Daily Comment (June 27, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity markets are off to a sluggish start as investors await Friday’s inflation data. In sports news, the Atlanta Hawks chose Zaccharie Risacher with the first overall pick in the NBA draft. Today’s Comment will delve into the impact that immigration may have on monetary policy, our thoughts on the latest Fed stress tests, and a summary of the attempted coup in Bolivia. As usual, our report includes a roundup of international and domestic data releases.

The Immigration Conundrum: Foreign workers have played a pivotal role in filling job vacancies and easing inflationary pressures; however, the broader public wants fewer of them.

- Switzerland is set to address immigration concerns through a constitutional amendment that would require government action if the number of permanent residents surpasses 9.5 million. It would also impose a cap of 10 million on the total number of permanent residents. This vote coincides with Switzerland’s negotiations for an updated agreement with the European Union, where disagreements over wages and immigration persist. Businesses, especially in hospitality, share these concerns, highlighting their reliance on foreign workers to fill vacancies. The sentiment reflects a broader trend of rising skepticism towards immigration in Western countries.

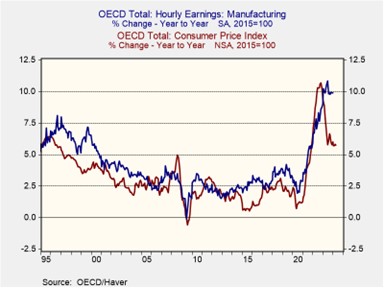

- The debate over immigration intensifies as central bankers grapple with the pandemic’s impact on labor markets and inflation. A recent report by French economist Olivier Blanchard and former Fed Chair Ben Bernanke warns that persistent wage pressures — a key driver of inflation — are making it difficult for central banks to achieve their goals. Immigration has offered some relief by easing labor shortages. However, policy changes could undermine this progress, potentially forcing central banks to take stronger measures like rate hikes. As Fed Governor Michelle Bowman noted, stricter immigration policies could put upward pressure on inflation.

- The recent rise in anti-immigration sentiment could eventually influence monetary policy discussions. While increased immigration has helped address labor shortages and ease wage pressures, its impact is not one directional. Despite Fed Governor Bowman’s acknowledgement that the influx of foreign workers has helped alleviate inflationary pressures, she also suggested that it may have also contributed to rising rents due to the group’s housing needs. This mixed effect means immigration may become a factor that central banks consider, but it is unlikely to be the sole driver of policy decisions.

Is This Time Different? Major US banks all passed the Fed’s annual stress test this year, but there are still concerns that a financial crisis could hurt the economy.

- The stress test results indicate that these firms can withstand a major loss during a recession and still maintain sufficient capital to meet their obligations. According to the report, the group of banks would incur approximately $685 billion in losses, lower than the previous year’s figure and still within the acceptable range established by recent stress tests. While the success of these firms, as a whole, allows for more generous payouts through dividends and stock buybacks, the results did vary by individual firm. In the first, quarter, banks repurchased $14 billion worth of shares.

- The health of the financial system has been a major concern for investors ever since the Federal Reserve began raising rates in 2022. This concern is heightened by the FDIC’s latest quarterly report, which estimates that banks are currently holding a staggering $525 billion of unrealized losses on their balance sheets — a figure about seven times higher than what was recorded during the financial crisis. While banks can avoid recognizing these losses as long as they maintain sufficient liquidity, a liquidity crunch similar to the one that forced Silicon Valley Bank’s collapse in 2023 could trigger a wave of bank losses.

- The Federal Reserve, keenly aware of the financial system’s vulnerabilities, has been implementing measures to mitigate crisis risks. These include requiring banks to hold more collateral and making the standing repo facility permanent in July 2021. However, unforeseen geopolitical or financial events could still trigger a crisis, forcing the Fed to take more drastic actions. While there are currently no signs of an imminent crisis, the risk remains elevated as long as the Fed maintains restrictive interest rates. That said, any signs of a pivot should benefit these firms, especially small to mid-sized banks.

Bolivia Unrest: One of the largest producers of lithium narrowly avoided a coup on Thursday, highlighting the political uncertainty in small resource-rich countries.

- Bolivia narrowly avoided a coup attempt on Wednesday. Soldiers led by dismissed army chief Juan José Zúñiga stormed the presidential palace in an attempt to remove socialist President Luis Arce. Luckily, Arce was able to rally public support and regain control later that day. The motive behind the uprising remains unclear, but it may be linked to Arce’s recent efforts to reconcile with his predecessor, Evo Morales, ahead of upcoming elections. Notably, Zúñiga had been fired earlier this week for expressing opposition to Morales’ return to office.

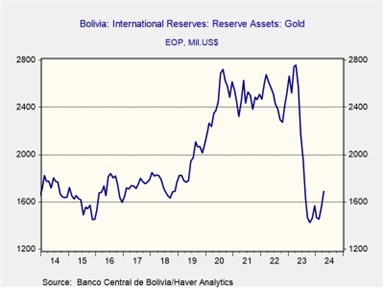

- The recent coup attempt in Bolivia throws a wrench into South America’s efforts for regional integration. Last year, Brazilian President Lula da Silva spearheaded efforts, alongside other leftist leaders, to reunite President Arce and his exiled predecessor, Evo Morales, in the run-up to elections. Bolivia’s economy has sputtered since Morales’ departure in 2019, but the discovery of vast lithium reserves in July 2023 has offered a glimmer of hope. Last year, the country narrowly avoided a financial crisis after draining its gold reserves to sustain spending.

- Bolivia has a long history of coups with 23 attempts since 1950, 12 of which failed. In fact, the previous coup took place only five years ago. Unfortunately, political instability has long plagued emerging markets, particularly those reliant on resource exports. This trend is likely to worsen in a deglobalizing world and will likely have an impact on global commodity prices. As a result, investors should expect energy prices to become volatile over the next few years as countries look to form into regional blocs. Additionally, this fragmentation could potentially lead to higher global inflation due to persistent supply disruptions.

In Other News: Bulgaria and Romania failed to meet the economic requirements needed to adopt the euro. Their failure is a reminder of the difficulty in joining the economic bloc, particularly for Ukraine. A census report has shown that Hispanics fueled the US population boom in 2023, signaling their growing political influence.