Daily Comment (January 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with items related to the Russia-Ukraine war. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a surprise easing of monetary policy in China and the latest on the U.S. presidential election following New Hampshire’s primary election yesterday.

Russia-Ukraine War: Reports today suggest a Russian military plane may have been shot down by Ukrainian forces over Russian territory close to the border with Ukraine, with no survivors. According to Russian officials, the plane was carrying 65 Ukrainian prisoners of war who were about to be part of a Russia-Ukraine POW exchange. That hasn’t yet been verified, but if found to be true, it could be a major embarrassment for Ukrainian President Zelensky and potentially increase domestic pressure on him to begin peace talks.

NATO-Sweden: As we flagged in yesterday’s Comment, the Turkish parliament last night approved Sweden’s bid to join the North Atlantic Treaty Organization. Once Turkish President Erdoğan signs the accession protocol in the coming days, the only hurdle left for Sweden would be to gain Hungary’s approval. Hungarian Prime Minister Orbán has invited Swedish officials to discuss the accession, but a vote still hasn’t been scheduled in the Hungarian parliament.

Israel-Hamas Conflict: Hamas officials yesterday told international mediators that they would consider trading some of the Israeli hostages the group still holds in return for a significant pause in fighting. The statement marks a shift for Hamas, as it had previously said it would only consider releasing more hostages as part of a permanent, comprehensive peace deal with Israel. Nevertheless, it isn’t clear whether the Israeli government will accept the deal, or under what terms. For now, the fighting is set to continue, as will the risk of a broader regional conflict.

- Separately, the U.S. carried out three different airstrikes last night against Iran-backed Kataib Hezbollah militants in Iraq, just as it has been carrying out strikes on Iran-backed Houthi rebels in Yemen.

- The strikes against Kataib Hezbollah follow multiple attacks the group has staged against U.S. forces in the region, which have caused multiple injuries to U.S. personnel. To reiterate, such strikes and counterstrikes mean there is still a risk that the fighting between Israel and Hamas could spread throughout the region.

China: The People’s Bank of China today unexpectedly slashed its bank reserve requirement for the third time since last September, cutting the standard to 7.0% from 7.4% previously. PBOC chief Pan Gongsheng also signaled the central bank will soon cut key interest rates. The moves may give some boost to the Chinese economy and financial markets, but slightly looser monetary policy is unlikely to overcome the big economic headwinds China is currently facing.

- Separately, technology giant Alibaba (BABA, $74.02) saw its share price jump 7.9% yesterday, and pre-market activity suggests the price gains will continue today. That follows reports that co-founders Jack Ma and Joe Tsai have been aggressively buying shares.

- As we noted in yesterday’s Comment, the Chinese government has reportedly been pressuring state-owned firms to buy shares and buoy the flagging market. It’s not inconceivable that high-profile individual owners and investors could also be under pressure to buy.

South Korea: Conservative President Yoon Suk Yeol is facing a growing scandal after a left-wing pastor secretly recorded a video of Yoon’s wife accepting the gift of a $2,200 handbag in violation of the country’s anti-graft laws. The scandal is important because it could complicate Yoon’s effort to ensure his party gains control of the national legislature in the April elections.

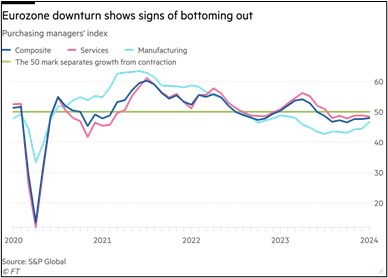

Eurozone: The composite “flash” purchasing managers’ index for January rose to a seasonally adjusted 47.9, marking its highest level in six months and improving from 47.6 in December. Like most major PMIs, the eurozone’s is designed so that readings above 50 indicate expanding activity. With its improvement in January, the composite PMI suggests the eurozone’s recent economic downturn is easing a bit, but output is still falling overall. The improvement in January came as manufacturing improved a bit but service activity weakened.

Germany: Deutsche Bahn train conductors today launched a six-day strike over working hours, marking the worst labor action at the railroad in thirty years. The strike is already disrupting freight and passenger service in Germany and could be a further headwind for the country’s struggling economy.

U.S. Politics: In yesterday’s New Hampshire primary election for the Republican Party, former President Trump won with about 54.5% of the vote, while former UN Ambassador Haley came in second with about 43.2%. Nevertheless, Haley vowed to fight on, so it looks like the pair will again face off in Haley’s home state of South Carolina, which holds its primary on February 24.

- While it increasingly appears that Trump will be the ultimate Republican nominee, Haley’s performance in New Hampshire and in last week’s Iowa caucuses have highlighted her strength with right-leaning independents and moderate Republicans.

- Resistance from those groups could be a weakness for Trump in his likely rematch with President Biden in November’s general election.

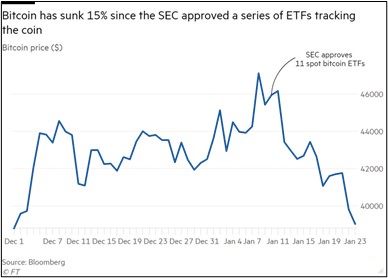

U.S. Cryptocurrency Market: The price of Bitcoin (BTC, $39,709.17) fell about another 3% yesterday, bringing its total decline over the last two weeks to approximately 15%. In part, the drop in value reflects investors taking profits after the Securities and Exchange Commission approved spot exchange-traded Bitcoin funds on January 11. The drop also probably reflects some disappointment as flows into those ETFs haven’t met expectations.

U.S. Entertainment Industry: The Academy of Motion Picture Arts and Sciences yesterday released its Oscar award nominees, with “Oppenheimer” pulling in 13 different nominations. Among other top films, “Poor Things” got 11 nominations, “Killers of the Flower Moon” received 10, and “Barbie” got eight. Release of the nominees often gives a short-term boost to the films and movie attendance.