Daily Comment (September 8, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] This morning’s big news is the ECB’s decision to leave policy unchanged. The EUR rallied, Treasuries dipped and Eurozone yields rose as well. We are well into Draghi’s press conference at the time of this writing and it is evident that the ECB did nothing at this meeting. Draghi did indicate that the ECB is ready to act and has the capacity to do so if necessary, but did not believe it was necessary at this meeting. We suspect, and think this is the market’s take as well, that Draghi could not convince the rest of the committee to take steps to add new accommodation. With QE set to end in March 2017 (although the ECB has indicated it could extend the program), there are worries that ECB stimulus may be coming to a close. Equity markets have turned lower in Europe and U.S. equity futures have also moved modestly lower.

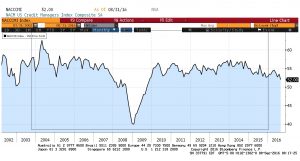

One of the lesser followed indicators we monitor is the National Credit Managers Index. The index measures the health of corporate credit—everything from the demand for borrowing to the recoveries on bad debt. The group noted that sales fell 6.3 points, from 60.0 to 53.7, consistent with the weak data seen in the PMI data.

This chart shows the composite index. It should be read like the PMI data; 50 is the expansion/contraction line. The current reading is the lowest since 2009 and it has been falling since Q2. Note that in 2008, the index hovered around 50 only to plunge under 50 as the financial crisis emerged. Although the data does not have a long history, the trend we are seeing is a worry.

We haven’t commented on the tax situation between the EU, Ireland and Apple (AAPL, 108.36), although we are gathering information on the issue. However, we do note that Sen. Elizabeth Warren (D-MA) has an editorial in today’s NYT in which she is critical of the tech giant and of corporate tax policy, in general. Economists tend to believe that corporate taxes are a bad idea—the incidence of the tax tends to fall on households anyway through higher product prices. Clearly, the more competitive the industry, the less those firms can pass the tax on to their products. But, for unique products and concentrated industries, the tax incidence tends to fall on households. However, that knowledge doesn’t stop Warren from calling for higher taxes on corporations. That she would take that position isn’t really news. What is interesting to us is the target of her wrath, Apple. Her party has received significant support from the tech sector and most of the commentary we have seen from Washington has been critical of the EU. This is the second time we have noted that Warren has attacked the tech sector, suggesting that the Sanders/Warren wing of the party holds significantly different positions from the current leadership of the Democratic Party.

Although Portugal has fallen from the headlines, today’s FT notes that structural adjustments have not been addressed in the 30 months since the last crisis. There are growing worries that a second bailout may be necessary. The current Socialist government holds a minority and remains in office only due to the tacit support of hard-left parties. If the current government falls, and creditors become nervous, a credit crisis originating in Portugal is possible. If it coincides with the upcoming Italian referendum next month, the potential for another Eurozone crisis will rise.

We want to update comments we made earlier this week regarding Venezuela. We noted earlier that Citibank (C, 47.48) had resigned as pay agent for PDVSA bonds. We speculated that if no other bank took the role, it might increase the likelihood of default. Our report that Citibank has resigned from its role is true. However, according to the terms of the agreement, Citibank can resign but cannot stop performing the role until another pay agent is appointed. Thus, PDVSA will have a pay agent for the foreseeable future and it will be Citibank, because it is highly unlikely that anyone else will want the job.

Russian President Putin withdrew support for a batch of new security laws, called the “Spring Package.” The new rules are very strict, essentially ending free speech, severely restricting foreign NGOs and curtailing social media. With parliamentary elections on September 18th and presidential elections in March 2018, Putin is caught between worries about unrest stemming from a weak economy, prompting the new security rules, and growing unpopularity due to the security measures themselves.