Daily Comment (April 15, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Iran-Israel situation, where investors are expecting tensions to cool, but we think risks remain elevated. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including new provocative naval actions by China against the Philippines and a discussion of the US Treasury’s disappointing bond auctions last week.

Iran-Israel: As widely expected, Iran launched a strike against Israel over the weekend in retaliation for Tel Aviv’s recent attack on Iranian diplomatic facilities in Syria, which killed several high-level Iranian military leaders. So far, it appears Iran has launched over 300 ballistic missiles, cruise missiles, and drones at Israel, mostly from Iranian territory. The Israeli military claims 99% of those attacks were intercepted before they could cause any damage, but the world now braces for a potential Israeli strike directly on Iran that could spark a wider conflict.

- Since Israel avoided any significant damage from the strikes, President Biden has reportedly urged Prime Minister Netanyahu to hold his fire. However, we suspect that Netanyahu’s domestic political environment will prompt him to retaliate in some way.

- If Netanyahu does decide to retaliate, a key question is how far he will go. One potential avenue would be to launch a go-for-broke attack to eliminate Iran’s nuclear weapons arsenal — something hardline Israeli officials have long wanted to do. Such a strike would almost certainly invite a strong response from Iran, as well.

- Of course, Netanyahu could also show restraint and decide on only a limited response or reserve the right to respond sometime in the future. Indeed, market action today suggests that is what investors are expecting. For example, near Brent crude oil futures are currently trading down 0.9% to $89.64, near their lowest level of the last week. Gold prices are steady at $2,373.40 per ounce.

- Despite today’s apparent expectation for a quick cooling of tensions, we suspect that the Israel-Hamas conflict could still be on the brink of widening and intensifying, as many have feared over the last six months. The situation will likely remain a risk for global financial markets in the near term.

China-Philippines: As a reminder that the Middle East isn’t the only place where a major war could start, the Chinese coast guard has blocked a Philippine maritime research vessel and its coast guard escort as they were about to cross the “nine dash line,” which marks China’s expansive, unrecognized claim to virtually all of the South China Sea. The incident happened just 35 miles from the Philippine coast in waters recognized by international law as part of the country’s exclusive economic zone.

- This occurred just days after President Biden reiterated the US’s commitment to defend the Philippines under the two countries’ mutual defense treaty.

- As we have noted previously, the US-Philippine defense treaty means today’s escalating Chinese-Philippine tensions are probably even more dangerous than China’s ongoing military provocations against Taiwan. If Chinese forces directly attack Philippine vessels, the US could be obligated to intervene and come into direct conflict with China.

China: The People’s Bank of China today held its key interest rates steady, with its one-year medium-term lending facility at 2.5%. However, it also drained liquidity from the financial system. The moves suggest that, on balance, Chinese monetary policy will be steady in the near term as the economy continues to face strong structural headwinds but is also showing signs of a near-term improvement.

North Atlantic Treaty Organization-France: Reflecting how the growing threat from Russia has spurred Europeans to take stronger defense measures, France will put an aircraft carrier and its strike group under NATO command for the first time ever in a naval exercise next week in the Mediterranean Sea. Besides the Charles de Gaulle carrier, the French strike group will include two frigates and a nuclear attack submarine, augmented by US, Spanish, Portuguese, Italian, and Greek navy ships.

United States-United Kingdom-Russia: The US and UK on Friday said they will ban Russian aluminum, nickel, and copper from Western metals exchanges in a further retaliation for the Kremlin’s invasion of Ukraine. Since the Russian metals can still be off-exchange, there will be no immediate impact on actual supply and demand. However, the move has raised concern about further restrictions in the future. Prices for the metals are therefore trading higher so far this morning. For example, near copper futures are currently up 1.6% to $4.3236 per pound.

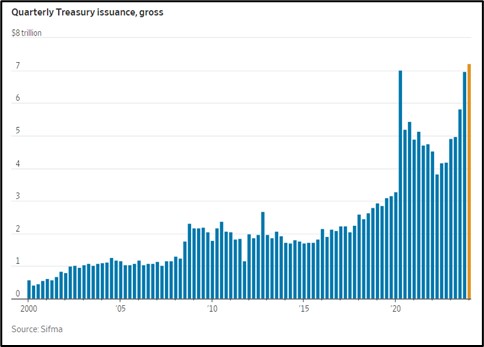

US Bond Market: Although last week’s unsettling report on continued consumer price inflation was probably the key reason that bond yields rose, it’s important to remember that Treasury auctions also suffered from weak demand. That’s raising the prospect that the government may be hitting its limit in terms of investor demand for new Treasury obligations. That would be a negative development because the Treasury plans to sell another extraordinary volume of $386 billion in bonds next month.

US Industrial Policy: The Commerce Department today said Samsung Electronics will be granted up to $6.4 billion to help the company build a major semiconductor manufacturing facility outside Austin, Texas. The company will also be eligible for billions of dollars in loans. The funding is part of the CHIPS and Science Act of 2022, which aims to boost production of advanced computer chips in the US and cut the country’s reliance on suppliers abroad, especially those in China and East Asia.