Daily Comment (May 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a potentially incendiary revelation that the US and UK have intelligence showing China is now sending, or preparing to send, lethal aid to Russia for its invasion of Ukraine. We next review several other international and US developments with the potential to affect the financial markets today, including signs of stickier-than-expected consumer price inflation in the UK and a couple of notes on the US financial markets.

China-Russia: At a defense conference in London today, British Defense Secretary Shapps said new US and UK intelligence shows that China is currently sending, or will soon be sending, lethal aid to Russia for its invasion of Ukraine. Shapps said the new intelligence shows that China and Russia have recently developed what he called a “deeper relationship.” This report comes just a week after Russian President Putin visited Chinese General Secretary Xi in Beijing, and as the two are planning another meeting this summer.

- The revelation by Shapps is potentially incendiary. US and other Western leaders have repeatedly warned Beijing not to provide lethal aid to Russia for its illegal invasion of Ukraine. Leaders in Washington have warned that the US would impose sanctions directly on China if it provided such aid to the Kremlin.

- As a reminder, our objective, quantitatively driven methodology for classifying countries by geopolitical bloc places Russia squarely in the China-led camp. More generally, we see Russia as the junior partner in that camp, which explains why we often refer to it as the “China/Russia bloc.” If China has now decided to accept the geopolitical and economic risk of providing lethal aid to Russia despite Western warnings, it suggests the relationship really has deepened, as Shapps suggests.

- Going forward, the new intelligence could potentially force Western leaders to live up to their warnings against Beijing. If that leads to substantial sanctions directly on China, then the current spiral of tensions between the West and China would likely worsen, creating further risks for the global economy and investors.

United Kingdom-Hong Kong-China: A former Royal Marine and UK immigration official who had been arrested for spying for Hong Kong was found dead in a park west of London. The incident is likely to spark concern that China, through its Hong Kong operatives, is working to silence Westerners who have been coopted to work for its intelligence services. Such concern would heighten the existing tensions between the US and China/Russian geopolitical blocs.

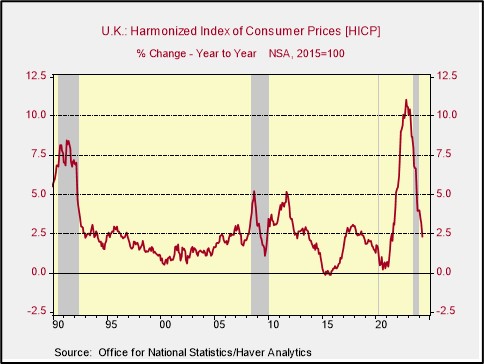

United Kingdom: The April consumer price index was up just 2.3% from the same month one year earlier, after increases of 3.2% in the year to March and 3.4% in the year to February. Consumer price inflation in the UK is now well below its cycle peak of 11.1% in October 2022. Nevertheless, the slowdown in April wasn’t quite as dramatic as investors were expecting. The data has therefore reduced expectations that the Bank of England could cut interest rates at its June policy meeting.

France: President Macron has embarked on an emergency trip to France’s overseas territory of New Caledonia, an island some 900 miles northeast of Australia, to help quell the rioting touched off by a new French law, which gives nonindigenous citizens in the territory more voting rights. Importantly, the unrest is threatening Macron’s vision of leveraging New Caledonia’s vast nickel supplies to make Europe a leader in green technologies.

Israel: The Israeli government today recalled its ambassadors to Ireland, Spain, and Norway over the trio’s plan to formally recognize a Palestinian state effective May 28. Several other European countries have recognized a Palestinian state for years, but the move by Ireland, Spain, and Norway appears to have touched a nerve in Tel Aviv amid growing international criticism of Israel over its war against Hamas in the Gaza Strip.

- Of course, Israeli leaders are also angry about an International Criminal Court (ICC) prosecutor’s recent request for arrest warrants for Israeli and Hamas leaders over their conduct in the conflict.

- Reflecting the US’s largely bipartisan support for Israel, Secretary of State Blinken yesterday said the Biden administration will work with Congress to craft sanctions on the ICC to punish it for the prosecutor’s call to arrest the Israeli leaders.

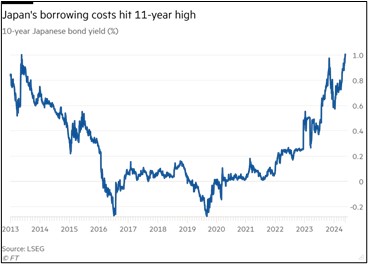

Japan: As investors increasingly expect the Bank of Japan (BOJ) to further tighten monetary policy, the yield on 10-year Japanese government bonds (JGB) rose above 1% today for the first time in 11 years. The most recent leg up in yields began on May 13, when the BOJ surprised investors by buying a smaller-than-expected amount of 5-year and 10-year JGBs.

- Despite the rise in 10-year yields, however, the yen (JPY) has continued to weaken.

- The currency is trading down 0.25% to 156.57 per dollar ($0.0064) so far this morning.

US Stock Market: One key event for the stock market today will be Nvidia’s earnings release, due shortly after market close. Given that Nvidia and other artificial-intelligence darlings have been key drivers of the overall stock indexes recently, anticipation of the release could have a significant impact on trading today.

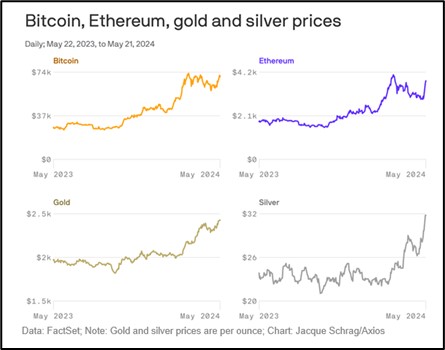

US Commodity Markets: In another note on the financial markets, we’ve noticed that there’s a new acronym being used to describe a fast-rising appreciating set of assets. The new acronym, BEGS, refers to Bitcoin, Ethereum, Gold, and Silver. The common threat in these assets is that they have no associated cash flow, so they should in theory be struggling against today’s high interest rates.

- For bitcoin and Ethereum, it appears that their recent upward trajectory mostly reflects expectations of more cryptocurrency deregulation.

- For gold and silver, the upward momentum reflects rising geopolitical tensions and strong buying by Chinese central bankers and consumers.