Daily Comment (March 4, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with several items touching on the global outlook for consumer price inflation and interest rates. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a preview of some important government policy meetings in China and a discussion of new rules aimed at improving the functioning of the US Treasury bond market.

Global Price Inflation and Monetary Policy: The Bank for International Settlements today warned that the recovery in supply chains and weaker commodity prices since the coronavirus pandemic won’t necessarily be enough to bring price inflation down to the major central banks’ targets. Instead, the BIS warns that price inflation in the labor-intensive services sector tends to be stickier, which could limit how quickly overall inflation falls. In turn, that could inhibit central banks from cutting interest rates as aggressively as investors expect.

Global Oil Market: At a meeting yesterday, the Organization of the Petroleum Exporting Countries and their Russia-led partners agreed to maintain their voluntary cuts to oil production for another three months to June. The cuts are intended to buoy global oil prices, but rising output in the US and weak economic growth in some countries has nevertheless kept a lid on prices.

- The cuts have only boosted Brent crude prices by about 6% and WTI crude by about 8% since they were first announced in late November. So far today, near futures prices are down slightly, with Brent at $83.54 per barrel and WTI at $79.90.

- Since the cuts have left major OPEC+ producers with plenty of excess capacity, it’s important to remember that even if prices rise substantially from here, those producers would have the incentive and the ability to open the floodgates again, driving prices back down. In sum, the near-term prospects for oil prices remain modest.

Global Nuclear Energy Industry: Ahead of a first-of-its-kind nuclear energy summit in Brussels later this month, International Atomic Energy Agency chief Rafael Grossi has castigated multilateral lenders such as the World Bank and the Asian Development Bank for not making their loans available for new nuclear projects. According to Grossi, the summit in Brussels will debate how to overcome opposition from a small number of nations, such as Germany, to using development banks to fund nuclear projects.

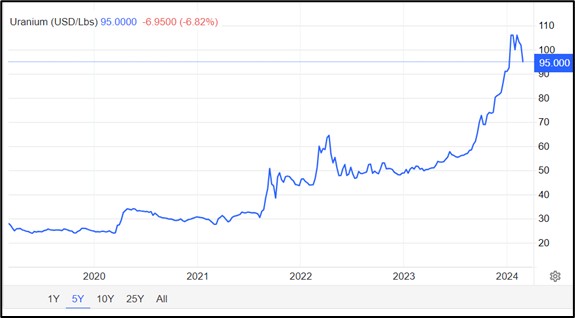

- Despite the lack of funding from multilateral lenders, we believe the use of nuclear energy to generate electricity will grow markedly in the coming decades, even as uranium supplies are crimped. As we examine in our latest Asset Allocation Bi-Weekly report, published today, that should result in rising uranium prices and strong returns for uranium miners going forward.

- Indeed, investors have recently begun to bid uranium prices up strongly, as shown in the chart below.

Germany-Russia: The government of German Chancellor Sholtz is facing a scandal today after a Russian website released intercepted phone calls of German military officials discussing the possible transfer of Taurus cruise missiles to Ukraine to help it repel Russia’s invasion of the country. The intercepts have raised concerns about Germany’s ability to keep its high-level communications secret.

- More broadly, the scandal also will probably make Sholtz even more resistant to sending the missiles to Ukraine. Sholtz has been extremely reluctant to do anything that might provoke the ire of the Kremlin, and he recently argued that the missiles would have to be targeted by German soldiers, bringing Germany into the conflict.

- Indeed, to exploit the scandal, the Kremlin today accused Germany of plotting to attack Russia. The assertion likely aims to put the German government on the back foot and make it even more reluctant to provide the missiles to Ukraine.

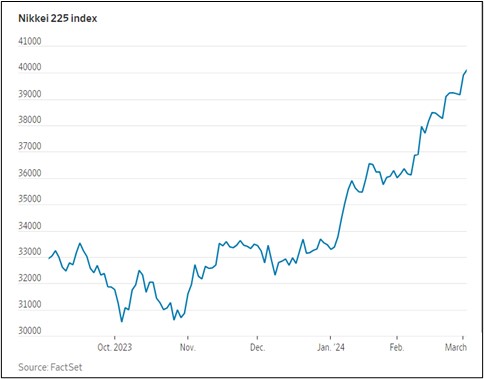

Japan: Not only has the main Japanese stock index finally started setting new record highs again, but today it surpassed 40,000 for the first time. We’ve also noted that a lot of the gains are coming from technology stocks expected to benefit from artificial intelligence, as in the US. The Japanese leaders include stocks the likes of Tokyo Electron, which makes semiconductor manufacturing equipment, Advantest, a maker of semiconductor testing equipment, and Renesas Electronics, a semiconductor manufacturer.

China: The annual “two sessions” meetings, consisting of the National People’s Congress and the Chinese People’s Political Consultative Conference, opened today in Beijing. The annual economic growth target is typically released at the sessions, and analysts this year appear to be expecting a target of around 5%, like last year.

- Top leaders will also provide some hints about their political and economic strategies. For example, they are likely to offer ideas about how they want to tackle China’s big structural problems, such as excess capacity and debt.

- However, General Secretary Xi is widely expected to resist offering any major new stimulus programs to address those problems. Rather, Xi is likely to continue trying to end China’s past practice of addressing economic growth shortfalls by adopting new debt-driven investment.

United States-China: The Biden administration on Friday issued its 2024 trade policy agenda and report to Congress, in which it vowed to double down on efforts to reverse the harms wrought by Beijing’s “trade and economic abuses.” The document indicated the administration will keep trying to enlist foreign countries to push back against Beijing’s trade abuses, including its stringent barriers to the Chinese market and massive subsidies for exporters in strategic industries, such as electric vehicles, solar energy, and lithium.

- The trade policy statement will be a disappointment for anyone dreaming of cooler tensions between the US and China.

- As we’ve noted so many times before, US-China tensions continue to spiral upward, so on any given day, investors could be faced with a sudden, disruptive new restriction on trade, capital, technology, or travel flows between the two countries, with potentially negative consequences for US and/or Chinese companies.

US Treasury Bond Market: The Financial Times today carries an in-depth analysis of recent rule changes by the Securities and Exchange Commission that are aimed at buttressing the market for Treasury obligations but will impose new costs on financial market participants. One goal of the change is to ensure that the Treasury market remains attractive for institutional and other investors around the world even as some countries in the China/Russia bloc and beyond work to reduce their use of the dollar.

- One such change is a requirement that Treasury trades go through a clearing house. The change aims to increase oversight and improve investor protections during market volatility.

- The second rule change described in the article brings high-speed traders and potentially some hedge funds under regulatory scrutiny.

US Weather: Following a major blizzard that dropped some 60 inches of snow on the Sierra Nevada over the weekend, California is bracing for another major storm later today. The storm over the weekend closed a major freeway and knocked out power for thousands of businesses and homes. Although storms like this can certainly be disruptive and have a local economic impact, they typically have only minor effects on national economic activity and those effects are usually quickly reversed.