Daily Comment (February 2, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities slumped and Treasury yields are up following a really strong jobs number. In other news, the GOAT of Formula One, Lewis Hamilton, will be joining the iconic Ferrari team next year. In today’s Comment we dive into Thursday’s tech earnings bonanza, explore the surging popularity of leveraged loans, and unpack recent central bank policy decisions. As always, we’ll include a roundup of global and domestic economic releases.

The Train Keeps Moving: Tech giants pleasantly surprised investors with earnings that exceeded expectations, and yet the duration of this upbeat trend remains uncertain.

- Meta (META, $457.50) basked in the afterglow of stellar financial results and notched its highest quarterly revenue in over two years while tripling profits through strategic cost-cutting. To amplify the joy, it announced its first-ever dividend and a whopping $50 billion share buyback, grabbing headlines and investor attention. This wasn’t the only good news in the tech world. Both Amazon (AMZN, $169.39) and Apple (AAPL, $180.32) delivered positive surprises. Yesterday’s earnings report showed that Amazon is solidifying its dominance in cloud computing, demonstrating its significant revenue potential, while Apple defied naysayers with strong iPhone sales, proving the device’s enduring appeal.

- Despite continued strong financial performance, tech firms are facing significant headwinds from geopolitical and regulatory risks. The slowdown in China, a key growth market, will likely impact overseas profits, as Apple’s recent sales outlook demonstrates. Additionally, growing concerns about tech giants’ influence and limited accountability are fueling regulatory scrutiny. Lawmakers like Missouri Senator Josh Hawley have publicly criticized platforms like Facebook for failing to adequately protect children from harmful content. The growing adoption of AI by tech companies is raising concerns among governments who are looking for ways to mitigate potential risks to the public.

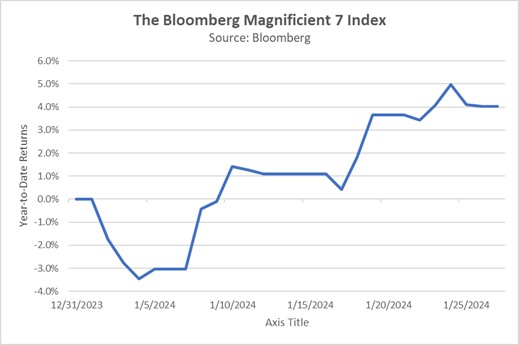

- Tech stocks currently outperform the market, but questions linger about the sustainability of their growth. The average P/E ratio of 38, while lower than the dotcom bubble peak, is still significantly higher than historical market averages, raising concerns about future valuations. Meeting current market expectations would require unprecedented revenue growth. Additionally, regulatory hurdles pose a major potential challenge. While navigating these hurdles successfully won’t guarantee smooth sailing, failing to do so could significantly impact performance and valuations. As a result, we still believe that investors could probably find better value in other places in the market.

Debt Wall Solution? As concerns rise about large amounts of maturing debt, companies are exploring options to restructure their obligations and avoid default.

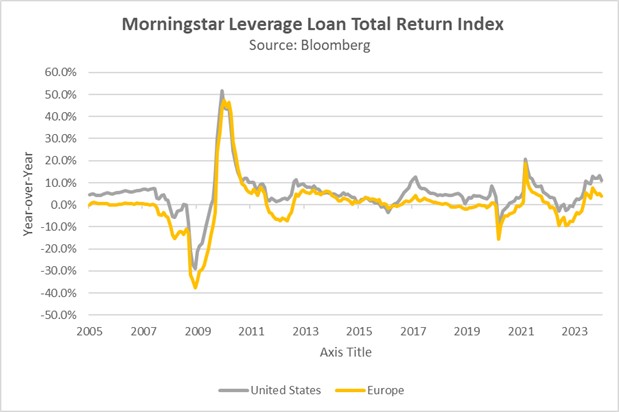

- As companies grapple with maturing debt, many are turning to private credit funds for relief, seeking lower interest rates or longer maturities. Leveraged loans offer a potential solution, allowing them to refinance existing debt with lien debt. However, this comes at the cost of potentially higher interest rates and the risk of asset seizure in case of default. While this trend offers relief from elevated interest rates, it also raises concerns about potential risks to the broader market if economic conditions worsened.

