Daily Comment (May 30, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures, though down overall, edged higher ahead of the opening bell as downward revisions to GDP data fueled optimism about a potential policy shift by the Federal Reserve. In sports news, the Edmonton Oilers were able to keep their NHL championship hopes alive by defeating the Dallas Stars on Wednesday. Today’s Comment will discuss the latest Beige Book and how it might impact Fed policy, why housing markets are showing early signs of troubles, and our opinion about elections in South Africa. As usual, our report will conclude with a roundup of domestic and international data releases.

Bad News on the Ground: The Federal Reserve’s latest survey of its 12 districts points to a slowing economy.

- The U.S. economy saw continued slow growth in early April to mid-May according to the Federal Reserve’s Beige Book. While most regions reported slight to modest expansion, some sectors showed signs of weakness. Auto sales were a particular concern, with dealerships resorting to adding more incentives to move cars. Additionally, there was a notable slowdown in hiring with the survey showing a modest increase in employment and firms reporting that they are finding it easier to fill positions. This suggests that demand is slowing, and the labor market is cooling down.

- This report is unlikely to sway policymakers to cut rates, but it should dissuade members from pushing for a rate hike. Economic data continues to show that the economy is growing at a stable pace. The latest consumer confidence report rebounded from April as households expressed more optimism about the economy, even as they worry more about rising prices. Similarly, the May Purchasing Manager Index (PMI) by S&P Global showed that output picked up in May, with services activity experiencing its best month in a year. However, the Beige Book suggests the recent slowdown in hiring and the weak Q1 GDP number might not be temporary.

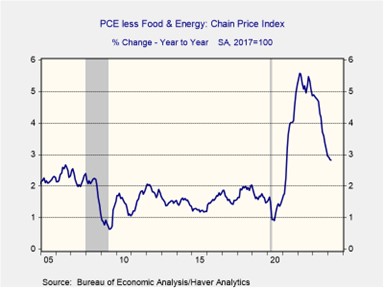

- This Friday’s PCE price index, the Fed’s preferred inflation gauge, is a critical indicator of progress towards its 2% target. Markets anticipate that the core index will hold steady at 0.3% growth from March and 2.8% year-over-year. A higher-than-expected reading could push back investor hopes for a rate cut to September or later. Conversely, a softer inflation reading could keep a July rate cut on the table. While we remain optimistic about one to two rate cuts this year if inflation meets the Fed’s 2.6% year-end projection, the possibility of no cuts is becoming increasingly likely.

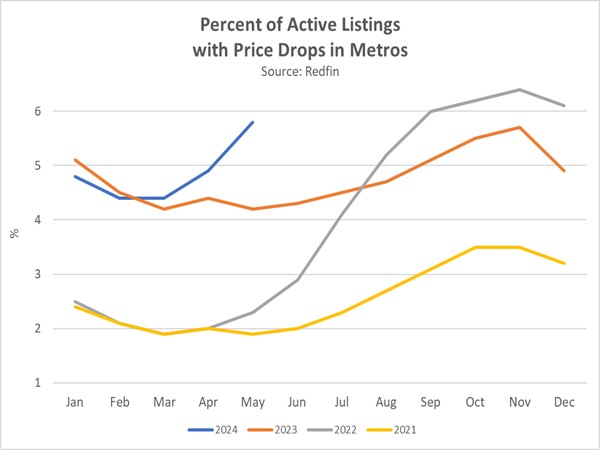

A Cool Summer: The supply of homes is starting to increase, but it appears that potential buyers are reluctant to purchase.

- Redfin data reveals a sharp increase in the number of US home sellers slashing prices to attract buyers. Nearly 6% of listings have undergone price cuts within just 12 weeks of hitting the market, a significant rise heading into the traditionally hot summer season — a time typically known for a surge in buyer demand. This data adds to growing evidence that the housing market may be losing momentum. Last week, the National Association of Realtors reported that existing home sales in April fell 1.9% year-over-year, despite expectations of a slight increase and an uptick in supply.

- Rising interest rates appear to be finally hitting the residential real estate market, as evidenced by the recent slowdown in demand. Homeowners, who locked in historically low rates during the pandemic, have been reluctant to sell. However, this trend may shift as new buyers face significantly higher borrowing costs. This could be especially impactful for a small group of homeowners who chose adjustable-rate mortgages during that period. According to a Bloomberg report, these homeowners could see a sharp rise in their monthly payments in the coming months, potentially contributing to current market headwinds.

- The surge in home-price drops presents a double-edged sword for the economy. While it’s welcome news for potential buyers and could lead to lower shelter price inflation (particularly rents and owner-equivalent rent), it might also dampen consumer confidence. Homeownership often represents a significant portion of a household’s wealth. Falling home prices could erode this wealth, especially for those without a diversified investment portfolio. As a result of this wealth effect, consumers may start to delay major purchases like cars or appliances and look to rebuild their savings first instead.

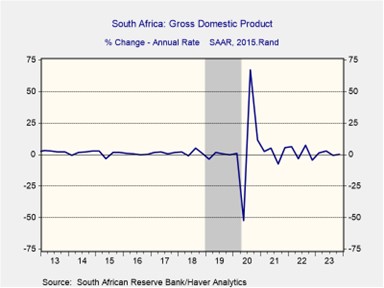

South African Sea Change: This week’s election is expected to see the ruling African National Congress (ANC) party lose its majority for the first time in 30 years.

- While the party is still expected to win the most seats, early results show that the ANC is slated to receive 42.5% of the vote. The opposition Democratic Alliance (DA) party should receive 26% of vote and the far-left Economic Freedom Fighters (EFF) will collect 8.4%. The official results won’t be known for several days but must be released within a week by law. If confirmed, the ANC will be forced to form a coalition government in order to maintain control, potentially requiring them to make compromises to their platform, which could lead to political infighting.

- This year’s election saw a large turnout, as voters looked to register their displeasure with the status quo. The country’s job market faces a significant challenge, with unemployment rising to 32.8% in the first quarter. While this is an improvement from the pandemic peak of 35%, it remains considerably higher than the pre-COVID level of 28%. Adding to the economic woes, the country is grappling with persistent power outages due to insufficient supply of electricity. To manage the strain on the power grid, the government has implemented load shedding. While this measure has been effective in reducing the load, it has also negatively impacted economic activity.

- Despite the ANC maintaining a strong plurality of seats following the election, there is still much political uncertainty. If the results hover around 40% of the vote, party members might seek to replace President Cyril Ramaphosa. Additionally, the rise of the controversial EFF could pose problems for investors. The party’s leader, Julius Malema, might leverage his influence for a greater role in government. In the past, he has advocated for the nationalization of the country’s gold and platinum mines and the seizure of land from white farmers.

In Other News: Goldman Sachs continues to supply talent to the Federal Reserve System, with Beth Hammack set to replace Loretta Mester as the President of the Cleveland Fed. Other notable Goldman alumni include former New York Fed President William Dudley and current Minneapolis Fed President Neel Kashkari. A report revealed that NATO only has 5% of the defenses needed to protect its eastern flank, a sign that Western governments are likely to ramp up spending on security.