Daily Comment (June 7, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities futures are down after strong employment data suggests that the economy remains robust. In sports news, the US Cricket team was able to score an upset victory over top contender Pakistan as it prepares for the World Cup. Today’s Comment dives into the European Central Bank’s latest rate decision, the recent flight to safety in the 10-year Treasury, and the ongoing investor uncertainty surrounding elections. As always, we’ll wrap up with a look at key domestic and international data releases.

European Central Bank: The ECB decided to lower its benchmark policy rate on Thursday but was mum on future hikes until data provided support.

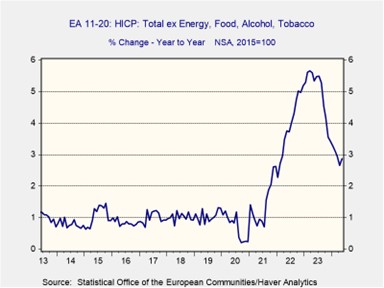

- The ECB lowered its key interest rate by 0.25% on Thursday, signaling a cautious approach to future reductions. The move was widely expected and followed weeks of hints from policymakers about their willingness to ease borrowing costs. While most council members supported the cut, there was one dissenter. Robert Holzmann, head of Austria’s central bank, believed the ECB acted too hastily given recent CPI data, which suggested a pick-up in price and wage pressures across the eurozone. Consequently, there’s uncertainty about whether another rate cut will occur this year.

- The central bank’s recent rate cut raises questions about the effectiveness of its tightening measures. Policymakers boosted inflation forecasts for 2024 and 2025 but held steady for 2026. The economic outlook has brightened with upwardly revised GDP for 2024 as the region recovers from the near recession of 2023. Despite a recent uptick in core CPI, which rose from 2.80% to 2.83% last month, the ECB remains confident that inflation will eventually decline. This confidence rests on its belief that the effects of past interest rate hikes are still filtering through the economy.

- The recent ECB rate cut could be a response to market pressures, following strong hints of a reduction in the weeks leading up to the meeting. This may lead the ECB to adopt a more cautious approach as they look to avoid boxing themselves in, or worse, be forced to make a U-turn to prevent a reacceleration in inflation. Wage pressures are in focus as they have been a key driver of service-sector inflation. However, leading economic indicators suggest a cooling labor market, potentially paving the way for one more cut later this year, as markets have anticipated. September or later seems to be the most likely timeframe.

US Treasurys: Subpar economic data has recently driven the yield on the 10-year Treasury to its lowest level in three months.

- US worker productivity rose by a modest 0.3% from the previous quarter, marking the slowest pace since early 2023. While exceeding expectations slightly, the increase reflects a broader slowdown in economic activity. This follows a string of concerning reports, particularly disappointing retail sales, job openings, and home prices. However, a glimmer of hope emerged in May. Both ISM and S&P Global PMI surveys reported a pick-up in service activity, while consumer confidence took a surprising leap. Despite these signs, the overall market sentiment leans toward slowing US GDP growth.

- Weak economic data is driving a dovish shift in investor sentiment. The 10-year Treasury yield has plunged nearly 30 bps in 10 days, reflecting hopes that the Fed can achieve a soft landing. Recent inflation reports, including April’s CPI and PCE price index, showed a welcome deceleration in price pressures, suggesting inflation may be nearing the Fed’s 2% target. In addition, labor’s share of economic output has fallen significantly from its peak of 59% to 55%, reaching its lowest level in almost a decade. This suggests that wage pressure on inflation should continue to subside over the next few months.

