Daily Comment (February 27, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with an assertion from French President Macron that European leaders have discussed sending Western ground troops to Ukraine to help rebuff Russia’s invasion of that country. We next review a range of other international and US developments with the potential to affect the financial markets today, including a disappointing corporate governance reform in South Korea and an important new antitrust lawsuit in the US.

Russia-Ukraine War: As Europe’s defense industry struggles to expand output enough to support the rebuilding of the Continent’s defenses and help Ukraine fend off Russia’s invasion, and as European leaders mull the prospect that the US might renege on its NATO mutual defense obligations, French President Macron said European leaders met yesterday to discuss sending Western troops to help the Ukrainians. Macron said there was no consensus to send troops “in an official manner,” but he insisted all options must remain on the table.

- French support for the Ukrainians has so far been more about words than deeds, and Macron has often seemed to put European and French industrial interests ahead of Ukraine’s needs. The shift in his rhetoric after yesterday’s meeting was therefore notable. Not only did Macron say that defeating Russia is essential to Western Europe’s security, but he acquiesced to Europe buying ammunition and equipment outside the region if necessary.

- Macron has long championed the idea that the countries of Western Europe should develop their own independent defense capability. Seeing Europe’s faltering defense industrial effort and slow military rebuilding, Macron may have sensed an opportunity for France to take the political lead on the Continent. The proof will be whether France now takes concrete steps to boost the European defense effort and provide more aid to Ukraine.

- In any case, Macron’s statement about potentially sending Western troops to Ukraine has already sparked pushback from some corners of Europe, particularly Germany. Today, Germany’s Vice-Chancellor Habeck said there was “no chance” that Germany would send ground troops to Ukraine and noted things would be better if France would just send more weapons.

Sweden-North Atlantic Treaty Organization: The Hungarian parliament yesterday gave final approval for Sweden to become the 32nd member of NATO, providing the required unanimous consent of all current members and setting the stage for Sweden to formally join the alliance later this week. The accession of Sweden into NATO is expected to strengthen the alliance’s northern flank and help transform the Baltic Sea into a NATO lake. That could help contain any Russian territorial aggression in the area, bolstering both European and US security.

China: It now appears that measures by Chinese authorities have successfully arrested the fall in the renminbi (CNY) this year. The measures, such as delaying short-term interest rate cuts, have put a floor under the currency at around 7.2 per dollar. The currency is still depreciating slowly, but not nearly as fast as in the first three weeks of the year.

Global Corporate Governance: In a survey of business leaders across the Group of 20 major countries, three-quarters of respondents said the pressure to cut carbon emissions and invest in green energy is coming mostly from their own board of directors, rather than from regulators or customers. Some 30% of the business leaders said the board pressure was “extreme,” while 47% said the pressure was “significant.”

- The survey results suggest the drive to transition to green energy is now deeply embedded in the viewpoint of those top investors, corporate leaders, academics, and former officials who make up so much of today’s corporate boards.

- All the same, with many consumers, farmers, and workers now starting to push back against the green-energy drive in many countries, it would appear that corporate directors pushing green policies could eventually face resistance in board elections, potentially creating disruption in some firms’ corporate governance.

South Korean Corporate Governance: The government has released highlights of its plan to boost Korea’s perennially low stock valuations. However, the “Corporate Value Up Program” was quickly panned as too weak, as it relies mostly on naming and shaming companies that don’t improve their governance. One key problem is that the plan doesn’t include specific incentives for firms to reform their corporate structures to better protect small shareholders vis-á-vis large, controlling shareholders (who are often the company’s founding family).

- The Korean program was inspired by Japan’s corporate governance reforms under former Prime Minister Abe about a decade ago. Those reforms are considered one reason why Japanese stock values finally began to rally in recent years and finally reached new record highs in recent days, after decades of lethargic performance.

- The government said it plans to release a more detailed version of the plan in June. Nevertheless, disappointment over the initial release helped drive Korean stocks lower yesterday.

UK Antitrust Policy: The Competition and Markets Authority has opened an investigation into possible illegal information sharing among eight British homebuilders. With Britain facing a major housing shortage, homebuilders have come under fire for limiting their development efforts to projects where demand is high enough that they can build on spec and be assured of making high profits. The new probe probably raises the regulatory risk for British homebuilders going forward.

US Antitrust Policy: Yesterday, the Federal Trade Commission sued to block the proposed merger between grocery chains Kroger and Albertsons. According to the FTC, the merger would lead to higher prices for US consumers and lower wages for the firms’ workers. The FTC suit reflects the Biden administration’s effort to crack down on industry consolidation, but that effort has often run up against the prevailing “Bork Standard,” which requires a higher level of consumer harm before a merger can be blocked.

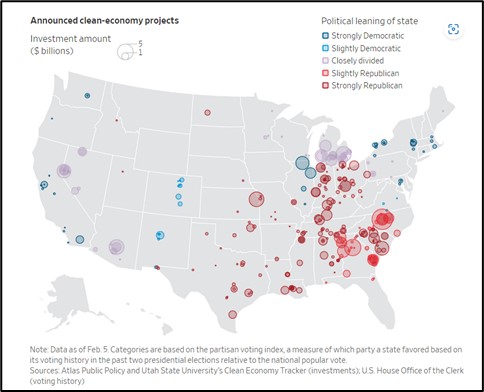

US Industrial Policy: The Wall Street Journal carries an article today showing that the boom in US green-energy manufacturing and mining, partially touched off by the Biden administration’s industrial policy, is channeling the most investment into Republican-leaning regions of the country. While Biden may be hoping that he’ll get credit from the new investment and gain politically in those areas, it seems just as likely that he won’t get much credit and will continue to struggle in public opinion polls because of public anger over consumer price inflation.

US Politics: Michigan holds its presidential primary elections today, in which former President Trump is expected to again trounce former UN Ambassador Haley on the Republican side. Nevertheless, Haley remains defiant and has insisted she will stay in the race at least through Super Tuesday next month.

- Both Trump and President Biden face age, popularity, and other issues that could conceivably undercut them or force one or both off the ballot before November.

- Therefore, Haley may be positioning herself to inherit the Republican mantle or even pursue a third-party or independent candidacy.