Daily Comment (July 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures have cooled this morning following favorable inflation data. In sports news, England defeated the Netherlands in the semifinals and will now play Spain in the Euro final. Today’s Comment will begin by examining the significant role that momentum has played in the market rally, followed by a discussion on why uranium remains a commodity with substantial upside potential for investors. We will also provide an update on the UK in the wake of the Labour Party’s recent victory. As usual, the report will conclude with a roundup of international and domestic data releases.

Momentum Propels Large Cap: The S&P 500 leapt past 5,600 for the first time ever on Wednesday, as investors piled into large-cap stocks in anticipation of a Federal Reserve policy shift.

- The market surged following comments made by Fed Chair Powell during his second day of testimony on Capitol Hill. While speaking with lawmakers, Powell stated that although he does not believe the central bank is ready to cut interest rates, Fed officials will not wait for inflation to fall to the 2% target before making a cut and will do so regardless of the upcoming election. Risk assets rose following his remarks, with the S&P 500 climbing 1.0% on the day and the Magnificent Seven stocks increasing by 1.2%.

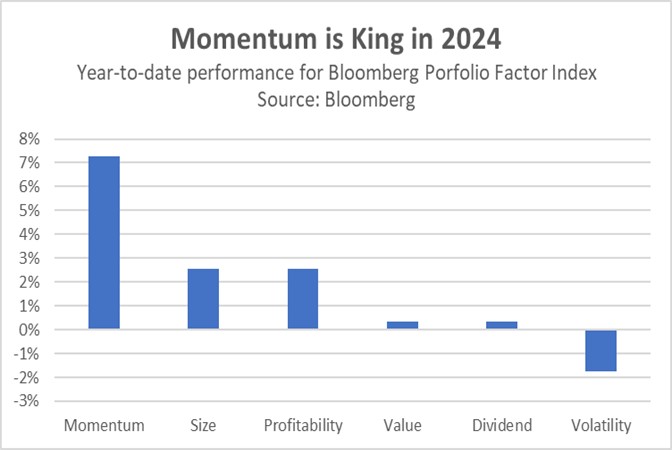

- The S&P 500’s record high might mask a troubling truth: many underlying companies lack the fundamentals to justify the rally. Bloomberg data confirms this, showing momentum chasing and a focus on large caps have dominated investment returns in 2024. Investors have been relentlessly buying a limited pool of large-cap stocks at any hint of good news, inflating their portfolios. In an uncertain economic climate with rising interest rates and inflation, investors are seeking stability and believe larger, established companies with growth potential will be better positioned to weather these headwinds.

- The S&P 500’s momentum dependence exposes it to steeper losses in the future. Mega-cap tech stocks, leading the large-cap surge, appear particularly inflated, making them more vulnerable if investor sentiment weakens. This concern is amplified as earnings season approaches and firms such as Nvidia are expected to meet lofty expectations. However, while we remain optimistic about equities overall, mid-cap and small-cap stocks might be better suited for this environment. They offer not only a lower correction risk but also the potential for more upside if interest rates fall.

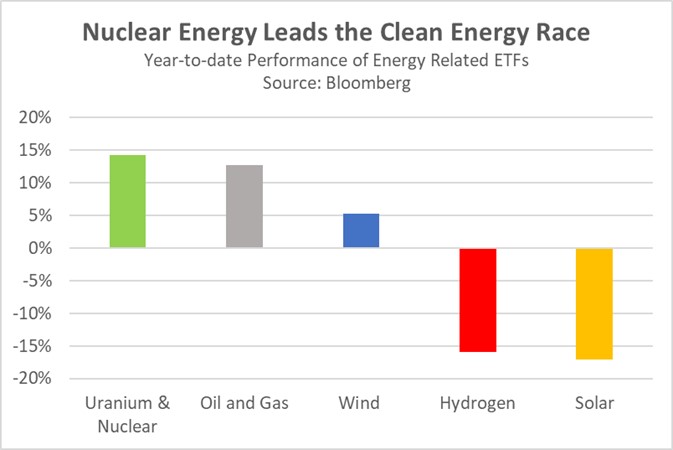

Uranium Popularity: While renewables gain momentum, nuclear energy from uranium remains a powerful tool for countries transitioning away from fossil fuels.

