Daily Comment (June 3, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with notes on the global energy market. We next review several other international and US developments with the potential to affect the financial markets today, including a cut to France’s sovereign debt rating, election results in several key emerging markets, and another Federal Reserve policymaker’s statement suggesting US interest rates will remain high for an extended period.

Global Energy Market: The Organization of the Petroleum Exporting Countries and its Russian-led allies agreed to keep most of their current output cuts in place until late 2025, as they try to boost prices in the face of weak global demand and rising non-OPEC production. The cuts that will remain in place amount to more than three million barrels per day of potential output. With little change in production for now, the announcement has had almost no impact on the oil markets. So far today, Brent crude is trading virtually unchanged at $78.91 per barrel.

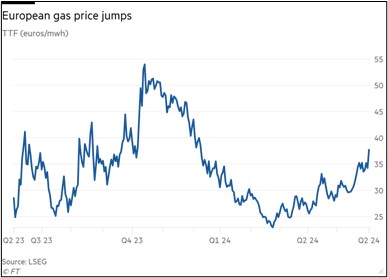

- Separately, European natural gas prices have surged some 13% so far today, following an outage at a Norwegian gas processing facility. Sources say the outage could eventually reduce Norway’s gas exports to Europe by about one-fifth.

- The outage is important because Norway has now become the single-largest supplier of gas to Europe, accounting for about 30% of the Continent’s total supply. The outage compounds other recent problems driving up European gas prices, such as a court ruling that could cut the remaining supplies of Russian gas through Austria and hot weather and high demand in Asia, which have diverted global supplies there.

France: On Friday, S&P cut France’s long-term sovereign credit rating from AA to AA-, with a stable outlook. According to S&P, the country’s weak economic growth is a key reason why it will be hard to cut its debt/GDP ratio in the coming years. The firm warned that political polarization will likely preclude passing economic reforms that could boost growth and/or reduce the budget deficit.

China-Australia: Based on national security concerns identified by its Foreign Investment Review Board, Canberra has ordered funds linked to a Chinese businessman to divest or cut their stakes in an Australian rare-earths miner. The move illustrates how growing frictions between China and the West continue to sever trade, capital, and technology flows around the world. The move could also anger Beijing and reverse the recent improvement in Chinese-Australian relations.

China: The private Caixin/S&P Global purchasing managers’ index for manufacturing rose to a seasonally adjusted 51.7 in May from 51.4 in April. That’s in contrast with the official PMI last week, which dropped to 49.5 from 50.4. Like most major PMIs, both these are designed so that readings over 50 indicate expanding activity. Since the index from Caixin/S&P Global puts a higher weight on smaller firms, its outperformance suggests that China’s smaller companies are now doing better than its bigger enterprises.

India: With official election results due out tomorrow, exit polls over the weekend showed the coalition led by Prime Minister Modi’s Hindu-nationalist Bharatiya Janata Party is on track to control at least 353 of the 543 seats in the lower house of parliament. If confirmed, the results would put Modi in a position to win a third consecutive term as the nation’s leader and continue his business-friendly economic policies, including strong infrastructure spending. That prospect has driven India’s stock market indexes up some 3.5% so far today.

South Africa: Official results from last week’s elections show the African National Congress has failed to garner a majority of votes for the first time since the end of apartheid in 1994. According to the results, the party won only about 40% of the votes, down from 58% in the 2019 elections, reflecting perceptions that it has become corrupt and arrogant. The ANC will therefore have less than a majority in parliament, forcing it to form a coalition with opposition lawmakers to form a government and potentially scaring off investors concerned about political stability.

Mexico: In elections yesterday, former Mexico City mayor and environmental scientist Claudia Sheinbaum of the ruling Morena party won the presidency with about 60% of the vote, although the final count isn’t expected until later today. It appears Morena will also have a two-thirds majority in the legislature, which would allow it to push through unfinished constitutional changes favored by outgoing President Andrés Manuel López Obrador.

- Those changes include moves to increase state control over the energy industry and weaken the electoral oversight agency.

- Faced with the prospect of continued leftist policies in Mexico, investors have driven down the value of Mexican stocks and the Mexican currency. So far today, the peso (MXN) is 2.4% weaker, trading at 17.4205 per dollar ($0.0574).

US Monetary Policy: In a podcast released today, Minneapolis FRB President Kashkari said the Fed should keep interest rates high for an “extended” period, given the current strength in the economy and Americans’ “visceral” aversion to consumer price inflation. The statement fits with many other recent statements by Fed policymakers indicating they are inclined to keep interest rates high for much longer than investors initially expected.

US Artificial Intelligence Industry: In a surprise move yesterday, Nvidia announced the next generation of its market leading AI processors, codenamed “Rubin,” just three months after announcing its previous generation, known as “Blackwell.” Amid concern about the energy consumed by Nvidia’s chips, the company noted that the Rubin processors have been designed to increase energy efficiency. Nvidia’s aggressive move and apparent success in innovating reduced energy consumption could well boost its stock price and the overall market today.

US Postal Service: The Postal Regulatory Commission late last week approved a five-cent hike in the price of a first-class stamp. Starting July 14, sending a first-class letter will cost $0.73, or 7.8% more than the current price. The price increase is the nineteenth since the year 2000, and the fifth in the last two years.