Daily Comment (March 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Despite strong economic signs like positive durable goods orders, equity futures are paring back earlier gains. On a brighter note, the University of Iowa continues to dominate the Women’s NCAA tournament! Today’s Comment dives into why rising analyst forecasts for the S&P 500 shouldn’t lull investors into complacency. We’ll also explore how rising housing costs might impact the Fed’s policy decisions and analyze the likelihood of a slow US-China decoupling. Plus, we include our usual wrap-up of domestic and international data.

Equity Bulls on Tap: With the first quarter of 2024 nearing its close, several banks have already begun revising their year-end forecasts upwards.

- Oppenheimer Asset Management isn’t alone in its bullish outlook on the S&P 500. After a stellar first quarter, it has raised its year-end target from 5,200 to 5,500. This optimism is echoed by HSBC, UBS, and Bank of America, all revising their projections upwards to around 5,400 for the index by year’s end. Fueling this sentiment are the market’s strong gains and surprisingly positive corporate earnings reported in the final quarter of 2023. With the S&P 500 already up 10% year-to-date, further growth is anticipated if the Fed manages a soft landing.

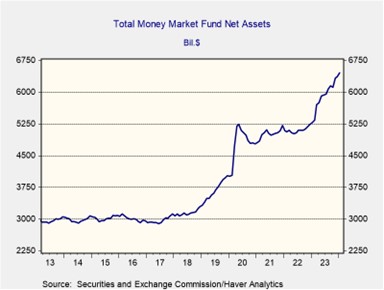

- A cloud of uncertainty looms over the recent stock market optimism. Positive earnings surprises stemmed from analysts significantly lowering their Q4 2023 earnings per share (EPS) estimates ahead of reporting season, reflecting concerns about a potential economic slowdown later this year. Furthermore, liquidity in the financial system is expected to tighten in the coming months due to tax payments, ongoing quantitative tightening, reduced use of the overnight reverse repo facility, and interest rates remaining higher than market expectations. These conditions will likely prevent much of the cash being held in money market funds from returning to financial markets.

- The strength of the US economy bolsters optimism for equities, but hidden risks obscure the outlook. This is evident in the looming debt maturity wall. While leveraged loans offered companies a temporary lifeline, they’ve come at the cost of eroded profitability, potentially creating future solvency issues. There aren’t any glaring signs of an immediate crisis, but the lack of transparency in the private credit market remains a significant concern. Given these uncertainties, investors should exercise caution before taking on excessive risk, especially with policy rates hovering above 5%.

Fed Leaning Hawkish? Rising shelter costs are dampening the Federal Reserve’s optimism for three rate cuts this year, and the high home prices continue to fuel domestic inflation.

- Federal Reserve officials presented a divided front on future rate cuts this week. Voting member Raphael Bostic, President of the Atlanta Fed, pointed to stronger economic data and scaled back his forecast from two cuts to one. While Bostic expressed caution, Fed Governor Lisa Cook emphasized the potential hurdles on the path to price stability. In contrast, Chicago Fed President Austan Goolsbee held firm to his projection of three cuts, as outlined in the Fed’s latest Summary of Economic Projections (SEP). These divergent views highlight the complex interplay between robust employment data and higher-than-expected inflation on policymakers’ outlooks.

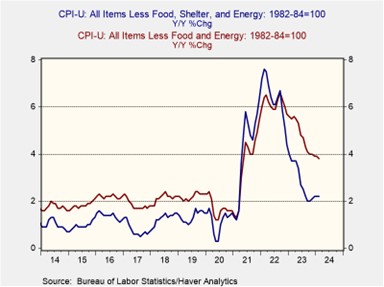

- Shelter costs remain a major hurdle for the Fed, delaying their shift on interest rates. While overall inflation shows signs of easing, housing prices act as a glaring outlier, driving a wedge in price trends. Excluding shelter, core CPI has held steady between 1.9% and 2.2% for the past seven months. This persistent rise in housing costs is often attributed to limited inventory and a slowdown in new construction. However, confusion clouds how this data is collected, with Fed Chair Jerome Powell himself acknowledging uncertainty about when the slowdown in housing prices will be reflected in inflation figures.

- Federal Reserve officials are signaling a cautious shift, with some openness to considering two rate cuts this year depending on economic data. While we expect the January and February inflation spikes to moderate, our confidence in the Fed achieving its target of 2% core PCE inflation by year-end has decreased. Stubbornly high shelter costs, a significant factor in inflation metrics, contribute to this hesitation. If inflation persists alongside a strong labor market, the Fed may postpone rate cuts until after the election.

Carrot and Stick Diplomacy: Despite China’s push for self-sufficiency in technology, it still seeks cooperation with US business leaders to temper U.S. hostility.

- On Wednesday, a select group of US corporate executives received an esteemed invitation to meet with Chinese President Xi Jinping. Following their participation in the high-profile China Development Forum, which wrapped up on Monday, these key players will convene for an exclusive gathering, aimed at providing insights into the nation’s burgeoning growth trajectory. The invitation arrives as US-China tensions escalate, fueled by policies targeting economic decoupling. With American businesses pulling back on investments in China, and Beijing planning to replace US technology, this high-level dialogue holds the key to shaping the future relationship between these economic giants.

- Despite recent tensions, a meeting between US CEOs and President Xi highlights the mutual dependence of the US and China. China’s manufacturing overcapacity strains its ability to sustain growth without access to US markets. This is particularly true for the electric vehicle industry, where China faces pushback from Western countries due to its surplus. However, US firms also rely on China’s vast consumer base for their own continued growth. Just look at Apple, whose sales of their flagship iPhone have dropped in China, prompting them to explore a partnership with Baidu to regain a foothold.

- High tensions simmer between the US and China, but a complete breakdown seems unlikely barring a major geopolitical crisis. Deep economic ties act as a safety net, minimizing supply chain disruptions and potentially creating space for a gradual thaw. Upcoming high-level visits, like Treasury Secretary Yellen’s expected trip to China next month, highlight the ongoing communication between the two countries. This trend is likely to continue, especially as China grapples with its economic slowdown. Nevertheless, we anticipate encountering occasional obstacles as both major economies strive to maintain their economic influence.

Other News: A major bridge in Baltimore collapsed late last night after a cargo ship collided with one of its supports. While there’s no indication of this being a deliberate act, authorities will likely conduct a thorough investigation in the coming months. Florida passed legislation to prevent minors under 14 from accessing social media, in another sign of the growing scrutiny of US tech companies.