Daily Comment (June 28, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity futures are off to a strong start thanks to a modest inflation report. In sports news, the Los Angeles Lakers “shocked the world” by drafting NCAA standout and USC star shooting guard Bronny James in the second round. Today’s Comment begins with a discussion about the first presidential debate, rising Treasury illiquidity, and the ongoing dispute between China and the Philippines. As usual, our report concludes with a roundup of domestic and international news.

First Presidential Debate: Although there was a clear victor in the debate, both candidates offered valuable insights into their visions for the next four years.

- Last night, both President Biden and former President Donald Trump presented their views on the state of the nation. Trump described the country as being in crisis due to rising immigration, elevated inflation, and increasing trade issues with China. In contrast, President Biden offered a more optimistic perspective, highlighting stronger job growth, progress in alleviating price pressures, and recent improvements in reducing border crossings. These contrasting viewpoints underscore how the two candidates will campaign in the coming months, each seeking to compare their records as president.

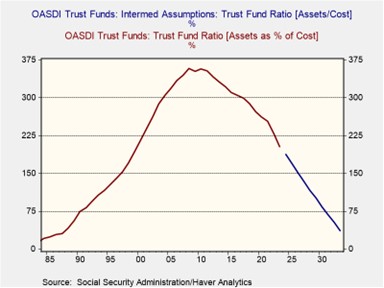

- Even though the national debt has become a pressing issue, neither candidate managed to clearly address how they plan to tackle it. While both mentioned raising revenue through tax increases, neither proposed significant spending cuts. President Trump focused on increasing tariffs, which raises the price that consumers pay for imported goods. On the other hand, President Biden advocated for raising taxes on high-income earners. Social Security benefits were a topic of discussion, but neither candidate presented a concrete plan to address the program’s long-term solvency. According to the Social Security Administration, the program’s assets that are available to pay benefits have been declining, while program costs are projected to rise.

- While it’s possible that neither candidate has a concrete plan yet, it’s more likely they’re focusing on popular policies without fully addressing the associated costs. The expiration of the 2017 tax cuts is likely to reignite debate on deficit reduction. We can expect differing approaches from the candidates. Trump will likely prioritize tax cuts and reduce spending, potentially targeting areas like climate change and social programs. Meanwhile, President Biden might advocate for letting the tax cuts expire to fund climate change initiatives.

Government Bond Liquidity: While the financial system appears stable, there are signs of financial stress bubbling beneath the surface.

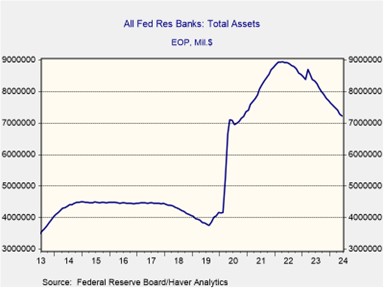

- The Treasury market is flashing warning signs. Indicators like JP Morgan’s Liquidity Stress Dashboard and Bloomberg’s US Government Securities Liquidity Index are signaling a drying up of liquidity, particularly for bonds maturing within six years. This comes despite a seemingly strong bond market, with yields on the 10-year Treasury dropping 30 basis points in the past month. However, the turbulence in the Treasury market underscores growing concerns that the economy may not be able to absorb the high level of future Treasury issuance. It also casts doubts on the Federal Reserve’s ability to smoothly continue reducing its bond holdings.

- The decline in bond liquidity coincides with a shift in US debt ownership. As the Federal Reserve raises interest rates, foreign buyers, who are typically less concerned with price fluctuations (price insensitive), are reducing their purchases. This creates a gap that’s being filled by domestic households, who are more sensitive to interest rates and bond prices. The lack of interest rate-insensitive buyers of US debt is important because it raises concerns about whether the government debt could be attractive at lower price yields, particularly as inflation remains elevated.

- Shifting demand for US government bonds could prompt the Fed to adjust its balance sheet normalization plans. In June, the Fed opted to slow the pace of quantitative tightening (QT), a move likely aimed at easing pressure on bond liquidity, while also allowing the Fed to continue with its drawdown. Fed officials aim to reduce bank reserves from “abundant” to a more “ample” level, though they acknowledge the exact sweet spot remains elusive. However, if these Treasury liquidity indicators are truly signaling limitations, the Fed could ultimately decide to end QT prematurely, which would likely boost bond prices.

