Daily Comment (July 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new details on why Philippine President Marcos is pushing back so strongly against Chinese territorial aggression in the South China Sea. We next review several other international and US developments with the potential to affect the financial markets today, including a new move by China to potentially weaponize its rare earth resources, a win by the far right in France’s first-round parliamentary elections, and additional signs of a potential economic slowdown in the US.

China-Philippines: As Chinese-Philippine tensions continue to worsen, a new article in the South China Morning Post provides a useful historical view on how the relationship soured. The article notes the key issue is Beijing’s multi-decade effort to assert its sovereignty over parts of the South China Sea claimed by Manila, which successive Philippine leaders have tried to stop with legal suits, appeasement, military investment, and alliance building — all to no avail. However, the article also emphasizes that Philippine citizens have become incensed at Chinese “Pogo” firms.

- Approved by the previous Duterte administration under its appeasement policy, the Pogos are lightly regulated, Chinese-owned gambling venues that have spread throughout the Philippines. Not only have the Pogos brought criminality, corruption, and illegal Chinese immigration, but recent police probes suggest they have also been used by Beijing to infiltrate secret Chinese intelligence and military operatives.

- Spurred on by China’s aggressiveness in the South China Sea and the revelations of the Pogo industry, almost 75% of Philippine citizens now favor the use of military force to maintain the country’s sovereignty over the disputed territories.

- The strong domestic political pressure on current President Ferdinand Marcos Jr. to take a hard line against Beijing is one reason we see today’s Chinese-Philippine tensions as an especially dangerous source of potential conflict. Because of the US-Philippine mutual defense treaty, any such conflict could also draw the US into a direct conflict with China.

China-Southeast Asia: As widely expected, the new US and EU tariffs on Chinese electric vehicles are starting to prompt Chinese EV makers to shift toward Southeast Asian markets. BYD (which Warren Buffet’s Berkshire Hathaway has invested in) and other Chinese EV makers are reportedly now spending billions of dollars to ramp up their sales and output in Indonesia, Thailand, and other countries in the region.

- Given that those countries are relatively poor, the move is expected to force the Chinese firms to cut prices, potentially weighing on their profitability.

- Of course, the invasion of Chinese EVs and any new Chinese EV factories could spark disruption in the region’s auto markets, potentially raising tensions between Beijing and regional capitals.

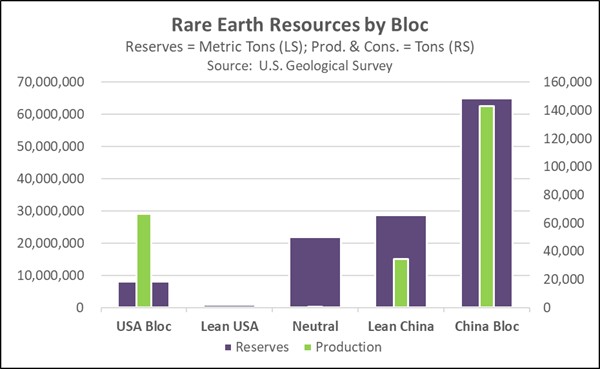

China-Global Rare Earths Market: On Saturday, China issued a package of new rules aimed at protecting its supply of rare earths, a class of exotic minerals critical to modern electrified technologies. Although China and its geopolitical and economic bloc already dominate the world’s supply and smelting of rare earths, the new rules emphasize that rare earth resources belong to the state and that the government will control the industry’s development. Importantly, the rules also establish a rare earth traceability system that could aid in embargoing rare earths.

- Beijing introduced restrictions last year on the export of germanium and gallium, which are critical to the manufacturing of semiconductors. It had also already banned the export of technologies for refining rare earths and making them into magnets.

- Under the new traceability system, Chinese firms involved in the mining, refining, or export of rare earths must establish a detailed product flow record and submit the data to the government.

- Of course, having detailed information on the flow of rare earth products would allow the government to fine-tune any restrictions it might want to place on their export. That’s consistent with our view that Beijing will likely try to weaponize its dominance of key mineral commodities as tensions between the US bloc and the China/Russia bloc continue to rise.