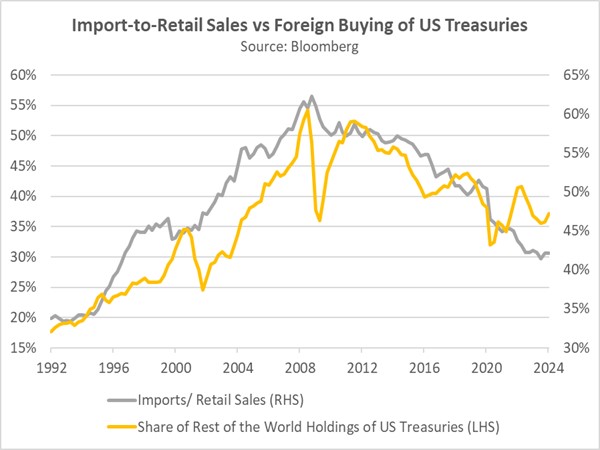

- The Federal Reserve’s policy undeniably shapes long-term bond yields. However, investors shouldn’t overlook the impact of geopolitical changes. Since the Great Financial Crisis, US foreign demand for Treasury bonds has fallen considerably. This loss represents a critical source of buyers who are less sensitive to interest rate fluctuations. Additionally, US reliance on imports, a major disinflationary force, has also been disrupted. Rising deficits coupled with growing trade tensions suggest a potential opportunity for investors to sell 10-year Treasurys before interest rates rise again.

Global Elections: At nearly the halfway point of the year, elections continue to present surprises, potentially causing trouble for investors.

- A notable trend has been the unexpected pushback against establishment candidates. Last week in India’s elections, the Bharatiya Janata Party (BJP) was widely expected to increase its majority, but it instead suffered an embarrassing setback and was forced to form a coalition. Meanwhile, in Mexico, the overwhelming dominance of Morena also caught investors off guard. This trend is expected to carry over to Europe and the US, with elections likely to show major victories for far-right candidates, including Marine Le Pen’s National Rally Party in France and the gaining popularity for former US President Donald Trump.

- The rise of less conventional candidates has yielded mixed results for emerging markets, as investors grapple with the uncertainty surrounding policy impacts. Argentine President Javier Milei initially received a positive response from markets following his victory in December, but sentiment shifted once the challenges of implementing his proposed changes became evident. India had the opposite impact as investors believed that the BJP may still be able to push its agenda despite losing seats. South African and Mexican markets have yet to recover from their recent elections, as investor pessimism persists due to a lack of clear policy direction.

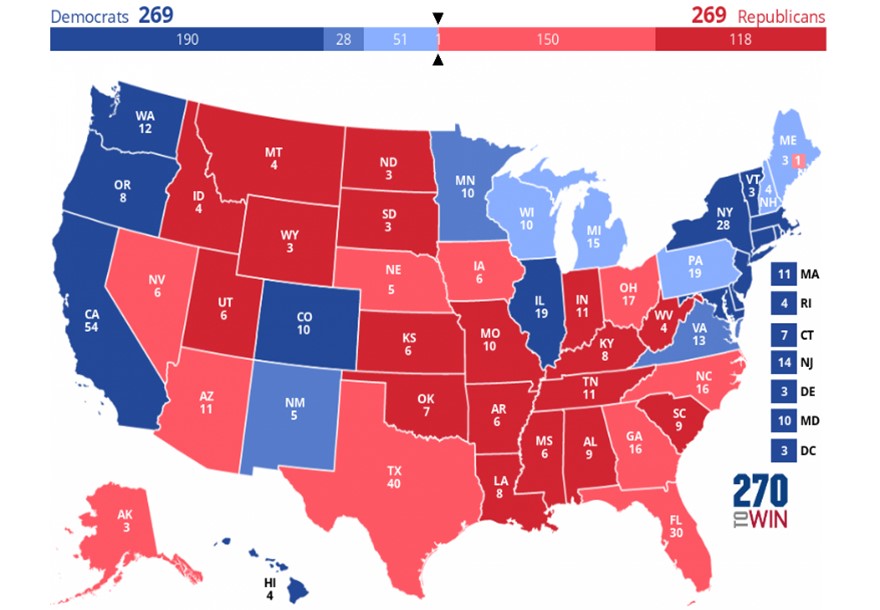

- Europe casts its first ballots this weekend, with parliamentary elections kicking off a wave of voting across the Atlantic. The UK follows next month, and the United States rounds out the year with its national elections in November. A common thread runs through these elections: anxieties over immigration, debt, and inflation. Early exit polls indicate a narrow victory for the left-wing parties in the Netherlands, with far-right candidate Geert Wilders making significant gains. Meanwhile, UK polls suggest that the Labour Party is poised to easily defeat the Tories. In the US, election polls show former President Trump leading in November, while other prediction markets show a dead heat.

In Other News: A record heat wave in the western states could potentially weigh on economic activity in June. China is cracking down on mutual funds with large-scale audits as it continues to scrutinize the financial sector.