Daily Comment (March 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Financial markets are off to a sluggish start today. In sports news, University of Iowa star and top WNBA prospect Caitlin Clark declared for the draft. In today’s Comment, we delve into the impact of the NYCB turmoil, analyze the latest inflation data, and explore the possibility of tightening monetary policy at the Bank of Japan (BOJ). We conclude, as always, with a summary of recent domestic and international data.

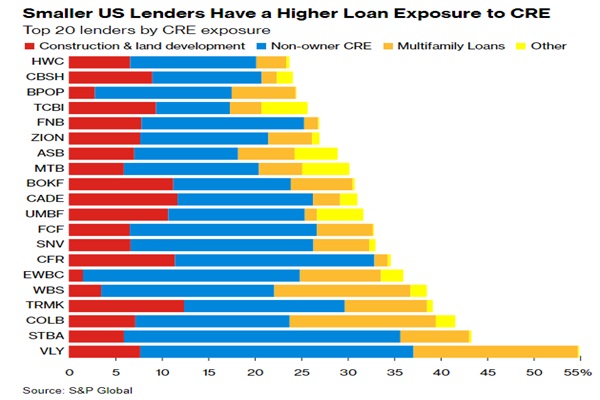

More Regional Bank Pain: Regional banks are under increased scrutiny following turmoil at New York Community Bank, raising concerns about a potential financial crisis linked to commercial real estate.

- On Thursday, NYCB announced a $2.4 billion earnings hit, citing a “material weakness” in its loan review process. The bank’s CEO resigned and NYCB revealed it would miss its annual report deadline due to “ineffective oversight and risk management.” This news follows a prior announcement of a $552 million loan loss provision, 10 times greater than analysts’ expectations. The disclosure raises concerns about potential defaults on commercial real estate loans, sending NYCB’s stock down 19% in after-hours trading and potentially sparking broader sell-offs in similarly exposed banks on Friday.

- While the commercial real estate market’s vulnerabilities are widely recognized, its potential to trigger a major financial crisis remains the subject of heated debate. According to research from the American Enterprise Institute, banks have accumulated $1.5 trillion in unrealized mark-to-market interest losses on fixed income securities since September 2023. This could erode their ability to absorb potential loan losses in the event of a downturn in the commercial real estate market, adding to concerns about financial stability. However, it’s important to acknowledge the Federal Reserve’s ongoing efforts to collaborate with banks to address these concerns. Thus, there is also a strong possibility that the central bank has a contingency plan in case of an emergency.

- While the Federal Reserve’s primary mandate prioritizes price stability and maximum employment, its historical role in preventing bank panics remains relevant in the context of rising risks within the regional banking system. The expected termination of the Fed’s Banking Term Funding Program alongside these concerns could incentivize policymakers to reconsider their monetary policy stance. So far, the Fed has only hinted at potentially lowering rates, while maintaining its quantitative tightening. Based on these factors, we believe a rate reduction of at least 50 basis points could be warranted if the situation worsens, and potentially even more if a significant crisis erupts.

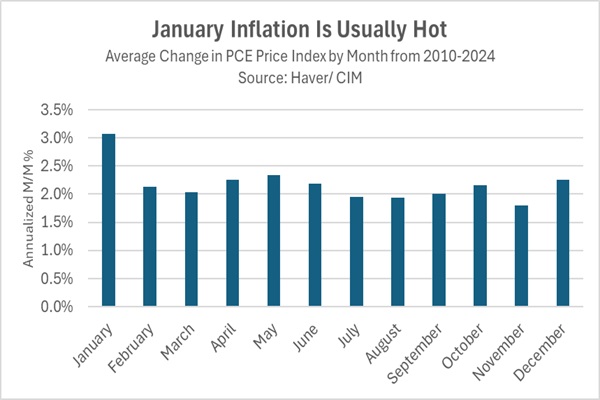

The January Spike: January’s hot inflation raises concerns that the Federal Reserve might delay rate cuts, but historical trends suggest a wait-and-see approach is likely.

