Daily Comment (February 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! It’s been a positive start for equities as inflation data meets expectations. Meanwhile, Dallas Mavericks’ star Luka Dončić celebrated his 25th birthday with a triple-double. Today’s Comment dives into three key topics: the impact of bitcoin on small indexes, the possibility of a June rate cut by the Federal Reserve and European Central Bank, and the ongoing influence of the war in Ukraine on defense and aerospace companies. As always, the report concludes with a summary of international and domestic data releases.

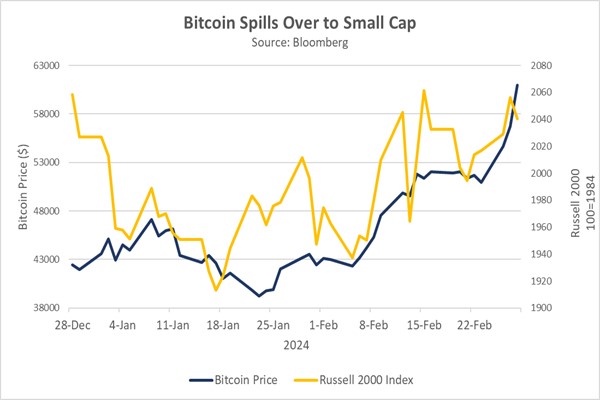

Crypto Powers Small Cap Growth: Fueled by bitcoin’s rally, the Russell 2000 Index has surged as investors seek growth opportunities beyond the established large-cap tech stocks.

- The combined market cap of cryptocurrency hit a record of $2 trillion earlier this week, fueled by the recent surge in popularity for bitcoin ETFs. Additionally, bitcoin surpassed $60,000 for the first time since November 2021. This rise followed the launch of Grayscale Bitcoin Trust last month and was further bolstered by several subsequent ETF launches, which are now attracting record inflows. Retail investors have been the primary driver of this popularity, eager to capitalize on bitcoin’s momentum. However, concerns are rising as early signs suggest leverage may be re-entering the market, potentially increasing volatility.

- Bitcoin’s surge has boosted small-cap stocks, particularly those with bitcoin exposure like MicroStrategy, Riot Platforms, and Marathon Digital Holdings. This shift may signal that investors are diversifying away from the AI craze that dominated the early part of the year. The Russell 2000 outpaced the S&P 500 over the last week, rising 2.2% compared to 1.7%. However, mirroring its large-cap counterpart, gains remain concentrated in a handful of companies. MicroStrategy fueled much of this growth, rising an impressive 43% and outperforming even media favorite Nvidia, which rose 15% in the same period.

- While current fundamentals raise concerns about the sustainability of this trend, it may reflect a broader shift as the business cycle nears maturity. The Russell 2000’s P/E ratio has soared from just above 30 to over 74 in just a week, highlighting the increasingly optimistic (but potentially risky) behavior of investors seeking growth opportunities in small-cap stocks. Historically, late-cycle expansions witness a transition from large-cap value to large-cap growth, followed by a shift into small-cap growth. If this pattern holds, investors’ growing risk tolerance could signal the need for portfolio caution. We remain optimistic but maintain vigilance for potential sentiment shifts.

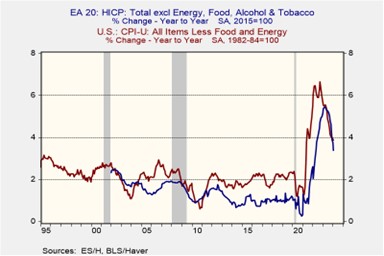

June a Possibility? Policymakers in Europe and the US have unequivocally rejected the possibility of an interest rate cut this spring but have signaled the potential for a cut this summer.