European Union-United States: The European Commission today charged US social-media giant Meta Platforms with violating the EU’s new Digital Markets Act, just as it issued charges against Apple and Microsoft last month. At issue is how Meta requires EU users of Facebook and Instagram to either pay a subscription fee or allow the firm to use their data for targeted ads. If found guilty of the infraction, Meta could be fined 10% to 20% of its global revenue. The action highlights the rising regulatory risks faced by US tech firms in the EU market.

European Union: The far-right government of Hungarian Prime Minister Viktor Orbán today takes over the presidency of the Council of the European Union, giving the nationalist firebrand a megaphone and opportunity to steer EU policy initiatives over the coming six months. Our new Bi-Weekly Geopolitical Report, to be published later today, explains how the Council fits into the EU’s governance structure.

France: In the first round of parliamentary elections on Sunday, preliminary results suggest the far-right National Rally (RN) party came in first with 33.2% of the vote, followed by the far-left National Popular Front (NFP) with 28.0% and President Macron’s centrist liberal alliance with 22.4% of the vote. That puts the far-right in position to potentially win an absolute majority in the National Assembly after the second-round voting on July 7.

- In such a situation, the far right would be in position to name the prime minister and force an uncomfortable “cohabitation” government with President Macron.

- However, the far-left NFP and Macron’s centrists are reportedly in emergency talks today to coordinate and block RN from gaining a majority. The parties are negotiating a plan to withdraw the weaker of their candidates in hundreds of constituencies, with the goal of limiting how many seats RN can win. The effort has given a modest boost to French stocks and the euro so far this morning.

- In any case, the results point to a sharp shift to the right in French politics, potentially leading to populist fiscal policies and a crackdown on immigration.

Iran: In Friday’s first-round presidential election, Masoud Pezeshkian, a reformist former health minister, came in first with 42% of the vote, followed by Saeed Jalili, an arch-conservative, with 38%. Since neither candidate won an absolute majority, the two will now face each other in a run-off election this coming Friday. Although the true power in Iran’s government lies with conservative clerics, a win by Pezeshkian could help nudge Iran toward better relations with the West and less belligerence toward Israel and other rivals in the Middle East.

US Regulatory Policy: In a decision Friday, the Supreme Court overturned its 40-year old “Chevron deference” doctrine, under which courts hearing challenges to regulations deferred to agency legal interpretations when the statutory language passed by Congress was unclear, as long as the interpretation was reasonable. Originally seen as a bulwark against excessive regulation, the doctrine more recently had been seen as giving regulators too much power. Now that the doctrine is overturned, it should be easier for firms to challenge regulations.

- When first laid down in 1984, in Chevron v. Natural Resources Defense Council, the doctrine aimed to recognize the expertise that federal regulators typically have in their area of responsibility. The decision on Friday turned in large part on the fact that while agencies have a lot of technical and policy expertise, they don’t necessarily have more legal expertise than the courts.

- Going forward, the decision means that a court hearing a challenge to a regulation won’t necessarily defer to the agency’s understanding of what it can or can’t do. That should tip the scale back in favor of businesses or property owners challenging a regulation.

- The decision illustrates how the US is now in the midst of a court-driven de-regulation phase. A key question is how far that de-regulation trend will go, especially given that today’s geopolitical tensions and political populism should tend to increase government power and lead to tougher regulation in some areas of the economy.

US Personal Income: In a little-noticed aspect of Friday’s report on May personal income and spending, the year-over-year growth in inflation-adjusted, per-capita disposable personal income (income after taxes) has slowed dramatically every month this year. In May, it was only up 0.5% year-over-year. The slowdown largely reflects the unusual jump in disposable income in early 2023, when tax brackets were adjusted for the high consumer price inflation in 2022.

- Real per-capita personal consumption expenditures have held up better, with the figure for May up 1.9% year-over-year.

- Still, the drop in real after-tax income threatens to weigh more on personal spending in the coming months. If so, that could lead to a more material slowdown in economic growth and greater pressure on the Federal Reserve to cut interest rates.

US Lumber Market: Near lumber futures on Friday fell approximately 3% to $452.50 per thousand board feet, bringing their drop to 27% since mid-March. The unusual decline in the middle of the prime homebuilding season suggests today’s high interest rates are finally starting to weigh on home construction and remodeling, despite continued high demand for new homes.