Daily Comment (April 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of the big foreign aid bill passed by the House of Representatives over the weekend. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including an analysis of why Japan and South Korea are agitating for a weaker dollar and some observations on where US bond yields go from here.

United States-Ukraine-Israel-China: The House of Representatives approved a package of bills on Saturday that will provide a total of $95 billion in military and other aid to Ukraine, Israel, and Taiwan, even though a majority of Republicans opposed the $60 billion or so destined to Ukraine to help it fend off Russia’s invasion. The Senate is poised to give final legislative approval to the package in the coming days, after which President Biden is expected to sign it into law.

- Here at Confluence, we have long noted how US voters have become increasingly resistant to supporting the country’s traditional role as global hegemon, with the enormous fiscal, economic, and social costs. We believe that resistance is a key reason why right-wing populists such as Donald Trump have gained power in recent years.

- Nevertheless, it is not set in stone that US voters will ultimately support a full pullback from US leadership in global affairs. The vote over the weekend is an example of how, when faced with the threat of authoritarian powers abroad, politicians could well line up behind renewed US engagement, higher US defense spending, and a stronger commitment to US military power.

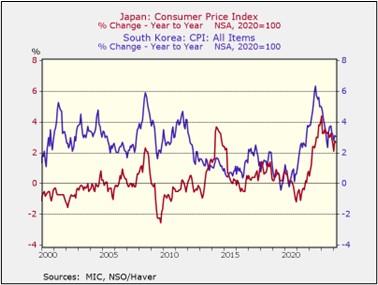

United States-Japan-South Korea: New analysis suggests Friday’s joint statement on currency rates by the US, Japan, and South Korea stemmed from Japanese and Korean concerns about consumer price inflation. As strong economic growth and the prospect of continued high interest rates in the US buoy the dollar, the yen (JPY) and won (KRW) have depreciated sharply. In turn, Japanese and Korean purchases of dollar-denominated goods have become more expensive, broadly pushing up price pressures in each country.

- Since the end of 2022, the yen has lost 14.8% of its value versus the greenback. Meanwhile, the Korean currency has weakened 8.3% against the dollar.

- The statement, which acknowledged that Tokyo and Seoul have serious concerns about their currencies, could signal a future coordinated effort to weaken the dollar and allow the yen and won to rise again. At any rate, it suggests the Biden administration has given the two allies a green light to intervene in the currency markets to boost their currencies.

Chinese Monetary Policy: The People’s Bank of China today said the country’s major banks have kept their prime lending rates unchanged this week, as widely expected after the central bank kept the interest rate on its medium-term lending facility unchanged last week. The banks’ one-year prime rate remains at 3.45%, while their five-year rate remains at 3.95%. Because of continued modest economic growth, some economists still expect the PBOC to cut rates further, but policymakers continue to resist broad, aggressive stimulus measures.

Chinese Military: State media on Friday said General Secretary Xi has ordered the biggest reorganization of the People’s Liberation Army since 2015. Under the change, the Strategic Support Force will be split up, with its space and cyberspace forces becoming new, standalone services and its remaining elements becoming a new Information Support Force.

- One likely reason for the change is to hasten the development and improve the operational efficiency of China’s key space warfare and cyberspace capabilities. If successful, the reorganization could help make those forces even more formidable threats to the US and the rest of its geopolitical bloc.

- Another likely reason for the reorganization is to stamp out corruption. Over the last year, several high-ranking military officials in the sprawling Strategic Rocket Force and defense industry were removed from their posts, apparently for procurement-related corruption that would have made them susceptible to recruitment by foreign intelligence agencies. Breaking up the Strategic Support Force could help increase control over its elements and reduce the opportunity for bribery, graft, espionage, and the like.

Iran-Israel: The Israeli military finally launched its retaliation on Friday for Iran’s direct missile and drone attack on Israel on April 13, striking a military base near the central Iranian city of Natanz. Details over the weekend showed the strike apparently used one missile and multiple drones to destroy an Iranian air defense radar near some of Iran’s key nuclear program sites. The limited nature of the strike and Iran’s muted response suggest the risk of escalation has diminished, but it’s clear Israel was signaling it can attack Iran by air if it so chooses in the future.

Canada: Bank of Canada Governor Macklem has given an optimistic assessment that consumer price inflation in Canada is now “closer to normal” and that the March data was a further “step in the right direction.” According to the report last week, March consumer prices were up 2.9% from the same month one year earlier. Macklem’s statement is being read as further evidence that the central bank will begin cutting interest rates as early as June.

US Bond Market: With the big rise in US bond yields over the last month, which has lifted the yield on the10-year Treasury note to 4.62% so far today, investors are increasingly wondering whether the benchmark yield could re-test the 5.00% level reached last October. Given the strength in US economic growth and sticky consumer price inflation, that’s possible. However, we note that Fed policymakers are behaving as if 5.00% is an informal ceiling that, if touched, would spur efforts to try to talk down yields or take other actions to push them lower.

- In other words, if the 10-year Treasury yield hits 5.00%, bond yields may not go much higher in the near term.

- Indeed, that level could potentially be a buying opportunity since Fed policymakers may then push yields lower again.

US Labor Market: The United Auto Workers said late Friday that 73% of the workers at a VW auto factory in Tennessee have voted to join the union, marking the UAW’s first success in organizing a non-Detroit Three assembly plant and its first major success in the South. The victory illustrates how labor shortages have boosted popular support for unions to a six-decade high and given workers increased leverage versus employers.