Daily Comment (April 3, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with new signs that global consumer demand for electric vehicles isn’t growing as fast as previously thought, with major implications for the global economy and policymakers. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including news of a major earthquake in Taiwan and the latest statement from a Federal Reserve policymaker pointing to US interest rates remaining “higher for longer.”

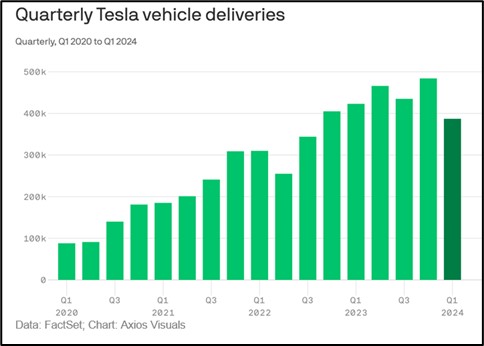

Global Electric Vehicle Market: Adding to the evidence that global demand for electric vehicles is slowing sharply, EV giant Tesla yesterday stated that its first-quarter deliveries were down much more sharply than expected. The company said it delivered just 386,310 vehicles in January through March, down 8.5% from the same period one year earlier and far below the anticipated rate of about 457,000.

- Even though top Chinese EV makers reported even steeper delivery declines, leaving Tesla as the world’s top seller, the news nevertheless pushed Tesla’s stock price 4.9% lower for the day, leaving it down about 33% for the year-to-date.

- If the delivery shortfalls really do reflect a saturated market or waning demand, it suggests there will be an even greater profit bloodbath as China’s excess capacity leads it to try to dump even more vehicles on the world market.

Taiwan: An earthquake with a magnitude of 7.4 struck the country’s east coast this morning, killing at least nine people and damaging infrastructure and buildings. Of course, a key question for the global economy is the fate of Taiwan Semiconductor Manufacturing Company’s fabs on the island, which produce most of the world’s advanced computer chips. The firm said damage to its plants has been minimal and workers are already returning to their jobs, but the quake will nevertheless refocus attention on the security of chip supply chains.

European Union-China: Just weeks after signaling the EU wouldn’t intervene to help European solar panel makers survive the onslaught of cheap Chinese imports, the European Commission today announced it will investigate whether two Chinese producers are using state subsidies to engage in unfair competition. The probe will utilize a new anti-subsidy law passed by the EU last July. The about-face on solar panels illustrates how political winds are increasingly forcing Western governments to take a tough stand against Chinese military and economic threats.

Eurozone: The March consumer price index was up just 2.4% from the same month one year earlier, coming in a bit better than expected and slowing from the rise of 2.6% in the year to February. The slowdown in inflation mostly stemmed from weaker price growth for food, energy, and other goods, while service inflation remained steady. Despite the sticky service inflation, the figure is likely to increase expectations that the European Central Bank can cut its benchmark interest rate in June.

- With the US’s healthy economic growth and sticky overall price inflation increasingly convincing investors that the Fed will move only slowly in cutting its benchmark interest rate, the prospect of near-term rate cuts by the ECB has been weighing on the euro.

- Even though the EUR is slightly higher today, trading at 1.0783 per dollar, it is still down some 2.5% against the greenback for the year-to-date.

US-China Diplomacy: Yesterday, during their first phone call in two years, President Biden and President Xi reportedly had a “candid” and “constructive” conversation about a range of issues between the two countries. However, Xi warned Biden that China “will not sit idly by” if the US continues what he called efforts to suppress Chinese economic and technological development. In turn, Biden said he will keep taking what he called limited steps necessary to ensure US national security.

- While it’s probably good that Biden and Xi are talking again, the tit-for-tat exchange on economic and technological relations should serve as a reminder that tensions look set to continue spiraling.

- The US-China relationship continues to show signs of being a “Thucydides Trap,” where the reigning hegemon (i.e., the US) faces a rising power (i.e., China). Some foreign affairs scholars, such as Harvard professor Graham Allison, argue that to avoid war in such a situation, the US should accommodate China’s rise. However, both Democrats and Republicans in Washington continue to show signs that they’re willing to stand up to China in an effort to preserve the US’s dominance in geopolitics and the global economy.

US-China Capital Flows: Reflecting the bipartisan effort to rein in China, Democratic and Republican lawmakers in the House of Representatives have introduced a bill that would bar index funds from investing in Chinese companies. According to the bill’s sponsors, the proposed No China in Index Funds Act is justified because index funds do not research the firms they hold and therefore can’t uncover the unique risks inherent with Chinese companies.

- The bill was introduced by Rep. Brad Sherman, a Democrat from California, and Rep. Victoria Spartz, a Republican from Indiana.

- Sherman and Spartz have also introduced a number of other anti-China bills that would “end tax breaks for Chinese equities, restrict sanctioned Chinese companies’ access to US capital markets, increase transparency on risks to American corporations, and reduce exposure to these risks for retail investors and other Americans saving for retirement,” according to a statement from the lawmakers.

US Monetary Policy: In a speech yesterday, Cleveland FRB President Mester said the continued fundamental strength in the US economy has convinced her that interest rates will settle at a higher level than she previously thought, even after the Fed finishes its impending rate-cutting cycle. Over the long term, Mester said she now expects the benchmark fed funds rate to settle in a range of 2.5% to 3.0%, rather than the flat 2.5% she assumed previously.

- Mester’s view of higher future interest rates is consistent with our view that geopolitical tensions and structural changes in the global economy will lead to increased inflation and interest rates going forward. In our view, inflation and interest rates are also likely to be more volatile.

- Separately, Mester also poured cold water on the idea of any rate cut at the Fed’s policymaking meeting in May. She hinted that a cut was still possible at the June meeting, but only if in-coming inflation data clearly supports it.