- The record-breaking issuance of U.S. leveraged loans in January ($140.1 billion) highlights the growing global appeal of this financing option, while European debt issuance in this category surged by 20.1% in 2023. This increase in issuance reflects companies seeking to manage their existing debt in a challenging economic environment, but also raises concerns about increased refinancing risk for borrowers with higher risk profiles. Notably, refinancing activity reached a record high of $50.4 billion, while repricing (renegotiating loan terms) reached $78.7 billion, suggesting a strong focus on reducing debt payments through various strategies.

- Leveraged loans offer a double-edged sword in tackling the debt maturity wall. While they can ease debt pressure and potentially mitigate the broader economic impact of rising interest rates, concerns linger about their long-term stability. This stems from the subjective valuation of underlying collateral, particularly for loans backed by volatile assets like commercial real estate. The opaqueness of private credit funds, where some of these loans reside, further complicates matters, making it difficult for investors to conduct thorough due diligence. However, if the economy remains strong and default rates stay low, these loans may not pose a systemic risk.

The Dust Settles: With central banks in the U.S., Europe, and Japan all signaling that rates are unlikely to change, the market awaits the exact timing, which remains anyone’s guess.

- All G-7 rate-setting bodies opted to maintain their policy rates during their most recent meetings, affirming to the markets that they are embarking on a new phase of the monetary cycle. Among the four major central banks announcing their decisions, the Bank of Japan stood out as the sole institution contemplating a rate hike. Meanwhile, all the other institutions have signaled that interest rates will be cut sometime this year but likely not as soon as the market anticipates.

- Interest rate uncertainty could deter institutional investors from re-entering the stock market, despite the S&P 500’s current proximity to all-time highs. Bank of America strategist Jill Carey Hall’s research shows that institutional investors recently sold the most U.S. equities in nearly a decade, suggesting a shift towards safer assets due to economic uncertainty. The outflows were recorded in seven out of the 11 sectors, predominantly driven by sales in Technology, Consumer Discretionary, and Consumer Staples. This reluctance likely stems from a fear of being caught off guard if central banks reverse course on interest rates.

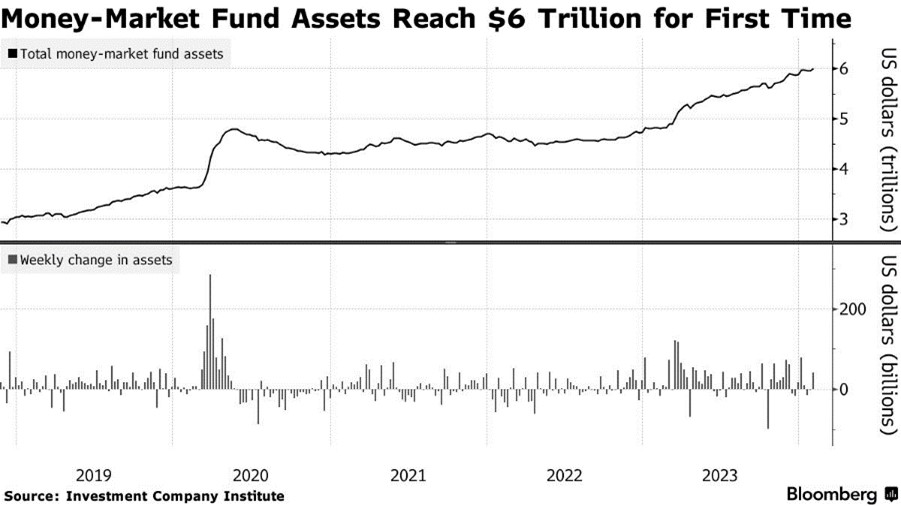

- Elevated interest rates may keep a significant amount of money parked in low-risk investments, but it could act as a potential tailwind for riskier assets once central banks start easing interest rates. This is evidenced by the record-breaking $6 trillion in U.S. money market assets. Although small and mid-cap stocks have not been able to grab headlines, these companies may be an attractive target for investors looking for a bargain. Valuations suggest that these firms provide investors with a lot of upside when risk sentiment changes.

Other News: Fed Chair Jerome Powell will appear on 60 Minutes on Sunday, sparking speculation that he may aim to clarify recent remarks interpreted by the market in unexpected ways, or possibly to address concerns about the overall health of the financial system. Tensions are rising between China and the Philippines after Beijing criticized the latter’s congratulatory message to Taiwan’s newly elected president. This incident highlights China’s growing influence and its sensitivity towards its neighbors’ formal interactions with Taiwan. Hungary is looking to play ball with the West after finally approving an aid package for Ukraine and possibly approving Sweden’s NATO bid.