Daily Comment (September 13, 2016)

by Bill O’Grady and Kaisa Stucke

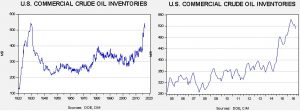

[Posted: 9:30 AM EDT] Risk markets are lower to sideways as oil tumbled this morning after the International Energy Agency revised its global demand estimates lower and indicated that the global inventory glut will last longer than it had previously estimated. Domestic oil inventories are expected to build this week following a week of inventory drawdowns as a result of tropical storm activity. This will likely pressure prices lower in the short term. We would expect OPEC members to jawbone about production freezes but, as recent OPEC talks have indicated, a production cut is unlikely.

The chart above shows domestic crude inventory levels. The chart on the left shows data going back to 1920, while the chart on the right shows inventories for this year. Stocks remain ample and inventories are expected to remain elevated given the expectations for falling demand.

Fed Governor Lael Brainard’s dovish speech yesterday afternoon fueled a rebound in equities. Brainard’s comments are the last before the Fed enters a quiet period leading up to the FOMC meeting on September 20-21. The speech was generally viewed as dovish, especially in contrast to Boston FRB President Rosengren’s speech last week, which was taken as hawkish and increased the likelihood of a rate hike to 60% for December. Following Brainard’s speech, the December rate increase probability fell to 54% but remains higher than it has been all summer.

Brainard indicated that the economy is making gradual progress toward the central bank’s goals, although a preemptive hike is less compelling in an environment where labor markets have improved but inflation pressures remain mild. Specifically, she pointed to five areas that should warrant caution.

- Inflation has been less responsive to labor market improvements than in the past, making the Phillips Curve a less reliable indicator. We have noted before that there is an ideological divide amongst the Fed board and FRB presidents over the importance of the unemployment/inflation relationship posited by the Phillips Curve. Brainard belongs to the group that does not believe the Phillips Curve is as dependable of an indicator in the present environment as it was during the 1970s and 1980s.

- Labor market slack has been greater than anticipated, with the unemployment rate improving but other labor market indicators only showing mild improvement. She specifically pointed to the low participation rate, higher percentage of workers in part-time positions for economic reasons and lackluster wage growth.

- There are risks presented by foreign market uncertainty. Brainard discussed risks from today’s interrelated global markets, especially as the spread of disinflation is a worry in developed countries and weak international demand is likely to pressure domestic growth.

- The neutral interest rate will likely remain low for an extended period of time and will be much lower than the pre-crisis neutral rate. Brainard argues that the new normal economic growth environment also warrants a corresponding lower neutral rate.

- Policy options remain asymmetrical as the low rate allows for the Fed to more easily respond to faster than expected growth, while options for responding to lower growth remain limited. This is the argument that some Fed officials have made for hiking rates now as they would have the ability to loosen policy if growth slows. The argument is somewhat controversial because a premature rate hike could add to conditions conducive for a recession in the current low-growth environment.