. and other countries, the aim of Seoul’s program is to develop its own domestic computer chip supplies.

North Korea-South Korea: North Korean paramount leader Kim Jong Un today ordered that his country’s constitution be changed to remove its language calling for eventual reunification with South Korea. Kim also ordered that all government agencies dedicated to reunification be dismantled and that North Koreans should now consider South Koreans to be their principal enemy. The aim of the move is apparently to give North Korea more political leeway for an eventual attack on South Korea, or at least to increase the credibility of threatening such an attack.

Philippines: After a meeting with President Ferdinand Marcos, Jr., yesterday, the chief of the Philippine military laid out an expansive plan to assert the country’ sovereignty over areas also claimed by China. The unexpectedly aggressive plan would include purchasing more military ships, radars, and aircraft, as well as building facilities to house troops on up to nine disputed islands. Given the U.S.-Philippine mutual defense treaty, Manila’s more assertive stance against China raises the risk of a potential U.S.-China conflict in the future.

China: In a speech to the World Economic Forum in Davos, Switzerland, Premier Li Qiang said Chinese gross domestic product grew by “an estimated” 5.3% in 2023. If confirmed when Beijing releases the official figures, that would mark an acceleration from the weak 3.0% growth in 2022, when the government was still imposing draconian lockdowns to battle the COVID-19 pandemic. Tellingly, Li bragged that the growth in 2023 was achieved without resorting to “massive stimulus,” which suggests investors shouldn’t hope for such policies in 2024.

Japan: As Prime Minister Kishida struggles with abysmally low ratings in opinion polls, compounded by his Liberal Democratic Party’s extensive illegal funding scandal, a recent poll shows that Foreign Minister Yōko Kamikawa is rising in popularity. Indeed, she is increasingly being seen as a viable candidate to replace Kishida, based largely on her reputation as an energetic and courageous leader.

Germany: Data released yesterday showed Germany’s gross domestic product fell by an inflation-adjusted 0.3% in 2023, making it the worst-performing major country last year. The decline reflected headwinds such as high energy costs, elevated inflation rates, and rising interest rates, all of which continue to weigh on Germany — and the broader European economy — so far in 2024.

Middle East Conflicts: Iran launched a series of ballistic missile strikes this morning against targets in Syria and northern Iraq, including what Iranian officials said was an Israeli “intelligence center.” According to the Iranians, the strikes were in response to recent Israeli attacks that killed an Iranian commander in Syria and members of Tehran-backed militant groups in the region. The strike against the Israeli facility, if true, could dramatically increase the risk of overt fighting between the Israelis and Iran.

- Separately, Iran-backed Houthi rebels in Yemen fired missiles at both a U.S. Navy ship and a U.S-owned commercial ship over the long weekend, hitting the commercial ship but only causing minimal damage. U.S. military officials said they are expecting more retaliatory attacks from the Houthis and are preparing to launch more punishing airstrikes in response.

- The Iranian and Houthi attacks are keeping alive the risk that the Israeli-Hamas conflict could broaden into a wider regional war that would draw in the U.S.

- A broader war in the region would threaten global trade and oil supplies, boosting prices and threatening to reverse the recent progress in bringing down inflation.

U.S. Monetary Policy: Atlanta FRB President Bostic warned on Sunday that cutting interest rates too soon could lead to a rebound in consumer price inflation. Indeed, Bostic also said that the recent fast progress in bringing down inflation will likely slow going forward. Bostic is a voting member of the policy-setting Federal Open Market Committee this year, so his warnings suggest he may help resist any move by the policymakers to cut rates as quickly as bond investors are expecting.

U.S. Fiscal Policy – Federal: Senate Majority Leader Schumer has submitted a new stopgap funding bill to keep the federal government open until early March, which would give lawmakers more time to agree on the appropriations bills needed to formally fund operations for the rest of the fiscal year. The bill is due to be taken up by the Senate today and would have to pass both houses and be signed into law by Friday to avoid a partial shutdown of the government, but opposition to the overall funding deal by some Republicans makes it unclear whether that will happen.

U.S. Fiscal Policy – State & Local: As New York Governor Hochul and New York City Mayor Adams today release their proposed budgets for the coming fiscal year, the plans are expected to encompass the state sending an additional $2 billion to the city to help cover the cost of providing housing, food, medical care, and other services to illegal immigrants sent their by border states. City officials expect the cost of caring for the immigrants will total $10 billion through mid-2025, likely helping create political pressure for tougher border policies.

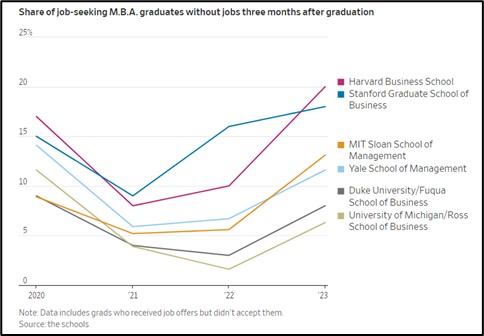

U.S. Labor Market: Although the overall demand for labor in the U.S. remains strong, data continue to show weak hiring for higher-paid, white collar jobs. The Wall Street Journal today carries an interesting story showing an unexpectedly high rate of joblessness for newly minted MBAs from top schools. For example, the report shows that 20% of students who received an MBA from Harvard Business School this spring were still unemployed three months later. Weak demand for white-collar labor could help explain some of the current crosswinds in the job market.