Daily Comment (June 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new data confirming the growth of US and European defense businesses as global military budgets rise. We next review several other international and US developments that could affect the financial markets today, including more evidence of a potential trade war between China and the European Union and signs that the Biden administration may release more oil from the Strategic Petroleum Reserve to hold down US gasoline costs ahead of the November elections.

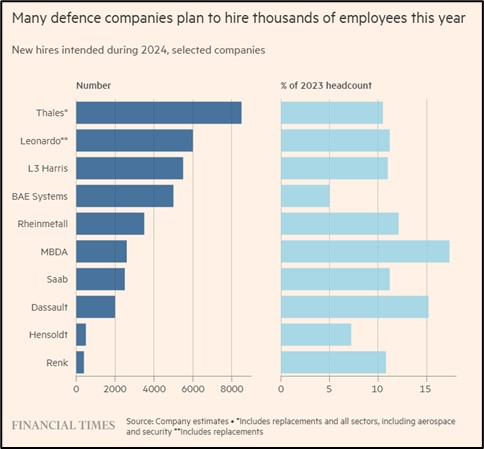

Global Defense Industry: New research by the Financial Times shows top US and European defense contractors have tens of thousands of job openings and are trying to hire at the strongest pace since the Cold War. Based on a survey of top defense firms, the data shows that the companies are looking to boost their workforces by about 10%. The figures are consistent with our oft-stated belief that global defense spending is likely to rise persistently in the coming years in response to the growing tensions between the US and China/Russia geopolitical blocs.

European Union: The leaders of the 27 members of the EU today are expected to endorse Ursula von der Leyen for a second term as president of the European Commission, the region’s executive body. Although some EU leaders had floated other names (including Mario Draghi, the former chief of the European Central Bank), they have apparently decided to prioritize stability and von der Leyen’s tough approach to foreign affairs.

- If approved at a more formal meeting of the EU leaders in the coming weeks, von der Leyen would also have to be approved by a simple majority of the newly elected European Parliament.

- If von der Leyen is successfully installed for a second term, a key implication is that the EU would continue to toughen its approach to Chinese economic predations and boost its defenses against the rising threat from Russia.

China-European Union: Beijing yesterday said it is probing whether the EU has dumped pork products on the Chinese market at unfairly low prices. The antidumping investigation is widely seen as retaliation for the EU’s recent probe and imposition of antidumping tariffs against Chinese electric vehicles. The Chinese probe is designed to put maximum political pressure on Brussels, as any tariffs against EU pork products would disproportionately hurt influential farmers in countries such as Belgium, the Netherlands, Denmark, Germany, and Spain.

China-Australia: In a new sign of the rebounding China-Australia relationship, Australia’s total trade with China (the value of exports plus imports) rose to a record $125 billion in 2023, beating the pre-pandemic record of about $112 billion in 2019. China had imposed strict barriers against key Australian exports from 2020 to 2022 in retaliation against Canberra’s call for a probe into China’s role in the coronavirus pandemic. Over the last year, however, Beijing has loosened those restrictions, giving a boost to Australian exports and economic activity.

China-Philippines: On Saturday, the Chinese government again accused the Philippines of provocative activity in the South China Sea, after Manila sent coast guard boats on Friday to land at islets in the area that are claimed by Beijing but internationally recognized as part of the Philippines. The new accusation came just a day before the start of a new Beijing rule allowing the Chinese coast guard to detain foreigners and their vessels that stray into the disputed areas.

- As we note in our “Mid-Year Geopolitical Outlook,” due to be released later today, the growing Chinese-Philippine tensions represent what is perhaps the world’s most dangerous confrontation through the rest of 2024. Although we don’t necessarily think the two sides will come to blows, there is an elevated chance that they could.

- If China and the Philippines do come to blows, the US-Philippine mutual defense treaty could force the US to come to Manila’s aid, leading to a direct US-China conflict.

China: May new home prices were down 4.3% from the same month one year earlier, versus a 3.5% decline in the year to April. The value of home sales in January through May were down a whopping 30.5% year-over-year, reflecting both weaker prices and reduced transactions. Even though some homebuilders have seen an uptick in sales over the last couple of months because of the government’s new program to ease mortgage rules and support home purchases, the data shows that the key property sector remains a major drag on Chinese economic growth.

Israel: Following the resignations of centrist politicians Benny Gantz and Gadi Eisenkot last week, Prime Minister Netanyahu has dissolved the unity war cabinet he formed after Hamas’s October 7 attack on Israel. The move does nothing to undermine Netanyahu’s power, but it could mean that Israel’s war against Hamas will be prosecuted without the input of more moderate voices. In turn, that could potentially lead to a longer, more intense conflict that might further isolate Israel politically and weigh on its economy and financial markets.

Russia-United States: The Kremlin announced the espionage trial of Wall Street Journal reporter Evan Gershkovich will be held in secret, beginning next week. The US government and the newspaper vehemently deny that Gershkovich was involved in spying, so the secret proceedings are likely to further strain ties between Russia and the US going forward.

US Corporate Governance: Days after Tesla shareholders approved a $56-billion pay package for CEO Elon Musk, new data shows the median pay for CEOs in S&P 500 companies in the first four months of 2024 was up some 14% from the same period one year earlier. That compares with an average increase of 4.1% for the average worker. That disparity could help explain the increasing concern about US income inequality and the rise of populism.

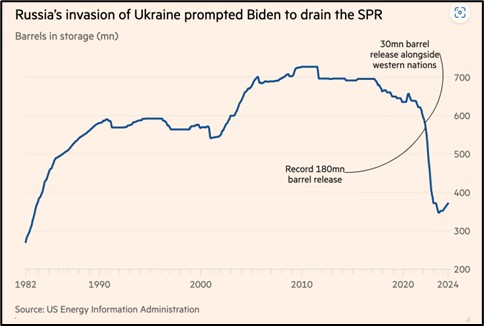

US Energy Policy: Amos Hochstein, President Biden’s top energy advisor, said the president would release more oil from the Strategic Petroleum Reserve to cap any surge in gasoline prices during the summer driving season. Such a move would be on top of the massive oil releases Biden already ordered in 2021 and 2022, as prices began to rise following the pandemic and Russia’s invasion of Ukraine. Such a move would also be further evidence that presidents facing re-election will try to curry favor with voters by bringing down energy costs.