Daily Comment (May 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start as investors welcome signs of an economic slowdown. In sports news, the Cleveland Cavaliers scored an upset victory over the Boston Celtics last night. Today’s Comment explores how decisions by foreign central banks to cut rates before the US Fed will influence the dollar’s strength. We also explain how recent changes to money market redemption rules will affect bond yields. Finally, the report explores the specific difficulties Canada is facing with immigration. As always, our report concludes with a summary of recent international and domestic data releases.

Lead from Behind: Most central banks in the West are set to cut policy rates this summer, while US monetary policy remains in limbo.

- Central banks around the world are signaling a shift toward looser monetary policy. This week, the Bank of England joined the Bank of Canada and the European Central Bank in hinting at potential interest rate reductions in June. These follow the Swiss National Bank’s recent rate cut, with further easing expected from it this year. In contrast, the Federal Reserve in the United States is on a different path. It is expected to hold rates steady at least until September, with most market participants anticipating cuts only later in the year, likely November or December.

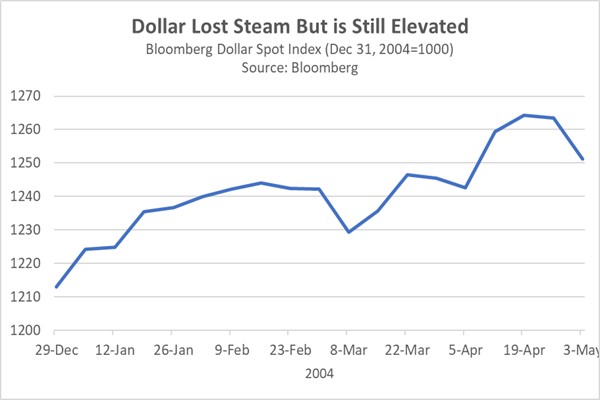

- A Federal Reserve which is hawkish compared to its global counterparts could buoy the dollar, particularly given the robust growth of the US economy. In 2023, GDP growth in the US accelerated to its fastest pace in two years, while the eurozone and UK economies stagnated. This strong performance has attracted investors to the dollar, especially as the Fed signaled a more cautious approach to potential interest rate cuts earlier in March. If this trend holds, the dollar’s strength against other currencies could accelerate, especially if Fed officials continue hinting at the possibility of holding rates steady or even raising them by the end of 2024.

- Nevertheless, there is still a good chance that the dollar’s rise will face some resistance. Despite the Fed likely holding off on rate cuts in June, tapering quantitative tightening could ease financial pressures and lower Treasury yields. This would narrow the interest rate differential for longer-term government bonds compared to other countries. Additionally, recent data suggests a potential slowdown in US GDP growth, while some peer economies appear to be gaining momentum. As a result, the divergence between interest rate and growth may narrow later this year.

Regulatory Shift: New SEC guidelines may help the government resolve some of its Treasury supply problems.

- In 2023, the SEC implemented new rules requiring liquidity fees for investors redeeming shares from certain money market funds during periods of financial stress. This regulation aims to prevent a repeat of the liquidity issues seen in March 2020 and will take effect in October of this year. To avoid these fees, some money managers are exploring strategies to navigate the rules, while others have chosen to close their funds altogether. The new regulations are expected to impact roughly $6 trillion in money market fund assets and will likely have some spillover effect into the fixed-income market.

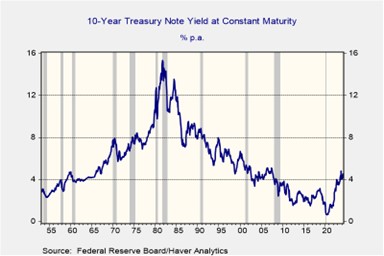

- This rule change arrives at a critical juncture, coinciding with rising fiscal debt and a hawkish monetary policy stance. Money market funds have surged in popularity as investors seek to capitalize on both the potential for higher short-term interest rates and daily redemptions. However, with fees now attached to withdrawing funds during times of market stress, institutional investors may be forced to park more of their money at the Fed overnight facilities. This shift should allow the Treasury to tap into additional funds as it seeks to finance government expenditures.

