Daily Comment (January 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Tech stocks are soaring on chip optimism, while La Liga giants Atlético Madrid and FC Barcelona are gearing up for a Copa Del Rey clash! Today’s Comment dives deep into the Fed’s rate cut whispers, the Red Sea crisis, and why U.S. oil is the crude market’s kryptonite. Plus, we’ve got your U.S. and international data roundup.

Fed Black Out: As the Fed enters its pre-meeting quiet period, expectations for a March rate cut have dimmed, but the possibility of adjustments remains on the table.

- Atlanta Fed President Raphael Bostic was the latest member of the Federal Open Market Committee to cast doubts about a cut within the next three months. During an event hosted by the Atlanta Business Journal, Bostic stated that he suspects that the central bank will lower its benchmark rate in the third quarter but maintained that he would be persuaded to move sooner if inflation falls faster. His comments follow a group of other policymakers such as Federal Reserve Board Governor Christopher Waller and New York Fed President John Williams, who are also looking to rein in investor expectations of an imminent rate cut.

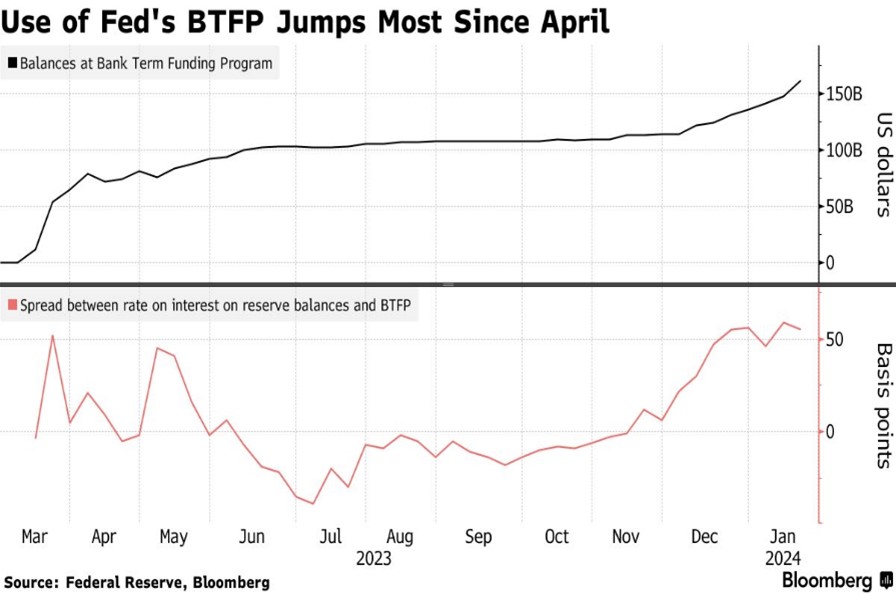

- Though the Fed insists the market is misreading its March intentions, the Bank Term Funding program (BTFP), established after the collapse of Silicon Valley and Signature Bank, may offer a different story. Set to expire on March 11, the program, which allows banks to borrow at discounted rates in exchange for discounted bonds valued at par, is unlikely to be renewed. In the lead up to the end of the program, banks have looked to ramp up their borrowings. The program’s closure could force the central bank to look for alternatives to help ease some of the financial stress, which may include policy rates or possible changes to its quantitative easing program.

(Source: Bloomberg)

(Source: Bloomberg)

- The Federal Reserve’s first meeting of the year on January 31 will be crucial in setting the stage for its 2024 policy approach. While some policymakers have hinted at further interest rate hikes, the Fed’s primary focus will be on lowering rates, albeit at a pace dictated by economic conditions, inflation, and financial stability. The upcoming election adds a layer of complexity, potentially influencing the Fed’s communication and policy decisions as it does not want to be seen as favoring a particular party or candidate. Nevertheless, with inflation in check, policymakers’ three-cut projection could be seen as a minimum rather than a maximum.

Red Sea Escalation: Western efforts to counter Houthi rebels in Yemen raise concerns of a broader Middle East conflict and potential supply chain disruptions.

- The U.S. launched its fifth round of airstrikes against the Iranian-backed Houthis in the Red Sea on Thursday, following a drone attack near Yemen that struck a third oil tanker. White House National Security Council member John Kirby insisted the attacks would continue as long as necessary to deter further attacks on commercial shipping while acknowledging the potential for escalation in the region. While the U.S. maintains it is not seeking conflict, the continued airstrikes raise concerns about the long-term stability of the region.