- The core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, saw a notable 0.4% uptick in January. Despite this substantial rise, the year-over-year change in the price index actually dipped from 2.94% to 2.85%. While this moderation might suggest a momentary relief, it has also sparked concerns about the Fed’s ability to effectively combat inflationary pressures. Policymakers seem to put little emphasis on the report. Atlanta and Chicago Fed Presidents Raphael Bostic and Austan Goolsbee suggested that the recent inflation report has not influenced their views on monetary policy.

- Policymakers’ dismissal of the report might be linked to the seasonal nature of inflation data. Historically, January tends to have the highest inflation rate compared to other months, often around 3.1% as the chart below demonstrates. This sharp increase is due to what some economists refer to as “residual seasonality,” in which prices increase due to changing out of contracts. This year’s inflation increase notably surpassed the historical average, hitting an annualized rate of 5.2%, though it marks an improvement over the preceding two Januarys, which recorded increases of 6.2% and 5.7%, respectively.

- Wages undoubtedly wield significant influence over inflation. The recent surge in strikes and a constricted labor market have empowered workers to negotiate higher earnings from employers, possibly fueling price pressures. However, there exists a trade-off between increased wages and employment levels. January witnessed a notable increase in WARN notices, which are expected to filter into employment figures over the next few months. While we anticipate most layoffs to be concentrated in finance and tech, it wouldn’t be surprising to see other industries affected as well.

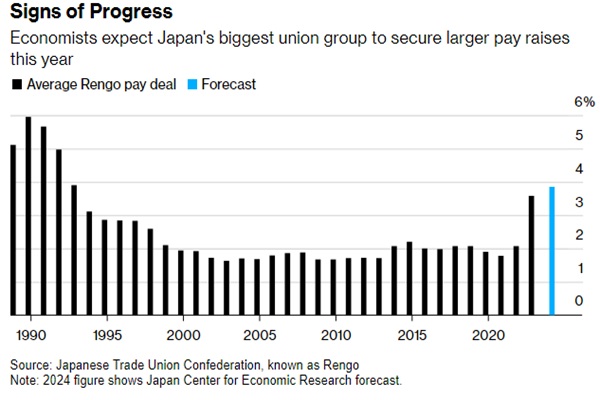

BOJ Ready for Lift Off: Despite the risk of recession, the Bank of Japan (BOJ) continues to signal its intent to exit its ultra-accommodative monetary policy.

- On Thursday, BOJ board member Hajime Takata declared that the central bank’s price target is “finally coming into sight.” His remarks add to the growing indication that Japanese policymakers are prepared to begin phasing out negative interest rates and yield curve control. While BOJ Governor Kazuo Ueda maintains that it’s premature to declare victory over deflation, he emphasized that the outcome of ongoing wage negotiations between unions and companies will be a key determinant of future inflation trends. A settlement is set to be released on March 13, a few days before policymakers start their two-day meeting on March 18-19.

- Predicting labor negotiations amidst the current economic climate and tight labor market poses significant challenges. Japan endured two consecutive quarters of economic contraction in 2023, meeting the technical definition of a recession. The downturn stemmed largely from decreased consumer and investment spending, compounded by a sharp decline in industrial output that threatens to further dampen growth prospects. Despite this, the labor market remains surprisingly strong, with a 2.4% unemployment rate — a four-year low. Additionally, surveys reveal that two-thirds of small and mid-sized firms face labor shortages, highlighting the unusual disconnect between the economy and the job market.

- That said, there is optimism that labor will be able to receive a notable bump in pay this spring. Economists are predicting that wage hikes will rise by about 3.9% from the prior year. Although lower than the 5% minimum initially sought by labor leaders, the negotiated pay increase still exceeds the previous year’s three-decade high of 3.58%. A rate hike is likely to occur in March or April. This development could pressure the greenback, put upward pressure on global bond yields, and potentially drive increased investment in Japanese financial markets.

Other News: Brazil’s and China’s economies are showing signs of weakness, reflecting broader global economic stagnation. The slowdown in these nations underscores a worrisome trend affecting economies worldwide. Moreover, George Galloway’s victory in Rochdale highlights a potential decline in the Labour Party’s popularity, possibly linked to its stance on the Gaza conflict. Lastly, Tesla CEO Elon Musk is suing OpenAI and its CEO Sam Altman. This legal dispute reflects the ongoing struggle in tech for control and dominance as various entities vie to shape the trajectory of artificial intelligence development.