Daily Comment (July 3, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Please note: Due to the Fourth of July holiday, we will not publish a Daily Comment on Friday, July 5. We will resume publication on Monday, July 8. Have a Happy Fourth!

Our Comment today opens with some good news on the dangerous Chinese-Philippine tensions in the South China Sea. At last, the two sides have held talks aimed at diffusing the situation. We next review several other international and US developments with the potential to affect the financial markets today, including the latest on the French elections, a preview of tomorrow’s elections in the United Kingdom, and a new effort by the US government to block a proposed merger on competition concerns.

China-Philippines: Beijing and Manila yesterday held emergency talks aimed at reducing tensions over their conflicting territorial claims in the South China Sea. According to Philippine officials, the two sides made “substantial progress” in cooling the situation. However, the officials also stressed Manila’s intention to remain “relentless” in protecting its sovereignty over the disputed areas. With China emboldened by its recent activities in the area, that suggests to us that the situation remains dangerous.

European Union-China: According to insiders, the European Commission will soon propose scrapping its €150 threshold under which items can be imported duty free. The move will be aimed mostly at Chinese purveyors of cheap goods, such as Temu, AliExpress, and Shein. We suspect Beijing will see the move as another form of trade protectionism aimed against China, on top of the EU’s new tariffs against Chinese electric vehicles. As a result, the move could further worsen EU-China trade tensions.

- Cheap e-commerce imports into the EU below the duty-free threshold reportedly topped 2.3 billion items last year. They are on pace to double this year to about two deliveries per every household in the EU.

- Because of the EU’s subsidized postage rates, Chinese firms find it cost effective to export to the region, but the shipments impose a cost on the EU.

France: In their effort to deny the far-right National Rally (RN) a parliamentary majority in Sunday’s run-off elections, cooperating far-left and centrist parties pulled their weakest candidate from more than 200 constituencies where they otherwise would have split the anti-RN vote. In those districts, a single far-left or centrist candidate will now compete, increasing the odds of beating the RN candidate and keeping the far-right party from an outright majority.

- However, all signs suggest RN will still win the largest number of seats in parliament, which would give it unprecedented power in France.

- Besides, RN has now said it is open to forming a coalition government, which would help ensure it has increased influence in French government going forward.

- Another key risk is that France could end up with a “hung” parliament, in which no party or group of parties can form a majority. That would leave France in political limbo, potentially for a long time.

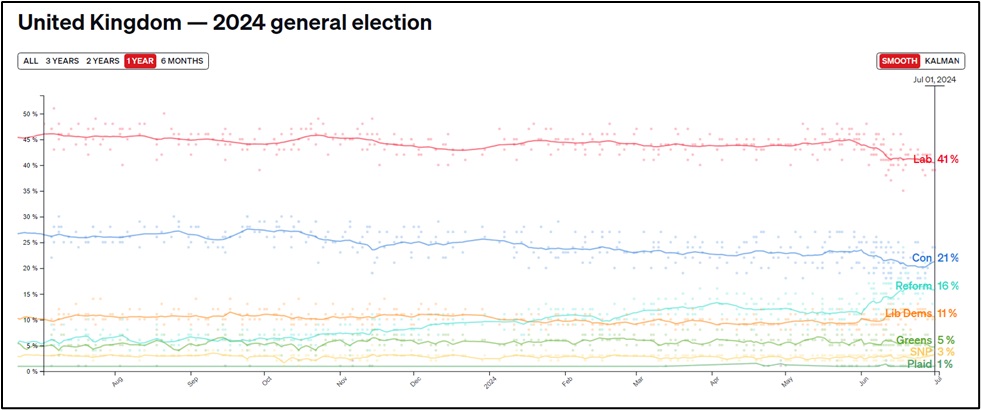

United Kingdom: In other European political news, Britain will hold parliamentary elections tomorrow, with the opposition Labour Party still looking set to win in a landslide. According to the latest polls, support for Labour remains about 20 percentage points above the support for the ruling Conservative Party.

- Even though Labour leader Sir Keir Starmer has managed to moderate the party’s past “tax, spend, and regulate” policies, investors are increasingly concerned about how they would be treated under a new government.

- Recent reports say rich Britons are already dumping stocks and real estate in anticipation that Labour will raise the capital gains tax.

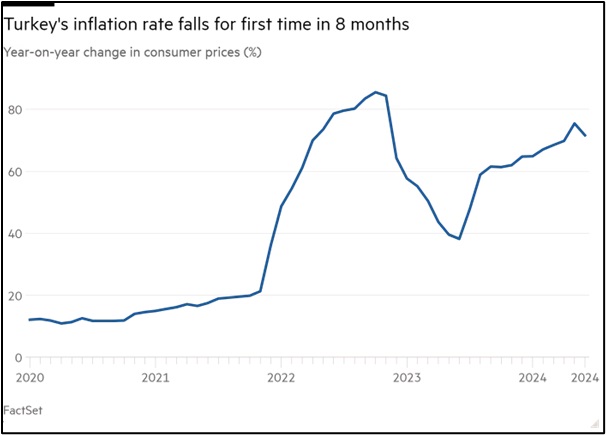

Turkey: The June consumer price index was up 71.6% from the same month one year earlier. As bad as that was, the increase was less than expected, and it marked a welcome deceleration from the 75.5% rise in the year to May. The data also marked the first slowing in consumer price inflation in eight months, raising hopes that the government’s pivot away from President Erdogan’s unorthodox economic policies a year ago may finally be bearing fruit.

Jamaica: As noted in our weather section below, Hurricane Beryl continues to “barrel” through the Caribbean and is expected to hit or skirt Jamaica later this afternoon. After becoming the earliest-ever Category 5 storm, Beryl has now been downgraded to Category 4. Nevertheless, it has already caused extensive damage in Grenada and other Caribbean islands, and it could still cause extensive damage in Mexico later this week.

US Politics: Democratic lawmakers, party leaders, and donors are reportedly becoming increasingly angry at President Biden and the White House staff for not addressing their concerns about the president’s age and weak performance in his first debate against former President Trump in June. Now that several Democratic lawmakers have publicly called for Biden to give up his re-election bid, we see an increasing chance that the president could ultimately capitulate, prompting the Democrats to scramble to choose a replacement candidate.

- Ironically, Democratic leaders say the issue now is more about the White House stonewalling their demand for answers and lack of concern for the impact on congressional candidates, rather than the signs that Biden’s age is catching up to him.

- As we have noted previously, both Biden and Trump are old enough and have other issues that it would not be a surprise if either or both were not on the ballot by November. For now, the odds still seem to favor Trump in the election, but anything could still happen.

US Antitrust Policy: The Federal Trade Commission yesterday voted unanimously to file a lawsuit against mattress maker Tempur Sealy’s proposed acquisition of giant bedding retailer Mattress Firm. According to the FTC, the combination would allow Tempur Sealy to restrict rivals’ access to an important retail chain, allowing it to boost prices. The lawsuit shows how the FTC has become much more aggressive in challenging potentially anticompetitive behavior.