Daily Comment (June 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are off to a modest start as investors eye Friday’s jobs data. In sports news, the Lakers are looking at hiring UConn Coach Dan Hurley to take over the team. Today’s Comment explains the potential reasons other central banks may be waiting on the Federal Reserve before making future rate decisions. We also explore whether Nvidia can sustain its current momentum and discuss the implications of the disappointing election results for Modi’s new government. As always, our report will include a roundup of international and domestic data releases.

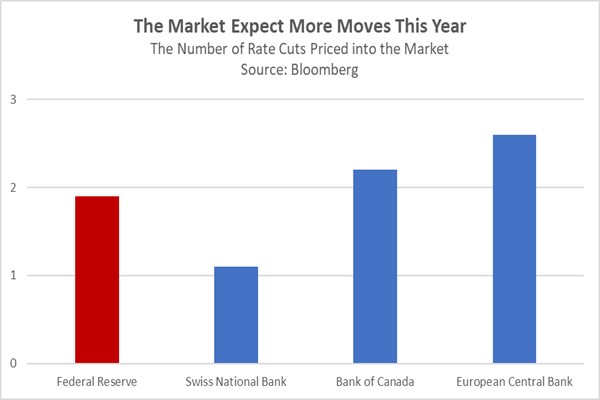

Rate Cuts in the West: Despite policy pivots by the European Central Bank (ECB) and Bank of Canada, the dollar’s strength against major currencies may persist in the near term as other central banks await Fed action.

- The ECB became the latest central bank to cut interest rates, lowering them for the first time since 2019. This move aims to stimulate the eurozone economy, which has seen a series of quarters with subpar growth. The ECB’s decision comes as annual inflation has dipped from a peak of nearly 6% in 2023 to under 3% a year later, suggesting a need to balance GDP growth and price stability. The ECB follows similar recent rate cuts by the Bank of Canada and the Swiss National Bank.

- Central banks are likely to tread carefully on further rate cuts despite the market’s positive reaction. A wider gap between their policy rates and the Fed’s rate could strengthen the dollar, making imports more expensive, especially for dollar-priced commodities. While there is optimism that the Fed might cut rates later this year, it’s far from certain. Before their blackout period, several Fed officials emphasized the need for more data before easing monetary policy. Adding to the complexity, the euro area is also experiencing a rise in price and wage pressures.

- Central bank flexibility hinges on the Fed’s ability to deliver on its planned rate cuts this year. Next Wednesday’s release of the Summary of Economic Projections will be a key indicator. Recent data weakness suggests a high likelihood of 1-2 cuts, aligning with market expectations. If the Fed delivers, other central banks are likely to follow suit with similar cuts to maintain parity, potentially easing pressure on the US dollar. However, a Fed decision to hold rates steady could see other banks stand pat, lending support to the dollar.

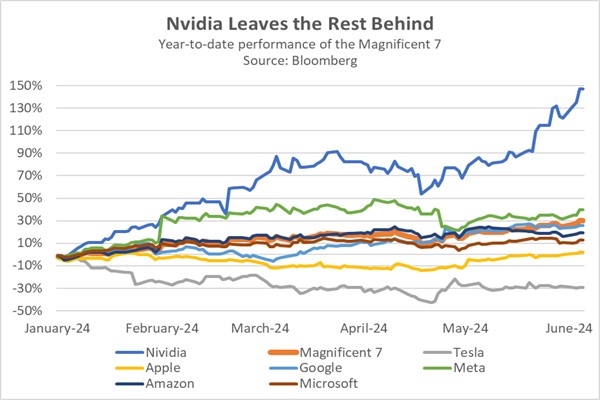

Nvidia Takes Over: The biggest mover of the Magnificent Seven is soaring, but its rapid rise could be masking a hidden weakness.

- So far in 2024, US chip designer Nvidia has surged to become the world’s second-most valuable company, boasting a market valuation exceeding $3 trillion and surpassing Apple. This remarkable rise follows a period of strong demand for their graphics processing units (GPU), particularly after the company strategically pivoted to develop advanced artificial intelligence (AI) capabilities. While Nvidia faces competition from Intel and AMD, its dominance in AI is undeniable. The company holds a staggering 70% to 95% market share for AI accelerators, solidifying its position as a leader in this rapidly growing field. This strategic shift toward AI has fueled consistent, impressive earnings reports, making Nvidia a major driver of growth within the S&P 500.

- Despite its dominance in AI and high-performance computing, some analysts view Nvidia’s valuation as riskier compared to the established Magnificent Seven tech giants. While the AI market holds immense potential, its relative youth raises questions about Nvidia’s long-term sustainability if the AI boom falters. Unlike its more diversified peers, it’s heavy reliance on AI could expose it to a significant correction if market demand cools. This lack of diversification is a familiar concern for companies reliant on a single hot trend. Tesla exemplifies this as their recent stock price decline has coincided with a slowdown in electric vehicle demand.

- Nvidia’s momentum could be amplified by its upcoming stock split on June 7. The lower share price might attract more retail investors, potentially mirroring past trends. Historically, Bank of America research suggests companies outperform the market over the next year (25% vs. 12%) following a stock split. However, it’s crucial to remember that past performance doesn’t guarantee future results. Investors should consider both Nvidia’s long-term prospects and its ability to meet current market expectations. Focusing on the company’s valuation fundamentals alongside short-term momentum can be a wise approach for building a well-rounded portfolio.

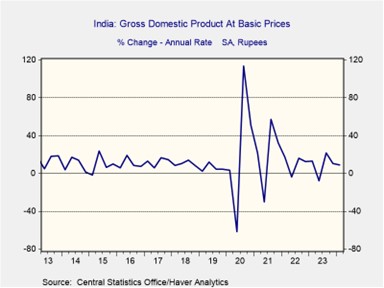

The New India: Prime Minister Narendra Modi failed to attain a demanding victory in the election, calling into question his longer-term ambitions.

- Modi was formally named the Prime Minister of India for the third consecutive time on Wednesday despite his party’s disappointing performance at the polls. The ruling Bharatiya Janata Party (BJP) won 240 out of the 543 seats in parliament, falling short of a majority and necessitating a coalition to maintain power. This result signifies a weaker mandate for Modi. Throughout his tenure, Modi has been a strong advocate for Hindu nationalism and has sought to amend the country’s secular constitution, a move that would require approval from two-thirds of the parliament.

- Modi’s hold on power, albeit with a reduced majority, has reassured investors by signaling continuity in market reforms. Throughout his tenure, Modi has set an ambitious agenda, aiming to propel India to developed nation status by 2047. In pursuit of this goal, his party has pushed pro-market reforms to enhance India’s attractiveness to investors and boost its overall competitiveness. He’s expected to leverage his new term to address labor and land regulations, which have faced significant resistance. Notably, farmer protests in 2022 forced the government to repeal three laws intended to deregulate the agricultural sector.

- One source of concern is that Modi, who is 73, is widely believed to be considering retirement in a couple of years. Although his party has downplayed this speculation, retiring at that age would be consistent with previous Indian leaders. His successor is widely expected to be his right-hand man, Amit Shah, whose views are highly nationalist. Given the likely negative impact Hindu nationalism had on the outcome of this election, the party could face significant challenges if Modi decides to step down. While optimism prevails due to recent reforms in India, we’ll be closely monitoring any political developments.

In Other News: The Federal Trade Commission has opened an investigation into the Microsoft AI deal, in another demonstration of the regulatory risks facing Big Tech. Boeing Starliner reached orbit in a sign that the company is looking to take on Musk’s SpaceX in the space race.