Daily Comment (August 30, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] Fed Vice Chairman Stanley Fischer gave an interview on Bloomberg TV this morning indicating that although a September rate hike is data-dependent, the likelihood of a move has increased. This comes after Fischer’s interview last week, which was also generally considered hawkish. Following the two Fischer interviews over the past week, the market is now pegging a September hike at 36% likelihood, up from 24% a week ago.

Fischer pointed to this Friday’s employment report as one of the main data points that the Fed uses to measure economic health. He said that the U.S. economy is close to full employment, despite the slowing pace of the expansion, as the “problem is largely about productivity growth, something which is very hard to control by policymakers. It depends enormously on what private individuals are doing at their companies, and it’s very slow at the moment.” Still, he expects technology to boost productivity growth in the future.

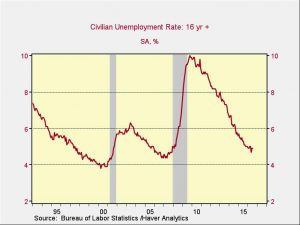

Expectations for Friday’s employment report are calling for an improvement in the unemployment rate, which is forecast to improve to 4.8% from 4.9% in July. The chart below shows the unemployment rate, which has improved steadily since the end of the recession.

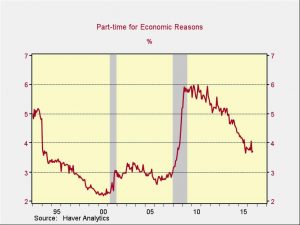

At the same time, earnings growth is forecast to remain slow, rising 0.2% in August. Additionally, the rate of part-time workers for economic reasons (shown in the chart below), one of Yellen’s favorite measures of labor market health, has seen some deterioration this year.

Thus, although a September hike remains a one-in-three possibility, it is looking more likely than previously perceived by the market. Still, a September hike would be risky ahead of the elections and Chair Yellen’s Jackson Hole interview was considered mildly dovish, so it is not clear whether she would support a hike this fall.