Daily Comment (July 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new data illustrating just how broadly and sharply trade tensions with China are evolving around the world. We next review several other international and US developments with the potential to affect the financial markets today, including key election results in France and the United Kingdom and the minutes from the latest Federal Reserve policy meeting.

China-Global Markets: Data from China’s Ministry of Commerce show the country was hit with 64 anti-dumping probes by its trading partners in the first half of 2024, up 166% from the same period one year earlier. India alone initiated 16 of the new probes, while the US and Brazil each launched seven. The data show how Beijing’s strategy to rekindle economic growth by boosting investment and exports is hitting resistance around the world, even beyond the US and EU tariffs on Chinese electric vehicles and other advanced goods that we’ve written so much about.

- Indeed, the new tidal wave of Chinese exports, which some economists have dubbed “China Shock 2.0,” is far broader than EVs, solar panels, wind turbines, and other advanced goods.

- About 40% of the new anti-dumping probes relate to basic chemicals from China. Other major targets include non-metallic items such as glass wine bottles, iron and steel products such as steel coil, and clothing and food products.

- To the extent these anti-dumping probes lead to more tariffs and other trade barriers against China, they amount to trade de-coupling. The breadth of Chinese exports subject to this de-coupling suggests the trend will be a meaningful headwind for China’s economy and Chinese companies, along with other structural problems such as excess capacity and high debt, weak consumer demand, bad demographics, and disincentives from the Communist Party’s intrusion into the economy.

China: Within China, consumers also continue to shift their purchases toward domestic brands for a range of products. For example, new data show foreign brands accounted for only 43.0% of Chinese auto sales in the first six months of 2024, down from 50.5% in the same period in 2023. The loss of business to domestic competitors has left several foreign brands with excess production capacity in China. Some have pulled out of the market entirely after realizing their bet on the country was ill-placed.

Japan: In a new survey by the Japanese Chamber of Commerce and Industry, 54.8% of small and medium-sized businesses said the yen’s current weakness is a big problem, up from 47.8% in a poll last November. Only 2.3% in the new poll said the weak currency was a help. While many of Japan’s big, international exporters have gotten a boost from the weak yen, the poll shows that smaller firms have been hit by skyrocketing costs for fuel, raw materials, and imported components.

- Notably, the new survey was conducted between June 13 and June 19, when the yen was trading at an average rate of ¥157.4 to the dollar ($0.0064). So far this morning, the currency has depreciated even further, to about ¥160.8 to the dollar ($0.0062).

- The poll results may put added pressure on the government to intervene in the market again, although the yen is not likely to get much lasting relief until the Federal Reserve starts cutting US interest rates, reducing the differential between US and Japanese rates.

European Union: Although Marine Le Pen’s far-right National Rally party was thwarted in France’s run-off parliamentary elections yesterday (see below), it has boosted its power within the European Parliament today by allying its legislators with a new group of far-right national parties called “Patriots for Europe.” With legislators from Italy’s League, Hungary’s Fidesz, Austria’s Freedom Party, and other national parties, the group should overtake the somewhat less right-wing European Conservatives and Reformists as the parliament’s third-largest group.

- As a reminder, our Bi-Weekly Geopolitical Report from July 1 provided a primer on the EU’s governing bodies, including a discussion of the European Parliament and the major political groupings in the body at that date.

- The importance of the new Patriots of Europe group is that it will put the more radical elements of the far right ahead of the more moderate European Conservatives and Reformists. As we’ve noted, this should help shift the European Parliament and overall European policy toward a new set of priorities, such as more restrictive immigration and greater national autonomy.

