Daily Comment (June 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity futures are holding steady as investors wait for fresh economic data to guide their next move. On the sports front, Argentina emerged victorious against Canada with a 2-0 win, setting the stage for the Copa América. Today’s Comment dives into three key topics: the persistently low bond yields, the recent restrictions on Chinese electric vehicle imports, and the performance of banks. We’ll wrap up the report with a look ahead to today’s domestic and international data releases.

Bonds are Back: Bond investors continue to doubt whether the Fed will hold rates steady as the economy continues to show signs of slowing.

- The yield on the 10-year US Treasury note remains stubbornly low, closing below 4.3% for the tenth consecutive day on Thursday. This defies expectations given several headwinds: the Fed’s recent shift towards fewer rate cuts, stubbornly high inflation, and a ballooning Treasury supply. Investor demand for bonds seems fueled by a confluence of factors. One is the hope that inflation will continue to cool in the coming months. Additionally, economic uncertainty is driving a flight to safety, pushing investors towards the perceived security of Treasurys. Finally, a string of weak economic data has reinforced the cautious market sentiment.

- The Fed’s recent slowdown in quantitative tightening, from $60 billion to $25 billion a month, might also be contributing to the decline in bond yields. This shift in policy suggests a less aggressive approach to draining liquidity from the financial system, potentially making long-duration assets more attractive to investors. While the two-year quantitative tightening program nears its final phase, the Fed plans to use the reduced pace of balance sheet reduction to ensure a smooth transition from abundant liquidity to ample liquidity. Phasing out this program will likely ease pressure on bond yields and provide support for stocks.

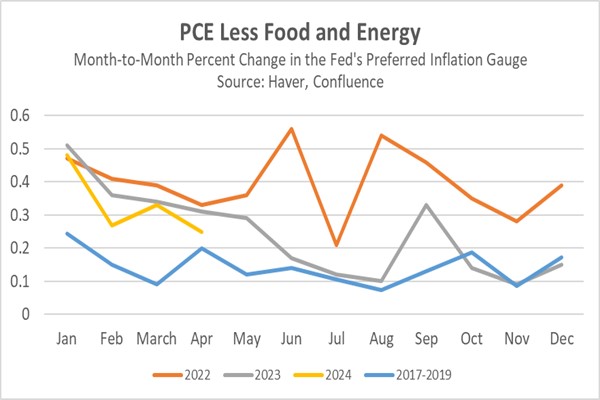

- However, further declines in Treasury yields are unlikely in the short term without clear signs of inflation subsiding. The Fed’s May decision to accelerate balance sheet reduction reflects its confidence in remaining patient as inflation pressures ease. Notably, the core PCE price index, the Fed’s preferred inflation measure, has shown a slower pace of increase in the first four months of this year compared to 2022 and 2023. For sustained confidence in inflation’s retreat, the index should continue this trend and align with pre-pandemic levels over the next three months.

The West’s EV Problem: Tensions escalate in the West-China trade dispute as Canada joins the fray.

- Canada is considering raising tariffs on electric vehicles (EVs) imported from China. This move aligns with similar actions taken by its allies such as the United States and the European Union. The concern is that China’s rapid growth in EV production could harm domestic auto industries. Earlier in 2024, the US significantly increased tariffs on Chinese EVs to 102.5%, while the EU implemented tariffs as high as 38% on specific vehicles. Canada, with its current 6% tariff, is exploring raising it to match the approach of its partners. However, a final decision on Canadian tariffs remains pending.

- The proposed tariff increase on Chinese electric vehicles comes as the Western green industry faces challenges. Weak domestic demand is hindering growth, as evidenced by EV startup Fisker’s recent bankruptcy after halting production. At the same, Tesla’s stock price also reflects these difficulties, dropping nearly 27% this year following its announcement of a tough industry outlook. Europe shares these struggles, with a particularly sharp decline in Germany. Last month, EV sales in the Continent’s largest economy plunged by 30%, while the broader European market saw a 12.5% drop.

- The fight for leadership in green technology shows no signs of slowing down, even though Western nations face challenges in attracting consumers to some eco-friendly products. Affordability appears to be the biggest hurdle, with electric vehicles remaining out of reach for many households and governments becoming more selective when offering subsidies. Tariffs on Chinese EVs might not be the silver bullet. While they could limit Western sales, they might also boost demand in emerging markets. In the meantime, Western governments may need to acknowledge that consumers are not yet fully prepared to abandon their gas-powered vehicles.

Higher-for-Longer and Banks: Banks in the US and abroad are facing headwinds as they struggle to attract deposits and protect their balance sheets, but there are no signs of a crisis.

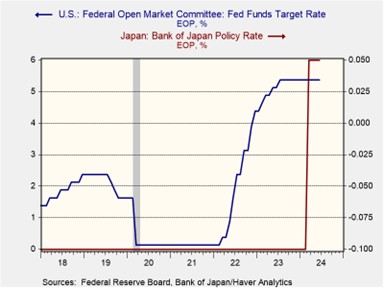

- Japan’s regional banks are facing increased scrutiny as interest rates rise. Moody’s rating agency warned last month that higher rates could lead to capital flight, potentially harming these banks. Similarly, S&P Global expressed concerns earlier this month that rising rates could pressure the capital ratios of regional banks, especially those with high buffers. This isn’t a solely Japanese issue. US banks are also under the microscope. Moody’s recently placed several American banks on watch for downgrades due to their exposure to the potentially risky commercial real estate market.

- The threat to bank profitability appears likely to persist as long as interest rates remain high. This current rate cycle has negatively impacted bank balance sheets, putting pressure on some major institutions. For example, Norinchukin Bank, a Japanese agricultural lender, announced it would unload $63 billion in low-yielding US and European government bonds. This move aims to stem losses following an unsuccessful gamble on falling interest rates. In contrast, US banks have been increasing their holdings of short-term, floating-rate collateralized mortgage obligations (CMO) backed by Ginnie Mae. This strategy aims to protect themselves from potential deposit flight if interest rates continue to rise, but exposes the banks if rates fall significantly as it could lead to a wave of refinancing.

- While rising interest rates pose challenges for the financial system, there aren’t immediate signs of a crisis. This can be maintained if central banks prioritize clear and open communication about their interest rate expectations. Additionally, banks must avoid excessive risk by not over-committing to specific forecasts on Federal Reserve decisions. The pandemic highlighted the dangers of banks relying too heavily on, or outright contradicting, Fed guidance. This approach may be viable in a stable environment, but it becomes riskier during periods of high inflation volatility and geopolitical uncertainty.

In Other News: Purchasing Managers Index (PMI) surveys suggest European economies are not as robust as previously thought. This could fuel expectations of further rate cuts from the ECB. US car companies face challenges from cyberattacks, highlighting the need for further investment in cybersecurity. The Philippines’ undisclosed reinforcement of a ship in the South China Sea could lead to heightened tensions with China.