- The recent market rule change for money market funds, coupled with the observed market reaction, suggests the government may be seeking to cultivate banks and institutional investors as a primary source of demand for government debt. This shift in dynamics implies that lawmakers might be strategically using regulations to maintain the attractiveness of bonds, particularly as government issuance is expected to increase over time. If this is the case, it could help the government control yields, particularly as it prioritizes short-term debt issuance. Theoretically, this approach could help mitigate the overall rise in government borrowing costs, which should improve financial conditions.

Build It, They Will Come: A Canadian solution to its demographic problem has mixed results as the government looks for a middle ground.

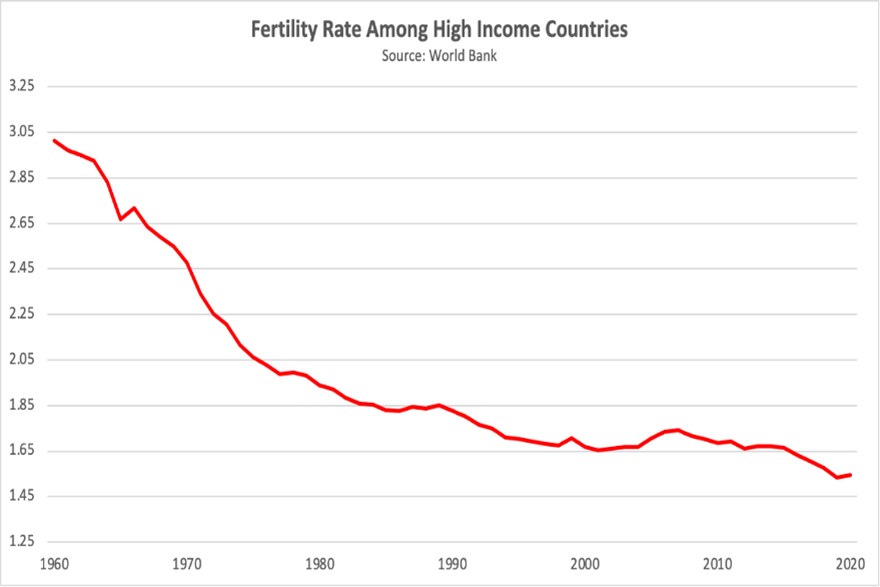

- This year, Canada is adjusting its immigration approach to address strains on social services and housing. The government is taking steps to manage immigration levels by limiting student visas, reducing admissions of temporary foreign workers, and capping the number of permanent residents. This shift marks a change from Canada’s previous focus on attracting immigrants to offset its demographic challenges caused by an aging population and low birth rates. Notably, immigration fueled a significant portion of Canada’s population growth in 2023, with nearly 98% of the 3.2% increase coming from newcomers.

- Despite recent adjustments to its immigration policy, Canada’s focus on attracting skilled workers has yielded positive results. Immigration in the first quarter of 2024 significantly boosted the workforce in skilled trades, with 13 occupations seeing their numbers double the average of the previous year. This influx of skilled labor has helped address the shortage of construction workers, a crucial factor in Canada’s plans to ramp up residential construction and tackle the housing shortage. The Royal Bank of Canada predicts that it will need an additional 500,000 workers by 2030 to help balance the housing market.

- Canada’s recent adjustments to its immigration policy highlight the demographic challenges facing many developed nations. Strict immigration policies, coupled with low birth rates, could strain government finances in the future. As a result, repaying the debt might necessitate unpopular measures like austerity or higher taxes. To address these challenges, governments might explore coordinated monetary policies. However, this approach could lead to unintended consequences like inflation or lower consumption. The market environment has generally benefited commodity assets as investors look to real goods during times of uncertainty.

In Other News: President Biden is preparing to impose tariffs on Chinese EVs as he seeks to prevent Beijing from dumping its overcapacity into the US. Separately, Israeli Prime Minister Benjamin Netanyahu has vowed that his country is willing to stand alone as it looks to defend itself from Hamas.