- The Federal Open Market Committee (FOMC) signaled that interest rate cuts are likely this year, though the pace of easing will be less aggressive than in previous cycles. While a baseline scenario is three cuts, New York Fed President John Williams emphasized that economic data will guide the ultimate decision. Atlanta and Boston Fed Presidents Raphael Bostic and Susan Collins also support rate cuts, with a potential start as early as June. This hesitancy comes in response to strong employment data and a hot January CPI report, fueling concerns that the Fed’s fight against inflation is far from over.

- European policymakers remain committed to using economic data to guide interest rate decisions, but some are signaling a potential rate cut by summer. Members of the European Central Bank’s Governing Council, Gediminas Šimkus and Peter Kažimír, have warned that premature cuts could harm efforts to control inflation and have urged patience. However, Kažimír also expressed concern about Europe’s declining competitiveness and suggested that low-interest rates alone may not be enough to avert economic hardship. This concern is underscored by the euro area’s narrow avoidance of a technical recession in Q4, where output remained unchanged from the previous quarter. This stagnation may prompt policymakers to consider policy accommodation.

- Market expectations of a June rate cut seem largely accurate; however, the size remains uncertain. US policymakers have expressed concerns about reducing the size of the cut due to persistent economic growth and lingering inflationary pressures. Therefore, while the three cuts outlined in the latest projections are still likely, a smaller, Greenspan-style 50 basis point “maintenance” cut is also a possibility. Europe, on the other hand, may take a slightly more aggressive approach than the US to mitigate a worsening downturn. Consequently, a 100 bps rate reduction before year-end should not be ruled out.

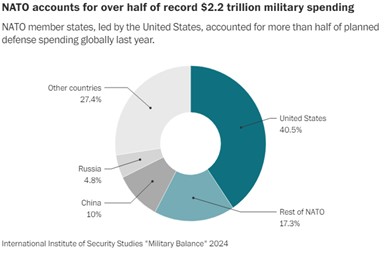

Ukraine on the Brink? Russia’s perceived military success in Ukraine is raising concerns about the potential for escalation into a wider European conflict.

- Russian President Vladimir Putin issued a stark warning, cautioning that direct Western intervention in the Ukraine conflict could escalate into a nuclear confrontation. His statement follows recent remarks by French President Emmanuel Macron, who acknowledged discussions within NATO regarding potential troop deployment to support Ukrainian efforts. Despite Western officials firmly rejecting the possibility of direct NATO involvement in the war, Putin’s comments suggest that he is taking the perceived threat seriously, especially as Ukraine struggles to maintain its war efforts amid dwindling resources while it waits for additional aid from the West.

- Putin’s menacing rhetoric regarding nuclear warfare has surged in prominence as nations scramble to stymie Russian aggression, particularly in light of its potential spillover beyond Ukraine. Recently, US officials issued cautionary alerts, suggesting Moscow’s contemplation of deploying anti-satellite nuclear weaponry within the year. President Biden has conceded that such a launch wouldn’t directly imperil human lives; however, security experts fear that the launch may risk an accidental explosion in space. Nevertheless, this development further highlights the intensifying military competition between Western powers and their adversaries, likely contributing to the record-breaking global military spending witnessed in 2023.

- Though the threat of nuclear warfare is sadly not new, Putin’s repeated threats underscore the increasingly perilous state of global security. Tensions continue to show signs of escalation between the West and its rival. Although a conflict is not imminent, the risk is becoming increasingly elevated. While NATO member states have demonstrated their commitment to developing collective defense capabilities, the specific response of the United States to an attack on its allies remains unclear. That said, the increased military spending should boost revenue for defense and aerospace companies.

Other News: The House is expected to pass a temporary stopgap bill to avert a government shutdown, highlighting the struggles of a divided Congress to reach consensus on essential legislation. Meanwhile, the Supreme Court’s acceptance of former President Donald Trump’s appeal regarding presidential immunity, (still likely to lead to an unfavorable ruling) suggests further a delay in a potential trial until after the general election. Turkish tech stocks have been on a tear this year, as investors consider tech stocks in emerging markets.