Daily Comment (June 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the initial results from the European Parliament elections over the weekend, which suggest that surging support for right-wing parties will produce big changes in the European Union’s economic and social policies. We next review several other international and US developments with the potential to affect the financial markets today, including an update on China’s effort to rescue its residential real estate market and some notes on US fiscal policy.

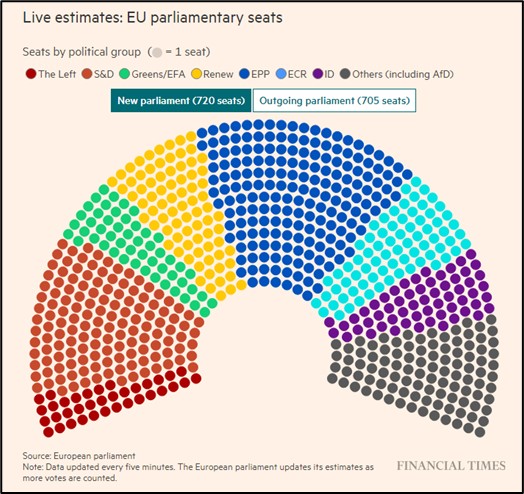

European Union: In weekend elections for the European Parliament, centrist parties kept their majority, but far-right parties did better than in the 2019 elections and appear to have won almost 180 of the 720 seats in the body. Support for the right grew strongly in Germany and France, prompting French President Macron to call snap elections on June 30 and driving down EU stocks and the euro so far today. The new parliament will likely shift European Union policies in a more anti-immigration direction and roll back the EU’s climate stabilization policies.

- Results so far suggest the center-right European People’s Party (EPP) alone will have 186 seats, making it the biggest party in the parliament. The center-left Socialists and Democrats (S&D) are projected to have 134 seats, while the center-left Renew party is on track to end up with 79 seats.

- The hard-right European Conservatives and Reformists (ECR) are expected to have 73 seats, and the hard-right Identity and Democracy (ID) group will have 58 seats. Along with smaller parties that share their ideology, the hard right will have almost one-fifth of the seats.

- The environmentalist-leftist Greens are expected to have only 53 seats.

Israel: Centrist politician and former general Benny Gantz said he is resigning from Prime Minister Netanyahu’s emergency cabinet to protest what he called Netanyahu’s mistakes in prosecuting Israel’s war against the terrorist Hamas government in Gaza. Gantz also called for early elections. Netanyahu’s conservative party and its right-wing allies retain a majority in parliament even without Gantz’s support, so the move doesn’t immediately topple Netanyahu. However, Gantz’s move adds to the destabilizing political uncertainty in Israel.

China: Major residential real estate developers Country Garden, Vanke, and Shimao have now all reported significantly higher home sales in May than in April. The firms’ sales are still down dramatically from year-earlier levels, but the reports suggest the government’s new plan to rescue the sector is having at least some success. However, we remain skeptical that the sector can regain its former luster merely based on the plan’s eased mortgage standards and financial incentives for local governments to buy up excess properties.

Iran: Ahead of the presidential election later this month, the Guardian Council has approved a list of candidates consisting almost entirely of hardline conservatives. The Council, made up of clerics charged with defending the nation’s theocracy, banned two prominent reformers who had called for more moderate religious policies and rapprochement with the US. The Council’s decision helps ensure that tensions between Tehran and the West will continue to present risks to global investors in the coming years.

Chile: New reporting shows that a powerful and dangerous criminal gang from Venezuela has rapidly built a presence in Chile, boosting the incidence of extortion, kidnapping, murder, and other crimes. Although Chile retains its reputation as one of Latin America’s most developed and safest investment locations, the new spike in violence and the inequality protests that ushered in a leftist president in 2021 continue to raise investor concerns.

US Monetary Policy: The Federal Reserve holds its latest policy meeting this week, with its decision due on Wednesday at 2:00 PM EDT. With price pressures stubbornly high, the policymakers are widely expected to keep the benchmark fed funds interest rate unchanged at 5.25% to 5.50%. Just as important, the officials will also release their updated economic projections, including their “dot plot” of expected rate changes going forward.

- Based on interest-rate futures pricing, investors currently look for the Fed’s first rate cut in the autumn. The biggest uncertainty is whether the policymakers will implement further cuts later in the year.

- Because of today’s sticky inflation, we continue to believe the policymakers could keep rates “higher for longer” than investors currently believe.

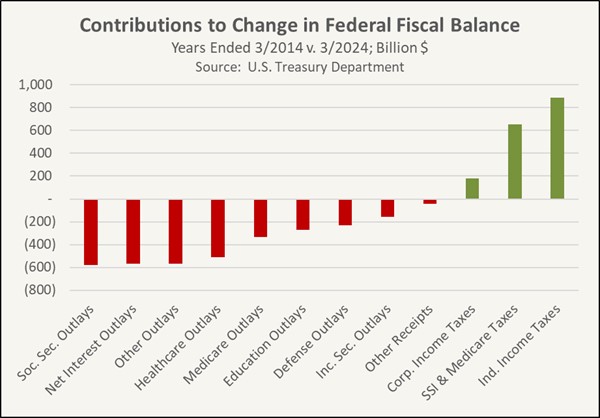

US Fiscal Policy: In an interview with the Financial Times, the International Monetary Fund’s second-ranking official argued the US has “ample” resources to bring down its fiscal deficit to more sustainable levels. In the interview, First Deputy Managing Director Gita Gopinath said that US policymakers should consider boosting taxes on high-income individuals. She also said that in the US, as in all advanced economies, there is “no way of getting around” the fact that population aging will require fundamental reforms to pension systems and medical spending.

- The volume of individual income taxes, Social Security and Medicare taxes, and corporate income taxes has certainly risen over the last decade, as shown in the chart below. However, the increase has been much smaller than it would have been without the tax cuts of 2017.

- Importantly, the rise in tax revenues hasn’t been nearly enough to cover the rise in spending. The biggest increases in spending have come from Social Security, Medicare, Medicaid and other healthcare, and net interest.