Daily Comment (April 4, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start after initial jobless claims data came in higher than anticipated. In sports news, the St. Louis Cardinals, considered by many to be World Series contenders, kick off their home opener today. Today’s Comment explores three key market concerns: the impact of future policy rate uncertainty on market jitters, how the AI rally might diverge from the dotcom bubble, and whether Swiss inflation data offers clues about global inflation trends. As usual, our report includes a summary of domestic and international data releases.

Shifting Sands: The Fed’s uncertainty about inflation’s trajectory is muddying the policy path, prompting markets to reassess their interest rate forecasts.

- Fed Chair Jerome Powell reiterated the importance of patience in considering rate cuts for the Federal Reserve. Speaking at a panel discussion at Stanford University, Powell highlighted the significant influence of supply-side factors in curbing inflation since the onset of the pandemic. While he avoided giving a specific rate forecast, he indicated the latest data hasn’t “materially changed” the Fed’s view on inflation. This aligns with San Francisco Fed President Mary Daly, who still favors three rate cuts this year. In contrast, Raphael Bostic has reduced his forecast from two cuts to one.

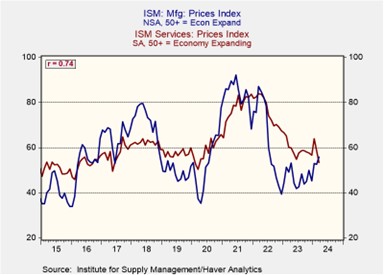

- Conflicting economic data is further muddying the Federal Reserve’s decision on interest rates. The Institute for Supply Management’s (ISM) latest manufacturing PMI shows prices paid have surged to their highest levels since 2022, indicating persistent inflation. However, the non-manufacturing PMI shows service sector prices at a four-year low, suggesting a potential easing of price pressures in that sector. This surge in manufacturing prices likely reflects rising commodity costs, while the low service-sector prices could signal easing wage pressures, which aligns with the decline in the non-manufacturing employment component. The negative response to manufacturing data and positive reception of service data highlights the market’s current volatility.

- The ISM report, though not directly influencing policymakers, exposes the market’s hair-trigger sensitivity to economic data, as evidenced by contrasting reactions. Uncertainty regarding rate cuts will hang in the air until the Fed’s June meeting, where their updated economic projections will shed light on their path forward. Committee members, especially the hawkish ones, are paying attention to payroll data. A significant drop in March or April jobs could trigger a dovish pivot towards rate cuts this summer. Conversely, persistently strong job reports could lead to a reduction, or even a complete halt, in planned rate cuts for the year.

Tech Moves: Soaring valuations prompt tech companies to seek new income sources to satisfy their investors.

