Daily Comment (March 27, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity markets are off to a strong start today. In sports news, the NFL has announced a rule change to its kickoff format, making it similar to the format used by its competitor, the XFL. Today’s Comment dives into the nuanced reasons behind the Bank of Japan’s cautious approach toward significant shifts in monetary policy, explores consumer apprehensions surrounding the upcoming election, and examines the burgeoning AI frenzy making its way across Asia. As usual, we include a round of international and domestic news.

Yen Worries Continue: The Japanese yen (JPY) weakens as the Bank of Japan indicates it will refrain from additional interest rate hikes, despite inflation exceeding its 2% target.

- The Bank of Japan threatened currency intervention to halt speculation, driving down the JPY. Earlier today, the currency plunged to a 34-year low of 151.97 per dollar, alarming policymakers. This sharp depreciation follows the central bank’s recent decision to end negative interest rates and to signal a pause in further tightening. However, Governor Kazuo Ueda’s dovish stance — suggesting the BOJ won’t raise rates aggressively until inflation expectations reach 2% — has spooked investors. Consequently, they’re dumping yen holdings in anticipation of other central banks, like the Federal Reserve and the European Central Bank, maintaining higher rates for a longer period than the market anticipated at the start of the year.

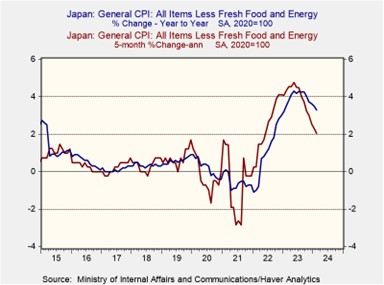

- Recent inflation data strengthens the Bank of Japan’s case for maintaining its dovish stance. Headline inflation rose 2.8% year-over-year, but this increase hasn’t translated to core inflation. The core index has remained flat since October 2023, suggesting underlying inflationary pressures are subdued. Furthermore, core inflation shows signs of further moderation, rising at an annualized pace of only 2.1% over the past five months, significantly lower than the 3.3% annual change observed in February. The setback in inflation has likely led policymakers to question whether the country has truly turned a corner in its fight against deflation.

- In a shift from past policy, central banks, including the Bank of Japan, are prioritizing a cautious approach to monetary policy. Their primary concern is to avoid triggering unintended economic downturns that would necessitate future policy reversals. This cautious stance extends even to central banks who have traditionally been seen as more hawkish, as evidenced by similar concerns about interest rate adjustments voiced by members of the European Central Bank and the Federal Reserve. This cautious approach by central banks is likely to keep the interest rate differential between the US and its peers stable or even widen it, potentially strengthening the dollar.

Election Concerns: Anxiety is rising among American households about the country’s direction, fueled in part by the potential for a rematch between President Biden and his predecessor, Donald Trump.

- Recent surveys paint a complex picture of consumer sentiment. While headline figures from the Conference Board and the University of Michigan suggest stability, a closer look reveals a growing unease about the future. This is evidenced by a decline in consumer expectations in the Conference Board’s March survey, with the six-month outlook dropping to its lowest point in six months (73.8, down from 76.3). The University of Michigan Sentiment Index echoes this trend, dipping slightly from 75.2 to 74.6. Notably, this weakening confidence emerges despite positive signs in the labor market and significant progress on inflation reduction from its highs in 2022.

- The forthcoming election appears to be a significant factor in the growing disparity between consumer sentiment and favorable economic indicators. According to the latest findings from the University of Michigan, the survey shows a downturn in sentiment among independent voters, while partisan optimism is on the rise among the two major parties. The Conference Board’s observations underscore a rising trend of write-in responses concerning the political climate. This coincides with a noticeable generational divergence among respondents. Individuals under 55 exhibit a considerable decline in enthusiasm, while those aged 55 and above demonstrate greater optimism.

- While the election may influence consumer sentiment, it likely won’t significantly impact short-term spending. This disconnect suggests voters perceive that neither candidate is offering solutions to improve daily living standards. A deeper reason could be the growing acceptance of a new economic reality: Low borrowing costs are likely gone. Tighter monetary policy and ballooning deficits are expected to keep long-term interest rates above 4% for the foreseeable future. This shift may force consumers who missed the window of easy credit to increase savings to maintain their desired financial stability. In the long run, this could stifle economic growth as households tighten their belts and reduce spending in order to adapt to the shifting economic landscape.

Emerging Tech: With tech stock valuations reaching lofty heights, investors are increasingly turning their attention to Asian countries to capitalize on the burgeoning growth in artificial intelligence (AI).

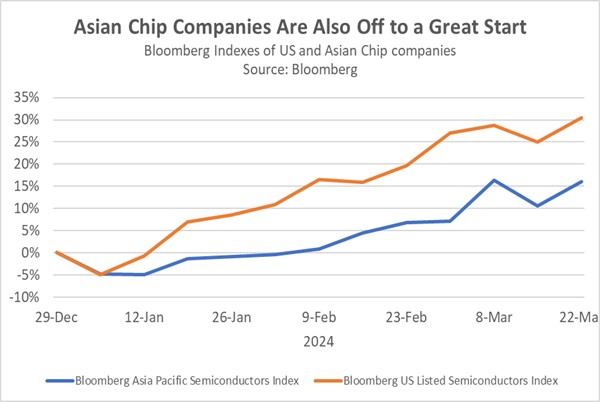

- US tech giants Meta, Nvidia, Microsoft, and Amazon have been driving the S&P 500’s returns this year, accounting for 55% of its gains so far. This surge is likely due to the increasing popularity of AI and the corresponding demand for semiconductors, which are crucial components in AI hardware. While some of the excitement may carry over from last year, Nvidia’s strong sales figures in Q4 have bolstered investor confidence that these companies can continue to deliver above-average returns in the future. That said, their high valuations have led investors to begin seeking cheaper alternatives.

- Fueled by the Asian tech boom, India, South Korea, and Taiwan have emerged as attractive destinations for investors seeking to diversify their tech holdings beyond the US. ETF flow data from Bloomberg shows that India is leading the way with $197 million in inflows year-to-date, followed by South Korea at $181 million, and Taiwan at $112 million. These countries are all well-positioned to benefit from the growth of key technologies like AI and semiconductors and are attracting investors seeking exposure to these trends. The rising inflow also reflects a growing investor preference for geographically balanced portfolios, with a focus on countries with strong economic ties to the US or those maintaining neutrality.

- Risk appetite is currently high, likely fueled by market expectations that central banks will begin easing monetary policy within the next six months. While US mega-cap tech stocks have been in the spotlight for years, their dominance seems to be fading. This is evident in the recent broad-based gains across the S&P 500. Investors seeking to capitalize on the AI boom might find opportunities abroad. Foreign AI firms have experienced impressive growth over the past year and currently trade at lower valuations compared to the well-established “Magnificent Seven” US tech giants.

Other News: Protests have broken out in Hungary after Prime Minister Viktor Orbán was implicated in a graft probe. The Bank of England has warned that a boom in private equity may negatively impact the country, elevating the potential for financial mishap. The Congressional Budget Office Director, Phillip Swagel, has warned of a “Liz Truss-style market shock” if the US government does not get its fiscal house in order.