Daily Comment (June 25, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with further details on how Canada is considering antidumping tariffs against Chinese electric vehicles, as we flagged in a short blurb late last week. We next review several other international and US developments with the potential to affect the financial markets today, including another EU antitrust complaint against a major US technology firm and a statement by a Federal Reserve governor saying she would be open to raising interest rates if consumer price inflation doesn’t keep falling.

Canada-China: Following up on an item we flagged without detail late last week, the Canadian government is seeking public opinion on whether to impose antidumping tariffs or other barriers against Chinese EVs. Starting July 2, citizens will have 30 days to register their opinion, after which the government can decide on what it believes will be the optimal path.

- To justify the action, Ottawa cited “unfair competition from China’s intentional, state-directed policy of overcapacity and lack of rigorous labor and environmental standards.”

- More interesting, Ottawa said its goal is not only “to protect Canada’s auto workers and its growing EV industry” but also to “prevent trade diversion resulting from recent action taken by Canadian trading partners.” In other words, it is worried that the new US and EU tariffs against Chinese EVs will divert them toward Canada, where they likely would be sold at fire-sale prices.

European Union-United States: One day after accusing US tech giant Apple of using its app store to snuff out online competition, the European Commission today accused Microsoft of uncompetitive practices for the way it bundles its Teams collaboration tool with its Office products. The move appears to be another use of the EU’s new Digital Markets Act, signaling it will be applied aggressively and could trip up other US tech firms. If found guilty under the DMA, a firm could face a fine of 10% to 20% of its global annual revenue.

European Union-Ukraine-Moldova: EU officials today will meet with Ukrainian and Moldovan officials in Luxembourg to begin talks on their accession to the bloc. At the meetings, the EU will outline the reforms and legislation each country needs to adopt before being deemed ready to join. However, both Ukraine and Moldova are likely to need several years to meet the EU’s standards, so joining is by no means imminent.

- In large part, the talks will be symbolic, since they are merely aimed at getting the ball rolling before Ukraine-skeptic Hungary takes over the six-month rotating presidency of the Council of the European Union on July 1.

- Our next Bi-Weekly Geopolitical Report, to be published on Monday, will provide a full explanation of what that Council is and how it fits into the EU’s decision making.

France: With polls showing the far-right National Rally could win the parliamentary elections starting on Sunday, leader Jordan Bardella yesterday held a press conference to unveil new details on the party’s economic, immigration, and foreign policies. To counter concerns that the party’s populist bent would lead to tax cuts and spending hikes, blowing out the French budget deficit, Bardella vowed that National Rally would actually bring the deficit back down to the European Union limit of 3.0% of gross domestic product by 2027, versus 5.5% of GDP last year.

- Besides vowing “reasonable” fiscal policies, Bardella also outlined an economic program that largely echoed President Macron’s mainstream goals of strengthening the French industrial base, boosting employment, and cutting regulation. The main difference was that Bardella said National Rally would reverse Macron’s pension reform, which raised the national retirement age from 62 to 64 years.

- Bardella’s economic proposals illustrate how many of Europe’s populist, far-right parties have moderated their policies once they attained power. One example of that has been Italian Prime Minister Giorgia Meloni and her Brothers of Italy party.

- If that turns out to be the case in France, the recent sell-off in French stocks and bonds could well be an attractive buying opportunity.

Israel: The Israeli Supreme Court today ruled that ultra-orthodox Jewish students cannot be legally exempted from military conscription. It also ruled that those students aren’t entitled to government funding if they don’t have a valid conscription exemption. While it remains unclear when the ruling will be implemented, it will eventually end a controversial practice that many Israelis see as unfairly benefiting ultra-conservative citizens. It could also weaken the cohesion of Prime Minister Netanyahu’s right-wing coalition government.

Kenya: Protestors have launched nationwide demonstrations against a new set of tax hikes the government hopes will raise some $2.1 billion and help cut the budget deficit from the current 5.7% of GDP to 3.3% of GDP next year. The tax hikes are required under Kenya’s most recent bailout deal with the International Monetary Fund. The protests have already turned violent, threatening political and economic instability in the country.

US Monetary Policy: In a speech today, Fed board member Michelle Bowman said she would be willing to raise the benchmark fed funds rate again if progress on lowering consumer price inflation stalls or reverses. According to Bowman, one key upside risk for inflation is the large federal budget deficit, which reflects factors such as weak tax revenue, higher interest costs, and increased outlays on Social Security, Medicare, and other programs. She also said high immigration could drive up the price of housing, even if it helps hold down wage rates.

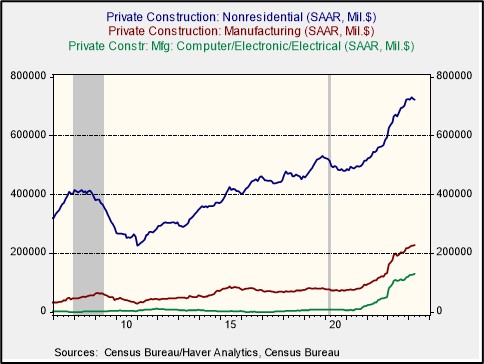

US Manufacturing Sector: Danish pharmaceutical giant Novo-Nordisk yesterday said it will invest $4.1 billion to build a new factory in Raleigh, North Carolina and expand production of its blockbuster weight-loss drugs Wegovy and Ozempic. The move will likely put pressure on US drug giant Eli Lilly to expand output of its rival drugs Zepbound and Mounjaro. The investments would add to the current boom in US factory construction, which to date has been driven more by manufacturing facilities for electronic goods such as electric cars and semiconductors.

US Artificial Intelligence Industry: The Recording Industry Association of America has filed copyright infringement suits against two AI startups developing products that allow users to generate new music using text prompts. The suits, brought on behalf of major music companies, allege that the startups used copyrighted works scraped from the internet to train their models.

- The suits illustrate the legal challenges that have to be sorted out for the AI industry to continue growing.

- One likely result of such suits is that specialized data sets that are useful for training AI models will become increasingly valuable. Those data sets will be guarded furiously, potentially to the point where specialized, focused AI models will proliferate and become even more important to the economy than the general AI models getting so much attention today.