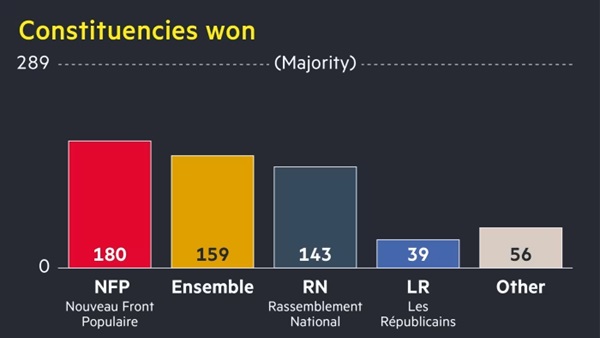

France: In yesterday’s run-off parliamentary elections, the far-left New Popular Front (NFP) unexpectedly came in first, with a projected 180 of the 577 seats in the legislature. President Macron’s centrist Ensemble alliance came in second with 159 seats (doing better than expected but still losing almost 100 of the seats it previously held). The far-right National Rally (RN) came in third with 143 seats, despite being supported by the Russian government.

- The results validate last week’s coordination deal between the far left and the centrists to keep RN from power. However, with no party having anything close to a majority of seats in parliament, France looks set for an extended period of political gridlock.

- Macron will be under pressure to appoint a leftist affiliated with NFP as the new prime minister as far-left politicians have argued that their strong showing means he should appoint one of their own. However, Macron could choose someone from the relatively more moderate Socialists or Greens.

- In any case, the leftists will be in position to push their priorities, such as reversing the hike in the retirement age that Macron pushed through, imposing a wealth tax, and hiking public salaries.

- Investors so far today have given a split verdict on the outcome. French stock prices at this moment are modestly higher, probably reflecting relief that the far right has been vanquished. Investors have sold off French bonds, pushing their yields modestly higher, but their spread over benchmark German bonds narrowed slightly. The euro today is roughly steady against the dollar.

United Kingdom: In Thursday’s general elections, the center-left Labour Party won in a massive landslide, taking an estimated 411 of the 650 seats in the House of Commons. The center-right Conservative Party won just 121 seats, marking the lowest total in its 190-year history and ending its 14-year lock on the government. The centrist Liberal Democratic Party rebounded from near obscurity to take 72 seats. Reflecting the results, Labour leader Keir Starmer was appointed prime minister on Friday.

- Labour now has its biggest majority since the election of Tony Blair in 1997. Starmer hasn’t been specific about the policy changes he’ll pursue, but many investors worry he will push through big tax hikes to fund progressive policy initiatives. All the same, relief over the end of Tory rule has helped push British stock prices higher, at least so far.

- While the results suggest the UK has bucked the recent far-right surge elsewhere in Europe, we note that Nigel Farage’s far-right Reform UK Party drew millions of votes and entered parliament for the first time, with five seats. Looking forward, a key question is whether Reform will continue to draw right-wing voters away from the Conservatives.

Iran: In the presidential run-off election on Friday, reformist Masoud Pezeshkian came out on top with about 55% of the vote. Pezeshkian has pledged to relax unpopular social restrictions and re-engage with the West to secure sanctions relief. However, since conservative clerics continue to dominate Iran’s government, Pezeshkian will largely have his hands tied, so Iran’s relations with the West may not improve much.

US Monetary Policy: In the minutes from the Fed’s June 11-12 policy meeting, released last Wednesday, the policymakers discussed the growing financial strains on lower- and middle-income consumers due to elevated prices, high interest rates, and depleted pandemic savings. According to the minutes, the officials expressed concern that the strains could lead to a sharp drop in consumer spending.

- Those worries are consistent with other recent signs of distress among consumers with low or moderate incomes. Those concerns could eventually prompt the Fed to revisit its current “higher for longer” approach to interest rates, although there is still a risk that the Fed could cut interest rates too late to avoid a big economic slowdown.

- Of course, the economic stress on lower- and middle-income households is probably also a key reason for the weak support given to President Biden in the opinion polls, along with the concerns about his age.

US Defense Industry: An interesting article in today’s Financial Times discusses how the growing importance of relatively small, inexpensive, quickly modified drones is starting to disrupt the traditional defense industry. While we still believe the new era of higher defense budgets will give a boost to today’s legacy defense “primes,” we agree that evolving military technologies mean there will also be new opportunities for start-ups, technology firms, and the producers of goods and services with dual civilian-military uses.