Daily Comment (March 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Stocks have pulled back from their recent highs after the Federal Reserve meeting, while the University of Oakland is writing its Cinderella story after upsetting powerhouse University of Kentucky in the NCAA tournament. Today’s Comment examines why the recent global rate shift has us concerned about the market, how ongoing regulatory risks continue to impact big tech companies, and what the potential consequences of China’s economic struggles are for other countries. As always, we wrap up with a summary of international and domestic news.

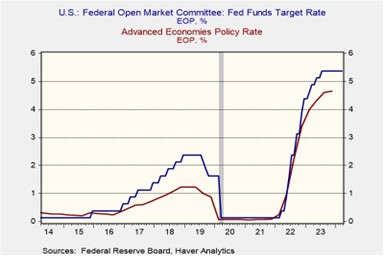

Cuts Aren’t Guaranteed: All G-7 central banks have signaled a potential shift in monetary policy this year, but investors should remain patient before taking on risk.

- The Bank of Japan stands alone in its monetary policy. It recently raised rates but signaled a pause in tightening, aiming to keep rates accommodative. In contrast, all other major central banks are shifting towards looser policies. The Bank of England, European Central Bank, and Federal Reserve all hinted at potential rate cuts starting in June. Meanwhile, the Swiss National Bank took the most aggressive action, implementing its first rate cut in nearly a decade. The decision by rate-setters to adjust their policy language is likely to pave the way for looser financial conditions.

- Central banks’ dovish tilts have triggered a global decline in interest rates, paradoxically strengthening the US dollar. Expectations of a robust US economy and the Fed’s potential to maintain a tighter monetary policy stance are driving this rally compared to its peers. A strong dollar poses a challenge for foreign central banks, as it can lead to higher import prices, particularly for energy-related goods. Upward pressure on inflation could force them to choose between supporting their economies with lower rates or raising rates to combat inflation, potentially hindering growth.

- The recent global equity rally rests on a precarious tightrope — a soft landing for the US economy and a mild or brief recession in other developed economies. While policymakers and the market seem confident in a central bank pivot by June, a more cautious approach is warranted for investors. The US economy’s continued strength suggests the Fed may delay rate cuts until inflation shows clearer signs of abating. This, in turn, could lead other central banks to hesitate with aggressive rate reductions, potentially undermining the current market optimism. As a result, the recent rally may be short-lived.

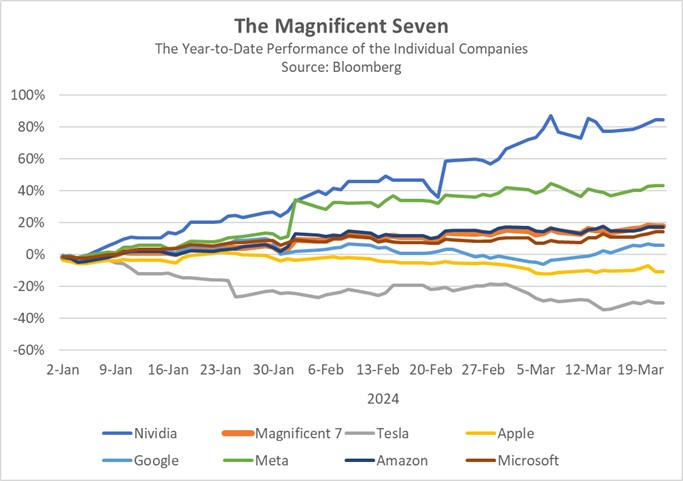

Tech’s Boogie Man: Recent lawsuits against Apple exemplify the significant regulatory risks facing the dominance of the Big Tech 7.

- Apple is facing mounting legal challenges. The US Department of Justice has filed an antitrust lawsuit, accusing the tech giant of stifling competition by restricting access to hardware and software features. This follows similar action from European regulators who charged Apple with non-compliance with the Digital Markets Act, alleging the company locks consumers into its service ecosystem. These legal battles, along with the potential for hefty fines and litigation costs, have weighed heavily on investor sentiment, contributing to an almost 8% year-to-date decline in Apple’s stock price.

- The legal challenges facing Apple exemplify a growing trend of government intervention in the tech sector. One contentious issue is the potential for governments to restrict sales of cutting-edge semiconductors to rival nations. The US, for instance, has implemented measures limiting the supply of such semiconductors to China, aiming to curb its technological advancement. Companies like Nvidia, which previously relied on China for a significant portion of its data center revenue, have had to reduce sales. Additionally, lawsuits regarding copyright infringement, such as those filed by the New York Times, could further dampen the enthusiasm of firms seeking to profit from generative AI.

- Tech giants facing legal scrutiny can weather initial skirmishes, but protracted legal battles lasting years loom large. Unfavorable rulings will likely trigger a flurry of appeals, further bogging down the process. Even absent a final verdict, these lawsuits can be a strategic nightmare, forcing companies to make temporary business adjustments that could erode their competitive edge. This is already playing out, with Apple recently lowering app sales commissions and allowing developers more payment flexibility in response to regulatory pressure. This trend is likely to continue and impact other major tech companies as well.

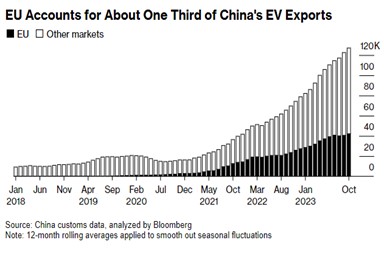

Yuan Breaks Threshold: A strengthening dollar and a production surplus could trigger heightened scrutiny of Chinese exports.

- The yuan (CNY) plunged to a four-month low after China’s central bank loosened its grip on the currency Friday, setting the dollar peg above 7.10 CNY. This move, likely driven by a strengthening dollar and soft data, weighed on the Chinese currency. The move fuels speculation of imminent stimulus to tackle slowing growth, partly caused by the property sector’s debt burden. The central government’s recent spending surge aligns with this, potentially aiming to alleviate pressure on local governments struggling with the ongoing property crisis. Finance Ministry data shows general public expenditure has surged 14% year-over-year, the fastest pace in over five years.

- China’s drive to boost growth is stoking fears of a wave of cheap exports, which may be particularly damaging to electric carmakers. Tesla underscored these concerns on Friday, announcing production cuts in China due to their inability to compete with lower-cost rivals. In response, both the EU and US are taking steps to shield their domestic industries. EU lawmakers are crafting legislation that could impose tariffs on Chinese electric vehicles (EV) by November. The US, already imposing a 27.5% import tax on Chinese EVs, is contemplating a significant increase, potentially reaching a staggering 125% of a vehicle’s value.

- China’s economic slowdown presents a multifaceted global challenge. While a surge in Chinese exports might provide temporary relief from inflationary pressures for some countries, it could trigger protectionist responses from others seeking to shield domestic industries and jobs. Furthermore, a significant portion of these exports are likely to be directed towards Belt and Road Initiative participant countries. BYD, for instance, has struggled in developed markets but remains the top choice for EVs in Brazil and Thailand. This suggests that China’s overproduction issue may continue to exert downward pressure on global prices, potentially harming Western companies indirectly.

Other News: Reddit’s IPO burned bright in a sign that investors are warming up to riskier bets. The recent decline in interest rates has fueled a tech spending spree, with companies taking advantage of cheap debt to refinance loans. Meanwhile, investors are actively acquiring corporate debt, seizing the opportunity for high yields before the Fed potentially cuts interest rates. This surge reflects a growing belief that rates have plateaued and are headed downward.