Daily Comment (May 3, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are higher as a relatively weak jobs report has reaffirmed hopes for Fed easing. In sports news, the New York Knicks edged out the Philadelphia 76ers in a thrilling playoff victory! Today’s Comment dissects how big tech companies are increasingly prioritizing shareholder rewards, explores the impact of the Federal Reserve’s policies on central banks worldwide, and examines the potential hurdles that upcoming local elections pose for UK Prime Minister Rishi Sunak. To wrap things up, we provide a comprehensive overview of key international and domestic data releases.

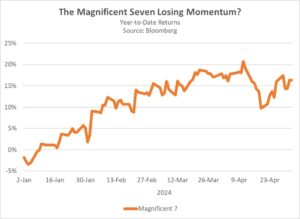

Big Tech Brings Value: Apple becomes the third company in the “Magnificent 7” to return capital to investors this year, a move that might signal a trend.

- Apple made a splash on Thursday by announcing a record-breaking $110 billion share buyback program, surpassing its previous high set six years ago. The company further emphasized its financial strength by raising its quarterly dividend for the 12th consecutive year. Before the announcement, investor concerns ran high due to anticipated disappointing sales figures stemming from the recent decline in iPhone market share in China, a crucial market for the company. However, the company was not only able to beat estimates, but it also expects to return to growth in the current period.

- Following Meta and Alphabet’s inaugural dividends this year, Apple’s decision further underscores a growing focus on shareholder returns among the tech giants. Fueled by investor expectations of high future growth, these companies have channeled significant resources into burgeoning areas like virtual reality, electric vehicles, and artificial intelligence, albeit with mixed results. This move to reward investors is likely a way of signaling strength even as the company looks to meet its lofty valuation and comes at a time of rising speculation that big tech stocks may be nearing their peak valuations.

- In a higher interest rate environment, value stocks tend to outperform growth stocks. This is because value stocks, trading at lower valuations (e.g., price-to-earnings ratio), offer more attractive current cash flows compared to the higher cost of borrowing. While buybacks and dividends from the big tech companies signal financial strength and the ability to return capital, this strategy is probably not sustainable for all companies in the sector, especially those prioritizing reinvestment for future growth. Investors will likely remain interested in the long-term potential of big tech, but they will also be looking for continued growth to justify valuations.

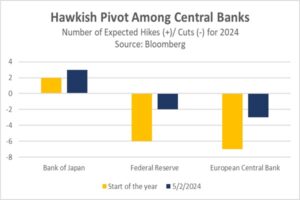

No Fear, Powell is Here: Central banks are growing more confident in maintaining a relatively accommodative policy stance this year, buoyed by Federal Reserve Chair Jerome Powell’s dovish signals on interest rates.

- A day after Powell’s dovish comments on Wednesday, ECB Governing Council member Yannis Stournas offered a glimpse into the bank’s evolving plan. In a recent interview with the Greek media site Liberal, he indicated the ECB might institute three rate cuts this year, revising down prior expectations of four. This revision suggests European policymakers, despite concerns about future inflation, appear confident in their ability to navigate an easing cycle. Additionally, the Bank of Japan’s efforts to prop up the yen on Thursday signal its reluctance to use monetary policy to combat currency weakness.

- Recently, strong economic data in the US has caused the Fed to dampen market enthusiasm for rate cuts. Expectations peaked at six cuts in January and have dwindled to just two as of this Thursday. This shift in sentiment has strengthened the US dollar against its peers, raising concerns about whether other central banks with more accommodative policies can hold their ground. As a result, expectations for ECB rate cuts have fallen from seven to three, while the BOJ is now anticipated to hike rates three times, up from previous estimates of two.

- Despite holding off on interest rate hikes in 2024 so far, central banks could find themselves constrained in their ability to cut rates aggressively. Premature rate cuts in the US could undermine the Fed’s fight against inflation, a risk that makes policymakers hesitant to commit. This hesitancy extends to economies like Japan and the eurozone, which rely heavily on dollar-denominated energy imports. Easing monetary policy in these regions could exacerbate inflation due to weakening exchange rates. Therefore, investors should brace for the possibility of tighter global financial conditions driven, in part, by US monetary policy.

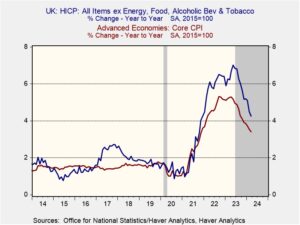

Tories in Trouble: The UK’s Conservative Party suffered significant losses in local elections, signaling potential challenges ahead for them in upcoming general elections.

- Early reports indicate the Conservative Party has lost over 120 seats as of the time of this writing. This setback is worse than anticipated and fuels speculation the party is losing ground to the rival Labour Party. The poor performance reflects public desire for change as evidenced by national polls that showed the Conservative Party trailing Labour over the last 18 months. UK Prime Minister Rishi Sunak faces mounting pressure to schedule general elections, although he’s not legally required to do so until January 2025.

- Since taking office, Sunak has struggled to fulfill his economic promises, which include halving inflation, growing the economy, reducing debt, cutting hospital waitlists, and moderating immigration. While inflation shows signs of approaching the target rate of 2%, price pressures remain high compared to other countries. This is compounded by a 1.2% GDP contraction in the first quarter of this year. Additionally, public debt as a share of GDP has grown since he took office, and long wait times for medical care continue to be a significant concern. However, he did address immigration problems with the passage of legislation allowing asylum-seeker transfers to Rwanda.

- One concern is the potential for the UK to resemble the recent political instability of Italy. If local indicators accurately reflect public opinion, the UK is on track to have its sixth prime minister in eight years since Brexit. This would be a significant change as the country only saw the same number in the previous 40 years. The lack of consistency in leadership is a concern for investors as it makes it hard to push the country in a single direction. As a result, we believe the country may be relatively risky as a long-term investment.

In Other News: Germany’s rebuke of Russia for cyberattacks targeting a political party provides evidence of a worsening relationship between Europe and Russia. In a twist of irony, Boris Johnson faced difficulty voting in local elections after reportedly failing to provide the proper identification mandated by legislation that he championed and helped pass.