Daily Comment (January 30, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a couple of notes on global oil supplies, including reduced capacity investment in Saudi Arabia but a new supply discovery in China. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, such as new data confirming Europe’s slow economic growth and a preview of key U.S. monetary and fiscal policy decisions due this week.

Global Oil Industry: In Saudi Arabia, state-owned Saudi Aramco (2223.SR, SAR, 144.40) said it will comply with a request from the energy ministry to suspend a planned investment program that would have expanded its maximum sustainable production capacity from 12 million barrels per day to 13 million bpd by 2027.

- The energy ministry didn’t provide an explanation for its move, but other big oil producers in recent years have cut back investment because of profitability concerns and fears of falling future demand associated with the transition to green energy.

- Saudi Arabia and its OPEC+ partners have also been holding down current output in an effort to boost prices amid weakening global demand. Therefore, the energy ministry’s decision to limit new capacity investment could aim to help raise concerns about future supplies, thereby helping to boost prices.

China Oil Industry: Officials yesterday announced the discovery of a large new oil field in central Henan province, saying the field could hold up to 732 million barrels of light crude. That volume alone would amount to more than half of China’s current annual oil production. The field, therefore, could help replace declining output elsewhere and modestly help reduce China’s dependence on foreign energy supplies, although the available volume probably isn’t enough to have a significant impact on global prices.

China Stock Market: In yet another move to support China’s flagging stock market, the Chinese Securities Regulatory Commission and both major stock markets yesterday said strategic investors would be prohibited from lending out shares for short selling during specific lock-out periods. The modest measure isn’t likely to help the stock market very much, but the drumbeat of new efforts to buoy the market show that the government is intent on at least arresting its recent decline.

China Military: The Chinese People’s Political Consultative Conference has removed another high-ranking military official associated with missile development, meaning at least 16 such officials are now being investigated or disciplined for corruption or espionage. As we’ve noted previously, the continued chaos surrounding the People’s Liberation Army Rocket Forces has likely unsettled General Secretary Xi, although we don’t necessarily subscribe to the theory that it has reduced Xi’s willingness to use military force if needed.

EU Regulation: Amazon (AMZN, $161.26) and robotic vacuum maker iRobot (IRBT, $15.50) called off their proposed merger yesterday, largely because of pushback from antitrust regulators in the European Union and the U.K. The deal’s scuttling shows how European officials have become much more aggressive than their U.S. counterparts when it comes to ensuring free-market competition and combating market concentration. Going forward, large U.S. firms hoping to combine will probably continue to face high antitrust hurdles in the region.

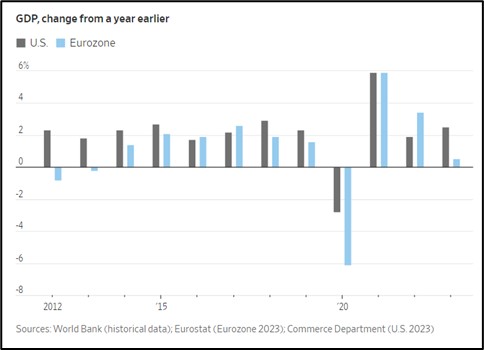

EU Economic Growth: The EU’s gross domestic product in the fourth quarter of 2023 was unchanged after a modest decline in the third quarter. As a result, the region’s GDP in all of 2023 was up just 0.5%, much weaker than the U.S.’s growth of 2.5%. The EU economy continues to struggle with elevated interest rates, high energy prices because of Russia’s invasion of Ukraine, and now broader supply disruptions because of the conflict in the Middle East. As a result, EU stock values rose much less than U.S. stock values in 2023.

Germany: A panel of outside advisors today issued a report saying the country’s constitutional “debt brake” is too rigid and should be broadly reformed to allow for more future-oriented fiscal spending. Implemented in 2016, the rule limits the country’s structural budget deficit to 0.35% of GDP, adjusted for the economic cycle. It was suspended at the outset of the COVID-19 pandemic, but it has nevertheless been criticized by left-wing and centrist politicians for slowing growth-enhancing public investment in infrastructure and green technology.

U.S. Monetary Policy: The Fed today begins its latest policy meeting, with its decision due tomorrow at 2:00 PM EST. The policymakers are widely expected to leave the benchmark fed funds interest-rate target unchanged at its current range of 5.25% to 5.50%. We think investors will be focusing on the decision statement and Chair Powell’s press conference, either of which could provide clues as to when the Fed will finally start cutting rates and reducing its balance sheet runoff. Many investors expect those moves as early as March, but we continue to think they’ll come a bit later than that.

- Separately, Elizabeth Warren and three other Democratic senators wrote a letter to Chair Powell over the weekend urging him to cut the current “astronomical rates” in order to bring down housing costs.

- Without doubt, the policymakers at the Fed are feeling a lot of political pressure to cut rates these days. Importantly, they’re likely feeling pressure from the Biden administration and from former President Trump, as well as Warren and her Democratic colleagues. Nevertheless, we still believe Powell will try to delay easing policy a bit longer than investors currently expect in order to be sure inflation pressure is under control.

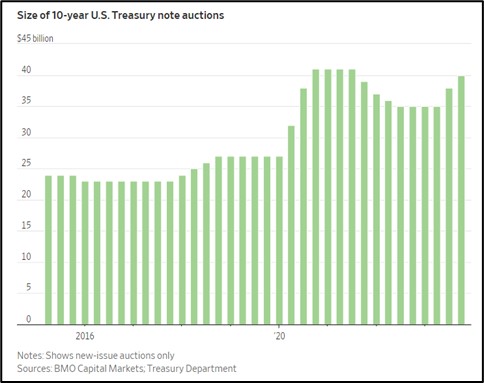

U.S. Fiscal Policy: The Treasury Department will release its borrowing plan tomorrow for the coming quarter, including its planned debt issuance by maturity. The quarterly refunding plan has recently been a market mover, and investors will be watching closely for any major change in the Treasury’s issuance of short-term obligations versus longer-term maturities. If the plan shows larger-than-expected issuance of longer-term debt, it will likely drive down Treasury prices, boost yields, and potentially weigh on risk asset values as well.