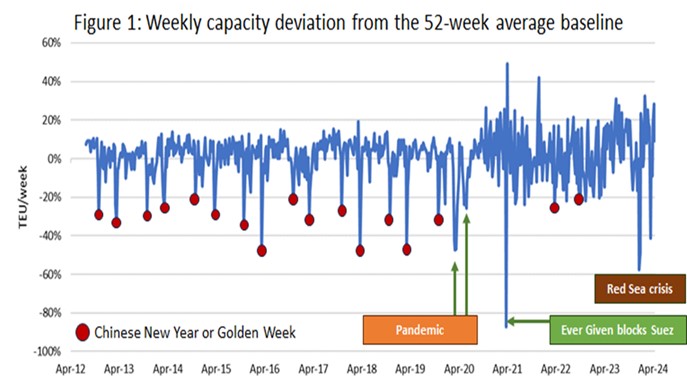

- Houthi attacks and international military responses in the Red Sea, by some accounts, are causing greater shipping delays than the early COVID-19 pandemic. The chart below reveals significant fluctuations in a key indicator of global trade flows, the Trade Capacity Index, which was developed by Sea-Intelligence CEO Alan Murphy. Notably, since Houthis started attacking ships, the average weekly deviation in shipping capacity from its annual average has dropped to levels last seen when the Ever Given blocked the Suez Canal in 2021, highlighting the dire situation for global supply chains.

(Source: Sea-Intelligence)

(Source: Sea-Intelligence)

- Amid escalating tensions, Arab nations are actively engaged in mediating efforts to broker a cease-fire agreement and pave the way for the establishment of an independent Palestinian state. The overarching agreement seeks not only to diffuse current tensions but also to set the stage for normalized relations between the involved Arab countries and Israel. In exchange for this normalization, there is a mutual commitment to undertake “irreversible” measures that contribute to the realization of a sovereign Palestinian state. Although it currently seems like a long shot, if successful, it could pave the way for lower commodity prices.

Shale’s Comeback: Even as geopolitical tensions in the Middle East threaten to disrupt supply and drive up crude prices, U.S. shale production continues to act as a dampener, reminding us of its lasting impact on the oil market.

- The International Energy Agency predicts a global oil surplus driven by a projected surge in production from the U.S. and other non-OPEC countries despite production cuts agreed upon by OPEC. This production surge, exemplified by the U.S. surpassing Iraq’s exports in November, is expected to outpace the moderating effect of OPEC cuts throughout the year. The surplus could lead to lower oil prices, impacting investments and potentially affecting energy security in countries reliant on oil imports. While OPEC’s cuts may slow the initial production boom, its influence is likely to wane later in the year.

- After a shaky start following Russia’s invasion of Ukraine, U.S. oil production is demonstrating impressive resilience. The U.S. Energy Information Administration (EIA) noted that the United States reached a record-breaking 13.2 million barrels per day as of October 2023, with a slight moderation later in the fourth quarter. The strong performance is expected to continue, with record production figures anticipated in both 2024 and 2025. In a recent move, Saudi Arabia lowered its crude price, likely an attempt to maintain market share in the face of rising U.S. competition.

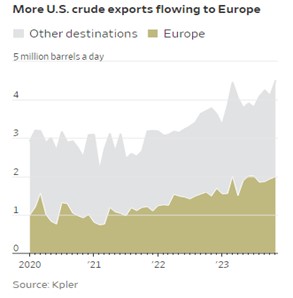

(Source: Wall Street Journal)

(Source: Wall Street Journal)

- The war in Ukraine has accelerated Europe’s growing reliance on the U.S. for energy, raising concerns about potential geopolitical risks. This shift comes as Russia’s ostracization forces it to lean towards China and India for its own sales, potentially creating new power dynamics in the global oil market. This dominance could pave the way for a potential ceasefire in Ukraine as Russia and Europe look to find ways to strengthen their position as they try not to be overrun by the two major superpowers.

Other News: The Federal Reserve is proposing a new rule that would require banks to borrow from the discount window at least once a year. This move aims to encourage banks to become more familiar with this emergency lending facility and lessen their reliance on backstops during times of crisis. Japan is aiming to become the fifth country to land an aircraft on the moon. Japan’s space exploration showcases its ambition to compete alongside established players.