Daily Comment (February 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities are unfazed by Powell’s remarks this morning, while Caitlin Clark continues her dominant run in women’s college basketball. Today’s Comment dives into the latest Fed rate decision, explores renewed concerns about regional lenders, and examines the potential impact of China’s overcapacity on other nations. As always, we’ll wrap up with a summary of key international and domestic data releases.

Mission Not Accomplished: The Federal Reserve dashed hopes for a March rate cut, sending stocks plummeting and lifting bond yields from their intraday lows yesterday as investors recalibrated their expectations.

- The Federal Open Market Committee (FOMC) kept its benchmark interest rate unchanged at 5.25%-5.50% in its January meeting. While the decision was largely expected, the accompanying statement and Chair Powell’s comments offered valuable insights into the Fed’s future plans. The FOMC statement notably dropped any mention of further rate hikes and instead mentioned that it would consider “any adjustments” to its key policy rate. Chair Powell elaborated during the press conference, expressing the committee’s confidence in the trajectory of inflation toward the 2% target. However, he emphasized the necessity for additional evidence before contemplating rate cuts, suggesting such measures are unlikely to materialize by March.

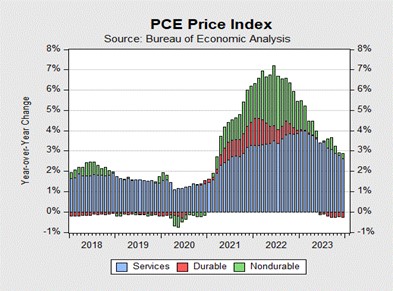

- Stronger-than-expected economic data, including a robust December jobs report and resilient consumer spending, could be behind the Federal Reserve’s decision to delay rate cuts. The December jobs report smashed expectations, with the economy adding 216,000 jobs and far exceeding the forecast of 170,000. Additionally, personal consumption remains a key driver of GDP, with December discretionary spending accelerating from 6.2% to 6.5%, significantly outpacing the 10-year average of 5.0%. Despite robust data, inflation has remained largely unaffected, prompting some members of the committee to express concerns about economic conditions that could potentially hinder the attainment of the 2% inflation mandate.

- The Federal Reserve is expected to closely scrutinize economic data over the next few months, searching for signs that could justify a policy shift. Two key inflation and employment reports will be released before the Fed’s next meeting, and the upcoming revisions to the Consumer Price Index (CPI) on February 9 could provide further clarity on the central bank’s progress against inflation. While the Fed has ruled out interest rate cuts in March, a policy pivot within the first half of the year remains a possibility. The latest CME FedWatch Tool shows that there is a 90% chance that policymakers will vote to cut interest rates in May.

Regional Bank Worries? The surprise earnings loss reported by New York Community Bancorp fueled fears of instability in the U.S. financial system amidst fresh concerns about the U.S. commercial real estate market.

- Fourth-quarter earnings at New York Community Bancorp (NYCB, $6.47) sent shockwaves through the market with a staggering $252 million loss, primarily driven by loan losses. The bank was forced to slash its dividend by 70% and scrambled to bolster its capital reserves to comply with stricter regulations imposed on larger institutions. This news sent the stock price plummeting 37%, while the broader KBW regional bank index dipped 6% as investors feared similar challenges across the industry. The bank’s weak performance comes just under a year after its acquisition of New York Signature Bank, which ultimately collapsed due to deposit flight driven by the failure of Silicon Valley Bank.

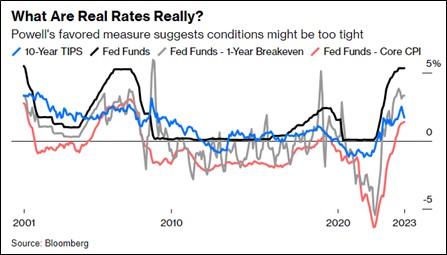

- NYCB’s news ignited an initial sell-off, but deeper anxieties linger regarding broader financial health. Falling inflation has pushed real interest rates to their highest levels since the pandemic, squeezing banks’ margins as they compete to retain deposits with attractive rates. While deposit flight has subsided since March, fears persist that savers may flee to higher-yielding money market accounts if rates remain elevated. The Federal Reserve’s bank term lending facility, which addressed the deposit run problem in the short term, is scheduled to end in March, thus raising concerns about potential economic challenges if broader policy changes are not implemented.

- The Federal Open Market Committee (FOMC) omitted its prior statement about the banking system being “sound and resilient,” which raises concerns that policymakers are increasingly worried about financial conditions when compared to the previous meeting. While the impact of NYCB’s news on FOMC discussions surrounding the banking system remains unclear due to the absence of questions on the topic during Powell’s Q&A, his suggestion of initiating discussions on balance sheet reduction in March indicates potential measures to address liquidity risk. However, the specific form this reduction will take — whether tapering quantitative tightening or complete cessation — is yet to be determined.

- The fallout from NYCB spread to other banks around the world with Tokyo-based Aozora Bank and German bank DeustchBank both reporting losses on loans on U.S. commercial properties. Such issues in real estate could likely put more pressure on central bankers to loosen monetary policy.

China’s Economic Fallout: There are fears that China’s economic slowdown could have spillover effects on the global economy, according to a business lobby group.

- The American Chamber of Commerce in China (AmCham China) sounded the alarm on persistent overcapacity woes, warning that Beijing’s credit shift from real estate to manufacturing could exacerbate the problem. This policy change, they say, raises the specter of “dumping” lower-priced goods into global markets, especially in strategically important sectors like electric vehicles. The report coincides with growing concerns that China might resort to increased state lending and industrial subsidies to prop up its flagging manufacturing sector.

- A potential glut of Chinese goods in the global market threatens to reignite Western concerns about unfair trade practices. The European Union is actively exploring measures to curb the influx of Chinese electric vehicles (EVs) within its borders, while the U.S. is pressuring companies to diversify their reliance on Chinese-made legacy chips for their devices. Pivoting exports towards developing countries within the Belt and Road Initiative might seem like a solution for China’s overcapacity woes, but the viability of this option is questionable. The global economic slowdown is expected to disproportionately impact these very countries, limiting their capacity to absorb significant amounts of additional imports.

- China’s bloated industrial capacity and escalating trade protectionism cast a long shadow over its fight against deindustrialization. Despite impressive recent growth, the country lacks concrete measures to unleash domestic consumption, a critical step needed to stabilize internal demand for its manufactured goods. Unfavorable demographic trends have further exacerbated this challenge and dampened consumption potential. While China’s economic resilience is undeniable, a strategic shift is necessary to navigate this complex crossroads and ensure sustainable, long-term growth.

Other News: The U.S. continues launching strikes against Houthi rebels in Yemen, escalating tensions in the region amid preparations for a response to the Jordan drone attack that killed three American service members. This escalating conflict in the Red Sea raises concerns about the potential for a broader war in the Middle East. U.S. regulators have targeted Chinese chipmakers over concerns that they aided AI firms with ties to the Chinese military. This crackdown on chip manufacturers reflects the intensifying competition between the two economic giants for dominance in the field of artificial intelligence.