Asset Allocation Bi-Weekly – Gold, Gold Miners, and Central Banks (April 1, 2024)

by the Asset Allocation Committee | PDF

One challenge for investors seeking to benefit from rising gold prices has been that trading and holding the yellow metal is often more expensive than trading or holding stocks or other financial assets. Buying physical gold can involve fat commissions and large costs for storage and insurance. Buying gold futures requires a margin account that may not be available for some investors. Many investors therefore buy gold miner stocks instead, assuming that rising gold prices will buoy miner profits and cause their stocks to appreciate in line with gold. Our analysis suggests that was a reasonable strategy until about 2003, when the Securities and Exchange Commission first allowed exchange-traded products (ETPs) that invest in gold. Up until 2003, the NYSE Arca Gold Miner Price Index (GDM) was highly correlated with gold prices. Since then, however, the relationship has swung wildly across periods. Now, there appears to be no lasting, consistent relationship between the GDM and gold prices. In the post-2003 era, it appears private investors seeking gold exposure should just buy gold or gold ETPs.

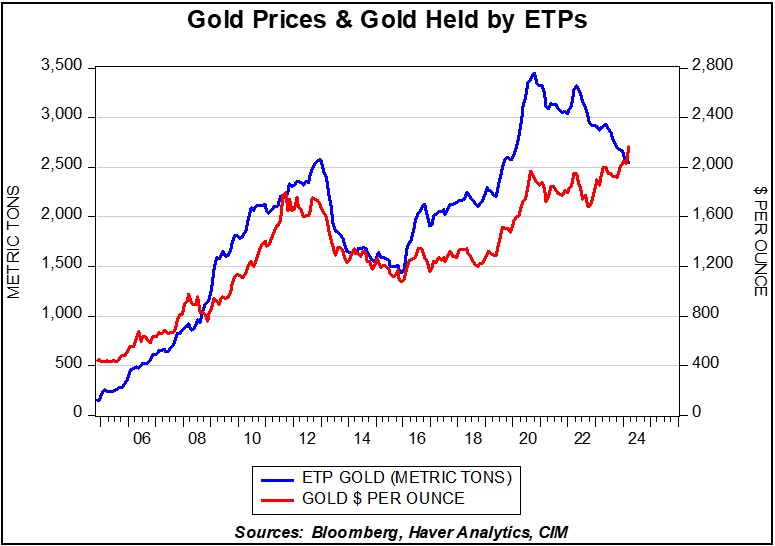

But what is the correlation between gold and gold ETPs? Until recently, spot gold prices have tended to move in tandem with the amount of the yellow metal held by ETPs, suggesting financial investors have become the market’s key drivers. As investors buy gold ETPs, the funds purchase physical gold and buoy prices. Our analysis suggests investor demand for physical gold and gold ETPs is often driven by concern about the value of the dollar and can increase when investors worry about issues like the rising federal budget deficit or inflation.

More recently, however, we have noted a breakdown in the relationship between spot gold prices and ETP gold holdings. As shown in the chart below, gold prices and ETP holdings had moved largely in tandem for more than a decade and a half, but they began to move in opposite directions toward the end of 2021. Since then, gold prices have soared and recently reached a new all-time record of $2,212 per ounce, but ETP gold holdings have been declining. How can gold prices be rising in the face of an apparent drop-off in investor demand for gold?

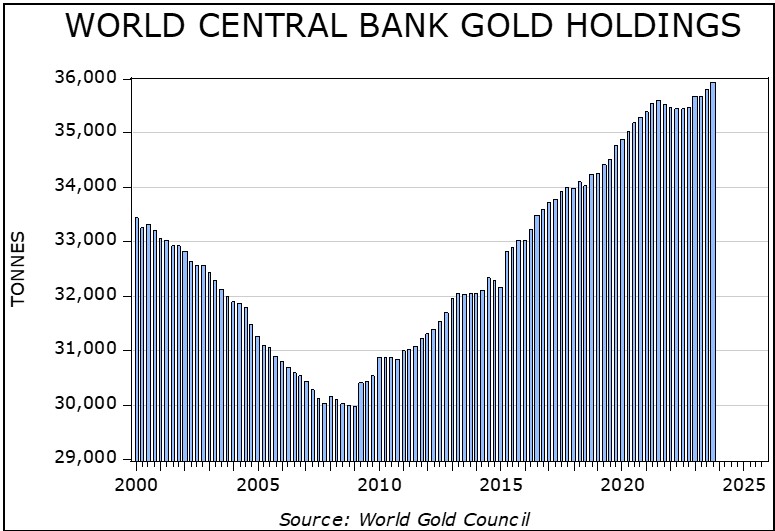

We think the answer is increased gold-buying by central banks. The chart below shows that the world’s central banks now hold nearly 36,000 metric tons of gold, a new record high. Importantly, central banks don’t necessarily act like private investors. For central banks, gold is part of their foreign reserves, which can be seen as a sort of “rainy day fund” for their country. Since the gold held in these reserves is for their own country’s economic security, central banks are likely to be relatively price insensitive when they go out into the gold market. Another distinguishing aspect of central bank gold-buying is that the institutions are much more oriented toward the security of holding physical gold rather than ETPs. Putting it all together, it appears that major central banks have been actively buying up physical gold despite today’s record-high prices, while gold-holding ETPs have apparently been selling to them.

We suspect much of today’s central bank gold-buying is being driven by institutions outside the US geopolitical and economic bloc or the central banks of other countries at odds with the US. After seeing US and Western moves to seize foreign currency reserves belonging to Afghanistan and Russia in recent years, we think many governments that aren’t on good terms with the US or might fall afoul of US policies have directed their central banks to shift their reserves more toward physical gold and other assets that the US or other Western governments wouldn’t be able to seize in times of souring relations. Given today’s ongoing spiral of tensions between the US bloc and the China/Russia bloc, which seems set to continue for years, we think central bank gold purchases will remain strong and give a continued boost to gold prices, at least in the near term.

Note: there will not be an accompanying podcast for this report.