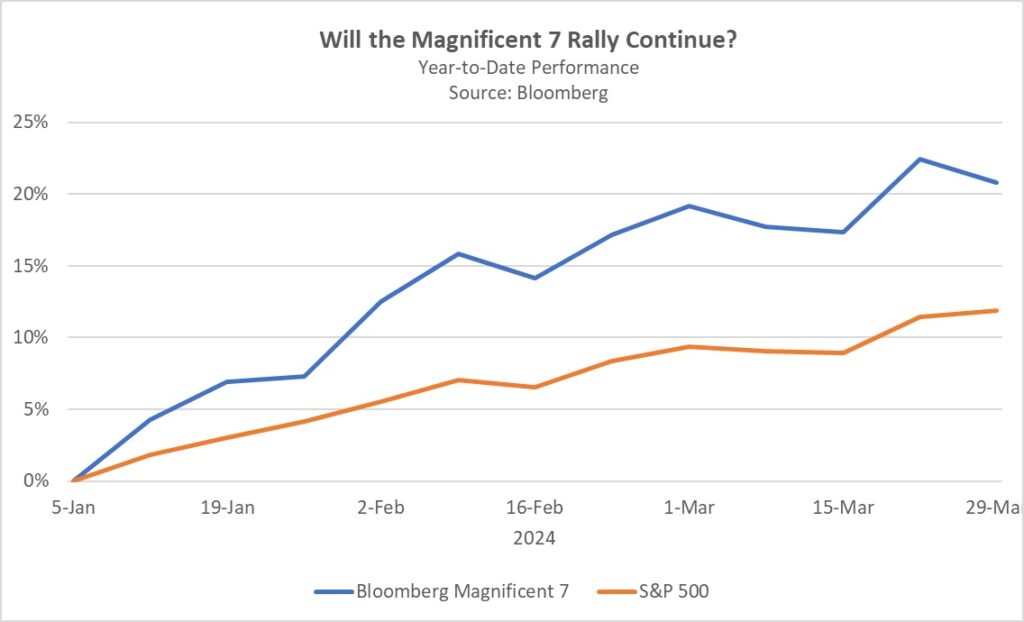

- Tech giants like Google are exploring premium features on select products behind paywalls, creating new revenue streams. This could fund continued development of these enhancements while maintaining their free, ad-supported core offerings. Meanwhile, Apple’s foray into home robotics signals a potential pivot away from their electric vehicle project. These moves, though not finalized, highlight the growing pressure on tech companies, particularly the Magnificent Seven (M7), to diversify income and justify high valuations in a changing market. The recent drop in Tesla stock following weak deliveries exemplifies how investor sentiment can quickly turn after negative news.

- The recent surge in the M7’s stock prices evokes comparisons to the dotcom boom of the late 1990s. However, a crucial distinction lies in the companies’ financial health. The dotcom bubble was fueled by speculation on unprofitable startups with minimal revenue and high debt. In stark contrast, the M7 are established powerhouses generating substantial profits. Their impressive free cash flow of $309.2 billion in 2023, a staggering $100 billion increase year-over-year, demonstrates their financial strength. This massive cash cushion positions them as far more resilient than the fragile dotcom companies, providing a buffer during periods of economic uncertainty.

- While there’s confidence that the large-cap rally will spread to other sectors, the M7’s future path remains uncertain. The upcoming Q1 2024 earnings season will be critical, potentially shaping the rally’s direction as it reveals these mega-caps’ abilities to maintain profitability. However, unlike the dotcom bubble, the size and scale of the M7 provide a buffer. Even if the AI boom weakens, these companies have the resources to explore alternative revenue streams, fostering a more resilient position. This doesn’t necessarily guarantee a complete avoidance of a correction, but investors should be prepared for a more measured market response compared to the dramatic downturns of the dotcom era.

The Swiss’s Dovish Surprise: March’s lower-than-anticipated inflation data supports the central bank’s decision and raises the possibility of additional stimulus measures.

- Swiss consumer prices have risen just 1% since March 2023, falling short of expectations for a 1.3% increase. This comes on the heels of the Swiss National Bank’s (SNB) decision in March to cut borrowing costs, marking the first such move by a G-10 central bank since November 2020. The SNB’s pivot aimed to curb the Swiss franc’s appreciation against the dollar. A recent study suggests the SNB would require an additional $30 billion alongside a commitment to keeping interest rates low for the next three years to prevent a mere 1.1% appreciation of the Swiss franc’s real effective exchange rate.

- Although a single month’s data shouldn’t be over-emphasized, recent CPI figures offer early signs of potential global inflation moderation. For instance, preliminary data from the eurozone shows core inflation dipping below 3.0% for the first time since March 2022. Similarly, both Japan and Canada have experienced a notable slowdown in inflation over the past several months. If this trend continues throughout the developed world, it is possible that the central banks will likely follow through on plans to reduce their policy rates this year.

- Slower economic growth in some countries is tempering inflation, but rising commodity prices threaten this progress. The robust US economy, with strong wage growth and a tight labor market, might prompt the Federal Reserve to maintain its current stance before easing monetary policy. This could lead to a stronger dollar as the interest rate differential between the US and other countries widens. Consequently, import-dependent nations may face challenges due to higher costs for dollar-denominated goods. This divergence in monetary policy could dampen global interest rate reductions, potentially falling short of market expectations.

Other News: Germany is undertaking military reforms in response to a perceived increase in global hostility. An Israeli cabinet member’s call for early elections highlights the current political instability in Israel.