Daily Comment (January 31, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the latest on the tensions in the Middle East, which still could expand into a broader regional conflict and disrupt key global oil supplies. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including more indications of weak Chinese economic growth and a preview of key U.S. monetary and fiscal policy announcements due out today.

Israel-Hamas Conflict: Kataib Hezbollah, the Iran-backed militant group thought to be responsible for this week’s drone attack on U.S. forces in Jordan that killed three Americans, said yesterday that it will temporarily halt further attacks on the U.S. Nevertheless, U.S. military officials said the announcement would not stop a planned retaliatory strike against the group, and President Biden said he has already decided how that strike will be carried out.

- Kataib Hezbollah’s stand-down could well reflect pressure from Iranian officials, who likely fear a U.S. strike and the prospect that the conflict sparked by the Hamas attacks on Israel on October 7 could expand to a regional war.

- Separately, Israeli forces continue their military operations against Hamas in Gaza; Prime Minister Netanyahu is still considering what kind of government should rule the territory when the fighting is over. Netanyahu remains under pressure from right-wing members of his governing coalition to eventually push Palestinians out of Gaza — a move that would likely be criticized around the world as ethnic cleansing and potentially spark further sympathy attacks by militant groups.

- In sum, the conflict remains a major source of global instability, especially if it widens and more seriously disrupts Middle Eastern energy supplies or Asian-European shipping.

China: The National Bureau of Statistics said its January purchasing managers’ index for manufacturing rose to a seasonally adjusted 49.2, improving slightly from the December reading of 49.0. The January PMI for services and construction rose to 50.7 from 50.4. As with most major PMIs, the official Chinese gauge is designed so that readings over 50 indicate expanding activity. At their current levels, the Chinese PMIs reflect the strong headwinds that are holding down growth, especially in manufacturing.

- Separately, the slowdown in Chinese growth continues to manifest itself in falling prices for Chinese real estate and stocks. Naturally, weak pricing in those two areas has forced Chinese investors to scramble for other ways to protect or build wealth.

- Recent reports indicate many Chinese investors have piled into domestic funds that invest in the U.S. or Japan. Those funds have recently provided good returns to the Chinese investors that own them, offsetting their losses from Chinese assets.

- Now, new data from the World Gold Council shows Chinese investors have also turned to buying gold as a way to protect themselves. Along with “blistering” demand from the world’s central banks, the WGC says strong Chinese purchases of gold jewelry and investment products were a key factor driving up gold prices in 2023.

- Based on our desire to hedge against today’s rising geopolitical risks and take advantage of the rising global demand for gold, we maintained our positions in the yellow metal across all our asset-allocation portfolios during our adjustments for the first quarter.

Hong Kong: The municipal government has released a summary of the new national security law that it intends to add to its mini-constitution this year. The proposed law, which is subject to popular discussion for 30 days, is intended to supplement the national security law imposed by Beijing in 2019. Observers have already raised concerns about its provisions against sedition and the release of state secrets. If passed, the law would likely further discourage foreign investment and travel to Hong Kong.

European Union-Russia: The European Parliament has launched an investigation into allegations that Latvian lawmaker Tatjana Ždanoka has been spying for Russia for years. The allegations were first published in a Russian investigative newspaper. Ždanoka was one of just a dozen or so European Parliament lawmakers who voted against a resolution condemning Russia’s invasion of Ukraine in March 2022.

European Union-Mercosur: French officials yesterday said the European Commission has stopped negotiating over a free-trade agreement between the EU and Mercosur, a trade bloc consisting of Brazil, Argentina, Uruguay, and Paraguay. If true, it appears Brussels has caved to protesting farmers in France and elsewhere in the EU, who fear a surge of cheap South American food imports, despite the promise of greater EU industrial exports. The end of talks over the deal also illustrates how politics has swung against free trade throughout the developed countries.

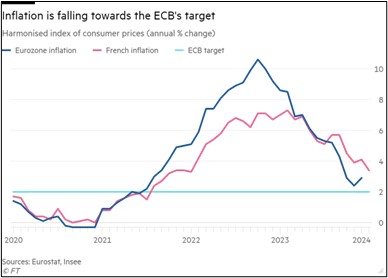

Eurozone: French consumer prices in January were up just 3.4% from the same month one year earlier, compared with 4.1% in the year to December. The good figures on price inflation have kindled new hopes that the European Central Bank could soon start to cut interest rates. However, in an interview last night, ECB chief Lagarde warned that the monetary policymakers still want to see more data confirming that price pressures are easing. Lagarde specifically cited a need to see easing wage growth.

U.S. Monetary Policy: The Fed wraps up its latest policy meeting today, with its decision due at 2:00 PM EST. The officials are expected to leave the benchmark fed funds interest-rate target unchanged at its current range of 5.25% to 5.50%. Investors will focus on the decision statement and Chair Powell’s press conference, either of which could provide clues as to when the Fed will finally start cutting rates and reducing its balance sheet runoff. Many investors expect those moves as early as March, but we continue to think they’ll come a bit later than that.

U.S. Fiscal Policy: Today, the Treasury Department will release its borrowing plan for the coming quarter, including its planned debt issuance by maturity. The quarterly refunding plan has recently been a market mover, and investors will be watching closely for any major change in the Treasury’s issuance of short-term obligations versus longer-term maturities. If the plan shows larger-than-expected issuance of longer-term debt, it will likely drive down Treasury prices, boost yields, and potentially weigh on risk asset values as well.

U.S. Immigration Politics: After Republicans in Congress pushed President Biden to accept tighter limits on immigration in return for new military aid to Ukraine, former President Trump has scuttled the deal to avoid giving Biden a win in the run-up to the election in November. Meanwhile, Republicans on the House Homeland Security Committee have pushed through a measure calling for the impeachment of Homeland Security Secretary Mayorkas for failing to enforce the national immigration laws and stop the recent surge of illegal border crossings.

- The tussling over border policy signals that immigration reform and border security will be a big part of the presidential campaign leading up to November.

- Given that polling suggests voters are more supportive of the Republicans’ tougher restrictions, it’s probably no surprise that Biden tacked to the right on border security in his effort to win support for more aid to Ukraine. Now that the Republicans have apparently decided not to accept the win, a key question is whether voters will punish them for playing politics with an issue they previously called essential to national security.

U.S. Defense Industry: As countries around the world work to rebuild their armed forces in response to worsening geopolitical challenges, new data shows U.S. defense companies recorded $81 billion in new foreign military sales in 2023, up 56% from 2022. The figures are consistent with our view that increased geopolitical tensions have set the stage for years of increased sales and profits for traditional defense contractors and other industrial or technology firms producing defense-related goods and services.