Daily Comment (April 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Stocks are surging on good news from Tesla. In the NHL, the Florida Panthers stole another victory, extending their series lead to 2-0 against the Tampa Bay Lightning. Today’s Comment examines how rising labor power could complicate the Federal Reserve’s fight against inflation. We also explain why markets are reacting positively to the latest PMI data and discuss how global investors are keeping a close eye on upcoming elections in India. As usual, the report concludes with a round-up of international and domestic news releases.

US Labor Power: Workers have scored a string of victories since the pandemic’s end, but these gains are now coming with drawbacks.

- The Federal Trade Commission has enacted a rule banning non-compete clauses used by employers. This change empowers 30 million workers to pursue opportunities at competing firms without fear of recourse, potentially boosting their wages and career mobility. Additionally, the Department of Labor also expanded overtime pay eligibility to salaried workers earning under $58,600 annually, significantly increasing the threshold from $35,500. These combined changes to labor rules will likely face resistance from businesses and advocacy groups through the court system, but also signal a potential shift in power dynamics, with workers gaining more leverage.

- Regulations enhancing workers’ bargaining power, coupled with an exceptionally tight labor market, pose a formidable challenge to the Federal Reserve’s efforts to curb inflation. The close correlation between the PCE core services index and the employment cost index is a critical indicator, suggesting a potential wage-price spiral. In this scenario, rising wages could be offset by price increases as businesses pass on higher labor costs to consumers. This dynamic explains why policymakers like Atlanta Fed President Raphael Bostic prefer restrictive-for-longer monetary policy as the economy continues to add jobs at a healthy clip.

- Stronger worker bargaining power could signal a shift in economic priorities, potentially favoring greater equity over pure efficiency. Historically, periods with stronger worker rights and income equality have often coincided with higher employment and inflation. While artificial intelligence may eventually ease some price pressures, its uneven adoption across sectors makes the timeline uncertain. This could lead the Federal Reserve to raise its neutral rate — the interest rate considered neither stimulative nor restrictive — to manage inflation. It may be close to around 3% to 4%, which is above the Fed’s long-term projection of 2.5% as outlined in its summary of economic projections.

US Loss is Europe’s Gain: The purchasing manager survey has boosted investor confidence, suggesting an improvement in market conditions for both the US and Europe, albeit for different reasons.

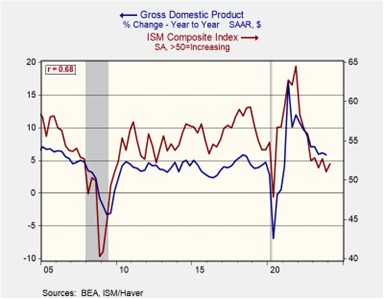

- Disappointing Purchasing Managers’ Index (PMI) data released on Tuesday revealed a sudden contraction in both the US services and manufacturing sectors. This is a significant shift from expectations of continued growth. The services PMI dropped from 51.7 to 50.9, and manufacturing fell to 49.9 from 51.9. Notably, the employment indicator also dipped for the first time since June 2020, raising concerns about a potential slowdown in job growth. Remember, readings below 50 in the PMI indicate a decline in private sector activity. The dollar fell following the report as it weakened the case for prolonged policy restrictions.

- However, a brighter picture emerges in Europe. Both the eurozone and UK PMI data indicated an acceleration in growth. The composite euro area index climbed from 50.3 to 51.4, while the UK composite index surged from 52.8 to 54.0. This robust upswing fuels hope that the worst of the economic downturn might be receding, especially as these countries prepare to cut policy rates sometime this summer. Despite the overall improvement in the index, manufacturing PMIs in both the eurozone and the UK remain in contraction territory.

- The contrasting economic picture could favor European equities, especially if it leads to a weaker dollar. A potential slowdown in the US might prompt the Fed to keep the door open for rate cuts this year as it aims to avoid a policy misstep. A disappointing GDP report tomorrow, although unlikely, could further encourage the Federal Open Market Committee to maintain a neutral-to-dovish stance at its meeting next week. Meanwhile, stronger GDP data in Europe and the UK could offer support for the euro (EUR) and pound (GBP) as these countries contemplate loosening monetary policy in the coming months.

Indian Elections: Prime Minister Narendra Modi looks to tighten the grip on his government as voters head to polls for the first of six phases of voting.

- Modi and his Hindu nationalist Bharatiya Janata Party (BJP) are widely anticipated to clinch victory in the election, with official results slated for release on June 4. Meanwhile, the opposition, spearheaded by the once-dominant Indian National Congress, seems to be grappling with internal discord, which has cast a shadow of doubt on whether the coalition can stay together to form a government if it wins. The weakness has given Modi an opportunity to attack his rivals over their welfare plan, suggesting it could lead to a redistribution of wealth to benefit minority groups, particularly Muslims.

- While the BJP is heavily favored, its goal of securing over 400 out of the 543 parliamentary seats — a milestone not achieved since 1984 — might be harder to achieve. A cornerstone of the group’s reelection bid lies in the robustness of the economy, consistently ranked among the world’s fastest growing. Nonetheless, criticism looms over the party’s approach, with concerns raised about economic growth being accompanied by widening income disparities, especially in rural areas. Additionally, the country’s unemployment rate remains a significant concern, standing at over 7% — a sharp increase from the sub-4% rate we saw nearly a decade ago.

- The reelection of Modi is poised to be welcomed by markets, with investors viewing him as instrumental in steering the country towards robust and sustainable growth. However, the election has proven to be more hostile than in previous years. Attacks on voting booths and allegations of vote rigging, especially in regions favoring the incumbent, have surfaced. As a result, there have been calls for a redo of voting in several areas. An extension of an already long electoral contest risks diminishing investor optimism. Although we expect the election to end in line with expectations, there is an elevated chance of unrest following the results.

In Other News: The US Senate passed a bill that could force a ban on TikTok, owned by Chinese company ByteDance. This move, while likely to face legal challenges, underscores the deepening tensions between the US and China. In Pennsylvania’s primary elections, both President Biden and former President Trump secured comfortable victories, but also saw a notable number of protest votes.