Daily Comment (April 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a slow start today as investors await key bank earnings reports. In a separate development, NFL fans are buzzing after quarterback Tom Brady hinted at a possible return. Today’s Comment examines the contrasting monetary policies of the ECB and the Fed, explores the reasons behind gold’s recent surge in investor interest, and analyzes the potential impact of South Korea’s parliamentary elections on its stock market. As always, we conclude with a summary of key domestic and international data releases.

Taking Different Paths: The ECB and the Federal Reserve are diverging on monetary policy, with both looking to loosen restrictions without abandoning their goals.

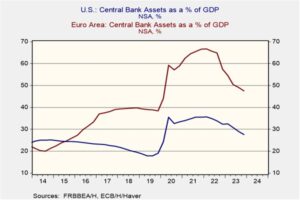

- The FOMC minutes unveiled on Wednesday provide valuable insights into the Federal Reserve’s strategy for balance sheet reduction. FOMC policymakers have signaled an openness to initiating this process, with a primary focus on scaling back the pace of US Treasury roll-off while maintaining mortgage-backed securities unchanged. While a specific start date isn’t confirmed, May or June are possible targets. Chair Powell stressed a gradual approach to control the process. This aims to reduce reserves from “abundant” to an as yet to be defined “ample” level, with the hopes of preventing disruptions similar to the 2019 short-term funding market issues.

- The European Central Bank (ECB) is taking a contrasting approach. The ECB is maintaining its current pace of balance sheet reduction, continuing to unwind its asset purchase program, and stopping the reinvestment of bonds from its pandemic program by year-end. This last step will significantly accelerate the shrinking of the ECB’s balance sheet. This faster drawdown aims to both limit new money entering the financial system and counteract any stimulus from potential future rate cuts, aligning with the ECB’s mission of ensuring the return of price stability within the market.

- The central banks are taking different approaches to monetary policy based on their economic concerns. The Fed’s measured pace of balance sheet reduction suggests a focus on preventing financial instability, possibly due to rising liquidity concerns. In contrast, the ECB’s preference for rate cuts suggests policymakers are worried about rising defaults, hoping lower rates will allow businesses to refinance debt more easily. That said, these adjustments by central banks may not signal a return to loose monetary policy, but rather a moderation of previous tightening measures. Investors should therefore remain cautious about excessive risk-taking.

Gold Bugs in Charge: The bullion has surged in recent months as central banks have looked to acquire the metal as a hedge against the dollar.

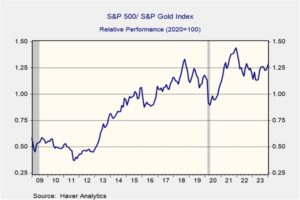

- Several factors are driving the gold surge, including heightened demand from central banks in emerging economies, such as China, that are seeking alternatives to the dollar. Investors are also increasingly drawn to safe havens due to rising geopolitical risks and uncertainty surrounding Fed policy rates, which could erode the value of US Treasurys. Additionally, consumers are actively seeking alternative assets to safeguard their savings amid sustained inflationary pressures. As a result, gold has been a star performer in 2024, outperforming the S&P 500 with a year-to-date return of 16.0% compared to 9.6%.

- Traditionally, gold and stocks have moved in opposite directions during uncertain times. But over the past five years, a surprising trend has emerged of a strong positive correlation, with both assets rising in tandem. The five-year moving correlation has jumped to +0.84, significantly above its historical norm of +0.22. This breakdown of the usual inverse relationship suggests a more complex market environment. While economic optimism typically fuels stock prices, with investors betting on growing companies, rising gold prices might indicate underlying anxieties about the high valuation of tech companies.

- A key factor influencing gold’s price momentum hinges on the Federal Reserve’s ability to achieve a soft landing – controlling inflation without stalling economic growth. Recent comments from Boston Fed President Susan Collins and Fed Governor John Williams suggest policymakers are cautious about cutting rates given the current elevated inflation levels. If policymakers continue to hold rates higher than the market is expecting, it may encourage more investors to purchase gold in order to hedge against a possible hard landing or an unexpected acceleration in inflation.

Yoon in Trouble: South Korea’s parliamentary election results dealt a severe blow to the ruling Conservative party, raising doubts about its ability to hold the government together.

- In Wednesday’s parliamentary elections, the liberal opposition in South Korea achieved a resounding victory, securing 175 out of 300 seats in parliament. Although the opposition fell short of the 200 seats required for a supermajority, its win holds significant implications. This strong opposition suggests that President Yoon Suk Yeol will need help enacting his agenda. He may be forced to compromise with the opposing side, which could significantly weaken his proposals. Following the crushing defeat, the prime minister and other senior officials tendered their resignations, which paves the way for the president to reshuffle his cabinet in response to the election results.

- The election outcome raises questions about the planned reforms designed to enhance the appeal of South Korean equities. President Yoon had pledged to eliminate the planned capital gains taxes on financial investment income before the election. He also proposed a program to address the issue of Korean companies trading at lower valuations relative to their global peers, a phenomenon known as the Korea discount. Despite some hope that the reforms would survive in a weakened form, the uncertainty surrounding their implementation is likely weighing on investors and contributing to today’s decline in the KOSPI.

- South Korea’s recent political situation exemplifies the challenges in making its equities more attractive. However, the country’s booming semiconductor industry, especially with its strengthened ties to the US, Japan, and Taiwan for chip security, offers a potential bright spot for investors seeking exposure beyond a weakening China. Investor confidence hinges on lawmakers’ ability to encourage companies to prioritize shareholder value alongside other considerations during decision-making. Unfortunately, the recent parliamentary shift makes achieving this reform more difficult, potentially dampening hopes for a rally similar to the one experienced by the Japanese stock market in recent years.

In Other News: Iran has signaled a limited response to Israel, easing fears of wider conflict in the Middle East. China’s exports fell more than expected in March, raising concerns about its economic slowdown. Meanwhile, former Fed Chair Bernanke unveiled revamped economic models for the BOE in a sign that central bankers are adapting to a changing world.