Daily Comment (April 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of the latest US bank to be seized and sold by regulators as a result of today’s high interest rates. We next review a range of other international and US developments with the potential to affect the financial markets today, including a UK proposal to cut long-term disability benefits due to their spiraling fiscal costs and a proposed tax increase on the wealthy in Russia to help fund its invasion of Ukraine. We also include a preview of this week’s Federal Reserve policy meeting.

US Banking System: On Friday afternoon, state and federal regulators seized Philadelphia-based Republic First Bancorp and sold it to fellow regional lender Fulton Financial. Reports say the bank faced challenges similar to Silicon Valley Bank and the two other lenders that had to be seized last year: a steep drop in the value of its bond holdings as interest rates rose, along with a wave of withdrawals as large depositors sought greater security and higher yields elsewhere. Nevertheless, the seizure hasn’t seemed to spark too much investor concern so far.

- The muted market reaction probably reflects the fact that Republic First had total assets of only about $6 billion at the end of 2023 and a stock-market capitalization that was closer to zero than anything else. The bank’s small size, well understood problems, and orderly seizure could minimize the risk of contagion to other financial institutions.

- Nevertheless, the development underscores how continued high interest rates in the US are stressing particular firms in the financial sector and related industries, such as commercial real estate.

- Despite the economy’s current positive momentum, an unexpected crisis for a big firm could still undermine confidence, spark financial contagion, and potentially put the economy into reverse. We therefore think high interest rates remain a risk for the economy and financial markets.

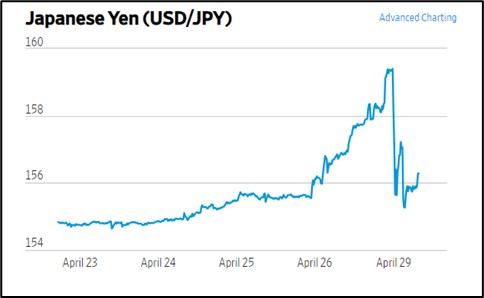

Japan: Continued high rates in the US also keep buoying the dollar, especially as foreign central banks hesitate to hike their rates or prepare to cut. Exemplifying the trend, the Japanese yen (JPY) today continued to depreciate, almost reaching 160 per dollar ($0.00625), a new multi-decade low. Reports indicate that the government then intervened in the market to lift the currency. As of this writing, the yen is trading at 156.26 per dollar ($0.00640).

United Kingdom: Faced with surging payments for long-term disability benefits, largely driven by mental health issues, the UK government will release proposed rules today to tighten eligibility and cut costs. The proposed rules mark a rare instance in which a Western government has been willing to suggest benefit cuts to a politically popular program as its costs increase in the face of population aging and worsening mental health conditions.

Russia: In a speech last week, President Putin said his government is exploring options for hiking taxes on wealthy companies and individuals. According to Putin, the aim is to make the tax system more progressive, with richer taxpayers obliged to pay a higher rate to fund social programs and channel more resources to the poor. Such a move would also disproportionately hit taxpayers in the rich, vibrant, liberal-leaning cities of Moscow and St. Petersburg, basically forcing them to pay more to support Russia’s expensive invasion of Ukraine.

- Sources say the government is considering hiking the top corporate income-tax rate to 25% from its current rate of 20%.

- For the individual income tax, the government is mulling a boost in the top rate to 20%, versus 15% today, for those with incomes over about $54,300 per year and an increase to 15% from 13% for those with incomes over about $10,860. Individuals with incomes below that level would continue to enjoy the flat 13% rate put into place early in Putin’s reign.

China-European Union: As China continues to boost its electric vehicle industry, leading to excess capacity and surging exports of ultra-low cost Chinese EVs, new research from the Rhodium Group suggests the EU would have to impose tariffs of about 50% to stem the tide and protect domestic EU producers. The report comes as Brussels continues its formal investigation into possible unfair dumping by Chinese EV firms.

- The dumping probe is widely expected to confirm that Chinese EV makers are exporting to the EU at subsidized, unfairly low prices. According to Rhodium, EU policymakers are likely to respond by imposing anti-dumping tariffs of 15% to 30%, despite the risk of angering Beijing and potentially prompting it to retaliate against European exports.

- Nevertheless, the Rhodium analysts believe many Chinese EV makers would still earn a comfortable profit at the EU’s contemplated tariffs. The analysis suggests it would take tariffs of 50% or even more to make the EU market unattractive to Chinese producers.

- Of course, tariffs that high would be even more likely to anger Beijing and prompt retaliation against the EU. All the same, now that EU leaders have joined US leaders in realizing that Chinese dumping could be a mortal threat to their domestic industries, the EU is becoming increasingly aggressive in erecting barriers to Chinese trade.

China-United States: Admiral John Aquilino, the outgoing commander of all US military forces in the Indo-Pacific, has warned that China is pursuing a “boiling frog” strategy in the region. In Aquilino’s analysis, Beijing is actively boosting its military strength and adopting more aggressive military behavior in the Indo-Pacific, but it is doing it so gradually that the US and its allies may not see the danger until it’s too late to reverse it.

- Aquilino’s analysis, which is consistent with our view of Chinese strategy, points to even more tensions or a potential crisis in the region in the future.

- As we often warn, the spiral of tensions and the potential for a future crisis will produce continued risks for investors going forward.

US Monetary Policy: The Fed holds its latest policy meeting starting tomorrow, with its decision due at 2:00 PM EDT on Wednesday. Given the continued momentum in US economic growth and persistent price pressures, the policymakers are widely expected to hold the benchmark fed funds interest-rate target unchanged at a range of 5.25% to 5.50%. Indeed, interest-rate futures trading suggests investors now expect the first rate cut — and potentially the only rate cut this year — to come around the end of summer.

- As noted above, continued high interest rates will likely put stress on certain banks, commercial real estate owners, and other players in the financial markets.

- Despite the economy’s current positive momentum, high interest rates probably remain a risk for the economy and financial markets.

US Electric Vehicle Industry: Tesla has reportedly won Beijing’s tentative approval to release its “full self-driving” software in vehicles sold in China. The company’s FSD software is considered key to reigniting its sales growth in major markets, so the news has boosted Tesla’s stock price by approximately 11% in pre-market trading. Nevertheless, given the Chinese government’s massive support for domestic EV makers, we suspect that excess capacity and falling prices will remain a big challenge for Tesla.