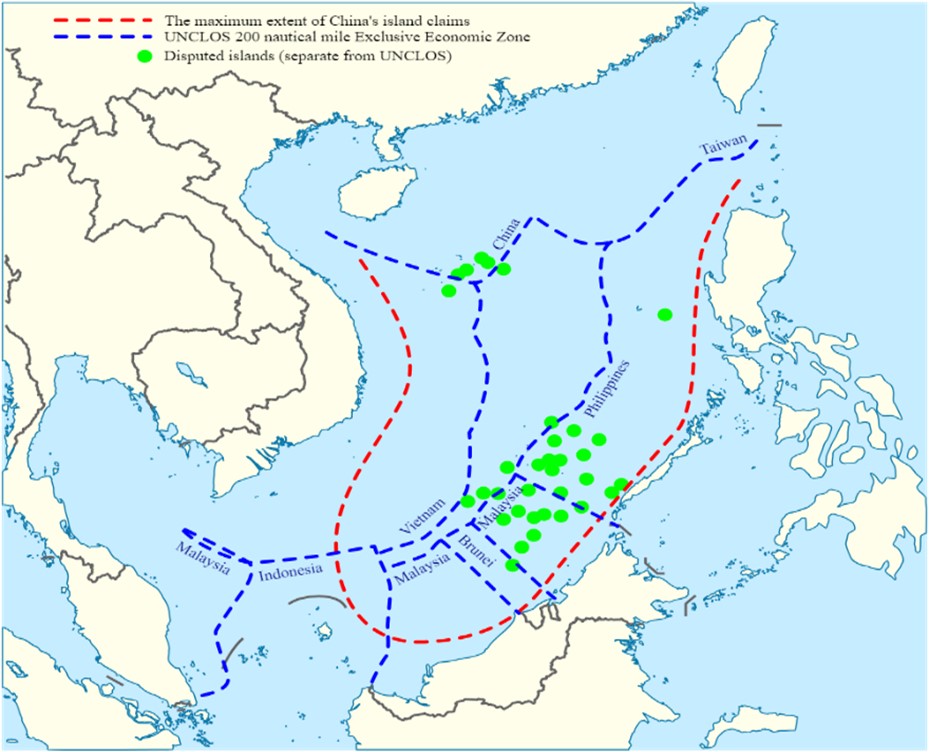

China-Philippines: Tensions between China and the Philippines continue to escalate in a spat that may lead to US intervention.

- In response to a recent clash in the South China Sea between the Philippines and the Chinese Coast Guard, the US reaffirmed its commitment to Philippine security on Thursday. The clash, which involved the sinking of a Philippine vessel and the alleged theft of firearms, has been seen as a hostile act by China. Following the incident, the US and the Philippines are set to continue with their pre-planned joint maritime exercises in the disputed waters, and they may include other countries such as Japan and Australia.

- The tense situation between China and the Philippines in the South China Sea has unnerved neighboring countries. Vietnam, Malaysia, and Indonesia also have territorial disputes with China in the region, raising concerns of a wider conflict. Despite seeking a peaceful resolution, the Philippines plans to send another supply mission to the Sierra Madre as early as next week. While the Philippine government has insisted that it can assert its sovereignty over the contested seas without the help of a US escort, the White House is already discussing potential responses to further Chinese aggression.

- The China-Philippines conflict in the South China Sea carries the risk of escalating into a black swan event. An attack on Philippine vessels by China could trigger the US-Philippines Mutual Defense Treaty, potentially leading to a direct military confrontation between the world’s two largest economies. This event would likely lead to a dramatic shift away from risk assets as investors look for safety until the situation resolves. This should benefit risk-free assets such as US Treasurys but could also be a boon for gold.

Other News: European Commission President Ursula von der Leyen was nominated for a second term, indicating that centrists still have significant influence in the European Union. French elections are set to take place next week, with polls showing that Macron’s party is likely to suffer a heavy defeat. Argentina’s President Javier Milei achieved a major victory after Congress passed his pro-business reforms, enabling the country to meet its fiscal targets.