- On Wednesday, President Biden signed legislation aimed at promoting the development of advanced nuclear reactors. The new law will cut licensing times and processing fees, making it easier for companies to bring these clean energy sources online. While nuclear power currently generates about 20% of US electricity, development has been hampered by cost concerns and unpredictable permitting timelines. The passage of this legislation should make it easier for firms to capitalize on clean energy incentives and offer potential solutions to concerns over the rising energy use of artificial intelligence (AI) technology.

- Fueled by the insatiable energy demands of AI, big tech giants are leading the charge in adopting nuclear power. A Wall Street Journal report reveals that one-third of US nuclear plant owners are in talks with tech firms to discuss the powering of data centers, with Amazon on the cusp of a deal with the nation’s largest nuclear company. This surge in demand is prompting utility companies like Dominion Energy Virginia and Bill Gates’ TerraPower to develop the first of their own commercially viable small modular reactor (SMR) in the US.

- Uranium and nuclear power stocks have skyrocketed this year, eclipsing the broader market. This surge is likely driven by a widening supply-demand gap for uranium. Booming AI and the global push for clean energy are fueling demand, while uranium production capacity lags behind. To bridge this gap, countries are expected to invest heavily in SMRs due to their lower cost and faster deployment timelines. While a near-term correction can’t be ruled out, we believe nuclear companies remain a compelling long-term investment.

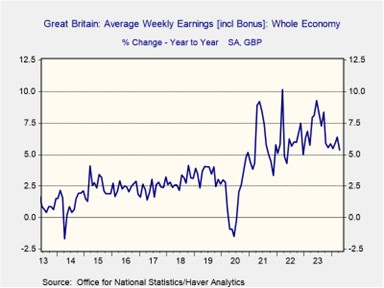

The UK Comeback: A surprise surge in economic growth has likely eased concerns about the UK’s debt burden, but also strengthens the case for keeping interest rates high.

- The UK economy defied expectations with a robust 0.4% expansion in May. This is a significant improvement over the previous month’s flat growth and double the forecasted rate for the period. The surge was fueled by a rebound in construction activity, which had been lagging for three months, and an increase in manufacturing production. This positive data strengthens the Labour Party’s position as they navigate economic policy. They can potentially avoid austerity measures while still promoting growth, all within the constraints of fiscal rules that require a balanced budget.

- However, the stronger-than-expected economic data likely diminishes the prospect of an interest rate cut at the next Bank of England meeting. The central bank had previously anticipated a slowdown to 0.2% growth in the second quarter, down from 0.7% in the first. The recent data suggests the quarter will exceed the estimates. Further complicating a rate cut, some voting members, including Huw Pill, have reportedly expressed concerns about high services inflation and wage growth leading to further price pressures.

- Strong economic growth is poised to bolster the attractiveness of UK assets, especially for value investors seeking bargains. British companies currently trade at a discount compared to their US peers, presenting a potential opportunity. Furthermore, the prospect of the Bank of England maintaining higher interest rates for longer than the market anticipated at the start of the year should help stabilize the pound (GBP) against the US dollar. While we remain skeptical of the UK market due to the Labour Party’s proposals, the overall sentiment towards the pound is improving.

Other News: Prominent Democrats and donors continue to urge Joe Biden to step aside, highlighting ongoing uncertainty about the party’s presidential nominee. In other news, Apple will not face fines from the EU after deciding to allow other providers to use its wallet technology for free. This decision underscores the impact of regulations on Big Tech earnings. Meanwhile, US officials are frustrated with India and Saudi Arabia for maintaining relationships with both sides of the conflict in Ukraine. This development illustrates how some countries can avoid aligning exclusively with either the US or China.