Daily Comment (May 15, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities futures are off to a great start as the consumer price index ended its streak of disappointments. In sports news, the Denver Nuggets took a commanding 3-2 lead in their series against the Minnesota Timberwolves. Today’s Comment will explain why leaving rates unchanged was seen as bullish for investors on Tuesday, why young investors are drawn to risk assets, and why Turkey wants to restore trust that it can contain inflation. As usual, the report includes a summary of international and domestic data releases.

Fed Remains Calm: Federal Reserve Chair Jerome Powell has ruled out the possibility of a hike even as inflation continues to disappoint.

- The head of the Federal Reserve reiterated that inflation remains too high for the central bank to consider cutting rates in the near future. Speaking at the Foreign Bankers’ Association, he acknowledged that disinflation, initially expected this year, hasn’t progressed toward the central bank’s 2% target. However, he surprised markets by indicating that the Fed’s next move wouldn’t be an interest rate hike. Instead, he emphasized the Fed will likely hold rates steady while the effects of current policy restrictions work their way through the economy. This downplaying of future monetary tightening boosted market sentiment, as investors continue to price in two rate cuts starting in September.

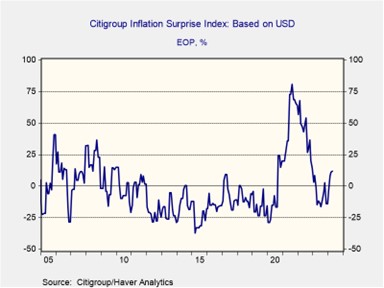

- Powell’s comments coincide with the release of a hotter-than-expected producer price index (PPI). The index for input costs rose 0.5% in April, exceeding expectations of a 0.2% increase. Despite the concerning reading, the data offered a glimmer of hope. A downward revision of the previous month’s number, from a 0.2% increase to a 0.1% decline, tempered the impact of the hot report. Additionally, the components feeding directly into the PCE price index, the Fed’s preferred inflation gauge, showed a mixed bag, suggesting consumer inflation may still align with forecasts.

- Even with Powell downplaying the possibility of a rate hike, the threat remains significant. Historically, the Fed has tended to manage market expectations; thus, consistent inflation readings exceeding investor forecasts could force them to act. A positive sign is that core PCE has largely met market expectations and may still fall within the range of the 2.5% terminal rate outlined in the Fed’s summary of economic projections. So far, our worst-case scenario is no rate change at all this year. However, if inflation continues to run hot, we may revise our forecast to include a possible hike at the beginning of 2025.

Meme Rally Back: In an attempt to close the wealth gap with other generations, some younger investors may be turning to riskier assets in hopes of higher returns.

- The return of Roaring Kitty has led to another frenzy in the markets. The social media icon helped lead a charge of retail investors to squeeze hedge funds looking to profit from shorts. He has become a cult figure following the GameStop fiasco and the movie documenting it called Dumb Money. This return has led investors to flock to GameStop and AMC, with those stock prices each rising 30% on Tuesday. Despite the attractive yields offered by traditionally safe assets like Treasurys, Roaring Kitty’s return highlights that risk appetite remains relatively high among investors.

- Limited savings, coupled with rising interest rates and home prices, may be pushing some investors, particularly millennials, towards riskier assets. The stock market appears to be an attractive option for faster financial growth, since it offers an alternative to traditional homeownership, which has become increasingly difficult to achieve for millennials. Supporting this trend, a 2023 National Association of Realtors survey shows the average first-time homebuyer is 35, while a World Economic Forum survey reveals that 70% of retail investors are under 45. Thus, preference for risk assets may be a generational trend.

- While Roaring Kitty’s return might be a temporary market ripple, his influence highlights the ongoing investor appetite for stocks as a store of value. The lack of savings suggests younger generations may be more willing to take on risk to build their retirement funds. This could lead to less sophisticated investors having a greater impact on market prices compared to in the past. While strong fundamentals remain the key to sustainable growth, investors should be aware that bubbles may still form even in a rising interest rate environment.

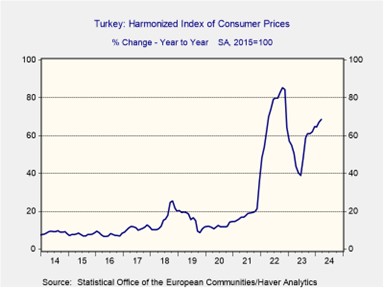

Turkey’s Inflation Fight: The country is looking for ways to win back investor confidence as it tackles surging inflation.

- On Tuesday, Turkish Finance Minister Mehmet Şimşek hinted that the government may be willing to implement tough fiscal measures to restore price stability. During an interview at the Qatar Economic Forum, he implied that President Recep Tayyip Erdoğan may be willing to tolerate slower growth as he looks to place the Turkish economy on a sustainable path. His comments come a day after investors shrugged off the government’s announcement of a series of cuts to public spending of about 100 billion liras (TRY) ($3.1 billion) over the next three years. The response was due to doubts that the government would tolerate such a hit to its economy.

- The country’s move to rein in its deficit stems from a decision to return to conventional economic policy. In the past, Erdoğan dismissed the idea that lower interest rates could bolster inflation, suggesting it might actually have the opposite effect. His logic hinged on the notion that higher rates would put more money in the hands of government bondholders, potentially leading to increased spending. To ensure that policymakers would follow his direction, he sacked and replaced the members of the central bank to get the policy that he desired. As a result, the annual change in inflation that year accelerated from 36% to over 80%, leading to a significant depreciation of the TRY.

- Despite concerns over inflation, Turkey continues to boast one of the world’s best-performing stock markets. The MSCI Share Price Index for Turkey is up nearly 40% year-over-year. The rally has been driven by investors seeking to protect their cash holdings from debasement, leading them to invest in stocks. However, this doesn’t necessarily mean that containing inflation won’t have benefits. Foreign investors still believe there may be opportunities if the country can get its fiscal house in order. As a result, it may be worth keeping an eye on Turkey as it may still have a lot of upside.

In Other News: The US announced additional funding for Ukraine in a sign that the war is likely to continue for the foreseeable future. Additionally, there is speculation that China may allow local governments to enter the housing market by purchasing homes, in a bid to reverse the country’s property slump. President Biden is set to provide $1 billion in new arm sales to Israel, as tensions between him and Israeli Prime Minister Benjamin Netanyahu deepen.