Daily Comment (March 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest statement by a high-ranking European official warning of a possible war with Russia. We next review a range of other foreign and US developments with the potential to affect the financial markets, including a new EU plan to finance weapons and ammunition for Ukraine in a way that could further bolster gold prices and another big subsidy to a major semiconductor firm to help it fund new factories and expansion projects here in the US.

European Union-Russia: In an opinion piece in top European newspapers, European Council President Charles Michel added his voice to those warning that Western Europe is on the road to war with Russia. In his article, Michel argues that no matter what territorial gains Russian dictator Vladimir Putin achieves in Ukraine, he will not stop there. Rather, he will continue trying to grab territory in Eastern Europe. Since the US may not come to Europe’s aid, despite its obvious interest in doing so, Michel argues that Europe must prepare to defend itself.

- According to Michel, “If we do not get the EU’s response right and do not give Ukraine enough support to stop Russia, we are next. If we want peace, we must prepare for war.”

- More to the point, Michel argued that Europe must rapidly shift to a “war economy” to deter further Russian aggression and prepare for hostilities.

- We agree that Putin’s apparent goal of re-establishing the Russian Empire would imply additional territorial grabs in Europe. So long as Ukraine continues to resist Moscow’s invasion, the Russian military is likely to have its hands full and may not directly threaten targets in Western Europe. The threat to the West would likely come when and if Ukraine stops fighting. At that point, the Russian military is likely to regroup and prepare for a renewed assault on Ukraine and/or Western Europe.

- With the Russian military preoccupied and largely depleted as an offensive force in Ukraine, a future Russian assault on Western Europe may not involve a broad, multi-front attack on numerous countries simultaneously.

- Rather, a near-term Russian offensive may well focus on specific, bite-sized territorial objectives, just as Nazi Germany initially focused on remilitarizing the Rhineland in March 1936, acquiring Austria in the Anschluss of March 1938, and then demanding and receiving the Sudetenland region of Czechoslovakia in September 1938.

- Initial Russian territorial claims following a victory in Ukraine might include taking control over Moldova and/or Georgia, where the Kremlin already has troops. Russia might also seek to take control over areas of Eastern Europe where the population has a lot of Russian speakers, or where Putin perceives European military vulnerabilities.

European Union-Russia-Ukraine: The European Commission today unveiled a plan to help buy weapons for Ukraine by using the earnings on seized Russian assets. Under the plan, 90% of the earnings on those assets would be diverted to the European Peace Facility, the main EU fund used to supply Ukraine with weapons, equipment, and ammunition. The remaining 10% of earnings would go to the general EU budget to help Ukraine rebuild and expand its defense industry. To come into effect, the plan will have to be approved by all EU member countries.

- If approved and implemented, the plan is expected to channel about 3 billion EUR ($3.25 billion) to Ukraine in 2024.

- US officials have supported using Russian assets seized as punishment for Moscow’s invasion, likely enticed by the poetic justice of making Russia itself pay for the damage it has caused. The risk, however, is that the US and EU moves to seize their adversaries’ sovereign assets will likely further fracture the global financial system, encouraging potential adversaries (especially countries in the China/Russia geopolitical bloc) to cut their use of the dollar or other Western currencies.

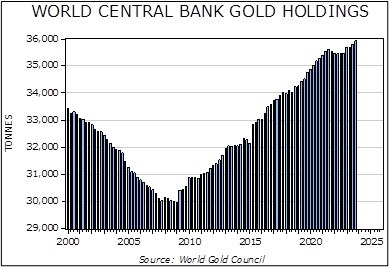

- In response to US seizures of Afghan and Russian assets in recent years, we think potential adversary governments are already directing their central banks to reduce their exposure to the greenback. One reflection of that is the recent jump in central bank gold purchases, which our analysis suggests is a key reason why gold prices have recently hit record highs. If the new EU program is implemented, potential adversary governments will likely order their central banks to buy even more gold, boosting gold prices further.

Eurozone: European Central Bank President Lagarde today said the ECB could cut its benchmark interest rate as early as June, but it can’t commit to a specific path of future rate cuts. According to Lagarde, continued price pressures for services mean the central bank will have to stay flexible and data dependent as it loosens monetary policy going forward. The statement suggests that both the Federal Reserve and the ECB want to maintain their room to maneuver and keep investors guessing as they cut rates in the coming months.

China: Not only is the European Union shifting its economy to a war footing, but new research by the Center for Strategic and International Studies shows China has already shifted its economy to essentially the same status. For example, the study shows that Chinese shipbuilding capacity is now approximately 230x current US capacity. In contrast, the study assesses that the US defense industrial base is still operating at a peacetime pace.

US Monetary Policy: The Federal Reserve’s policymaking committee wraps up its latest meeting today, with its decision and new economic projections due at 2:00 PM EDT. The committee is widely expected to hold the benchmark fed funds interest-rate target at 5.25% to 5.50%. The first cut is now expected in June. Nevertheless, the policymakers could signal an earlier or later date for their first cut and may also announce an end to their quantitative tightening policy or other changes in their approach to policy.

US Military: The Wall Street Journal carries a video today explaining the challenges faced by the US military as it replaces its Minuteman III strategic nuclear missiles with a more modern arsenal. The video is a nice complement to our Bi-Weekly Geopolitical Report from March 11, in which we explored the US’s overall effort to modernize its nuclear deterrent and what the program means for investors. (Clearly, we at Confluence remain a step or two ahead of the Journal!)

US Semiconductor Industry: The Commerce Department said it has awarded $8.5 billion to microprocessor giant Intel to help fund new computer chip plants and expansion projects in Arizona, Oregon, New Mexico, and Ohio. The award is part of the roughly $50 billion provided for in the CHIPS and Science Act of 2022 to help bring more chip manufacturing back to the US and ensure secure supplies of the products.